Is Wells Fargo’s (WFC) Clean Energy Push a Sign of Shifting Strategic Priorities?

October 4, 2025

- Wells Fargo’s upcoming earnings report has attracted attention as optimism builds for the banking sector, supported by positive outlooks for loan demand and trading activity, while recent regulatory milestones such as the lifting of the asset cap have further set the stage for future growth initiatives.

- In addition to financial momentum, Wells Fargo’s collaboration with Ever.green on a high-impact solar project highlights the bank’s efforts to facilitate clean energy deployment and underscores its growing role in shaping sustainable investment trends.

- We’ll explore how Wells Fargo’s enhanced balance sheet flexibility and renewable energy initiatives influence its broader growth and earnings potential.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

Advertisement

Wells Fargo Investment Narrative Recap

To hold Wells Fargo today, I believe investors need confidence in its ability to unlock post-asset cap growth, leverage improved balance sheet flexibility, and manage ongoing regulatory scrutiny. The latest fixed-income offerings and green energy initiatives are positive for the bank’s strategic progress, but the key short-term catalyst remains the upcoming earnings report, with resilient loan demand and trading activity in focus. The most pressing risk continues to be the execution and timing of resolving outstanding regulatory and compliance obligations, which could weigh on net margins and operational efficiency if not managed effectively.

Among recent developments, Wells Fargo’s collaboration with Ever.green for a 28-megawatt solar project is especially relevant. This effort signals the bank’s ongoing push to align with sustainability trends, potentially broadening its appeal to environmentally conscious clients and supporting its growth narrative, while offering a complementary catalyst to traditional balance sheet expansion.

Yet, despite the bank’s progress, investors should be aware that, unlike some competitors, persistent unresolved consent orders …

Read the full narrative on Wells Fargo (it’s free!)

Wells Fargo’s narrative projects $90.6 billion in revenue and $22.1 billion in earnings by 2028. This requires 5.3% yearly revenue growth and a $2.6 billion earnings increase from the current $19.5 billion.

Uncover how Wells Fargo’s forecasts yield a $89.12 fair value, a 10% upside to its current price.

Exploring Other Perspectives

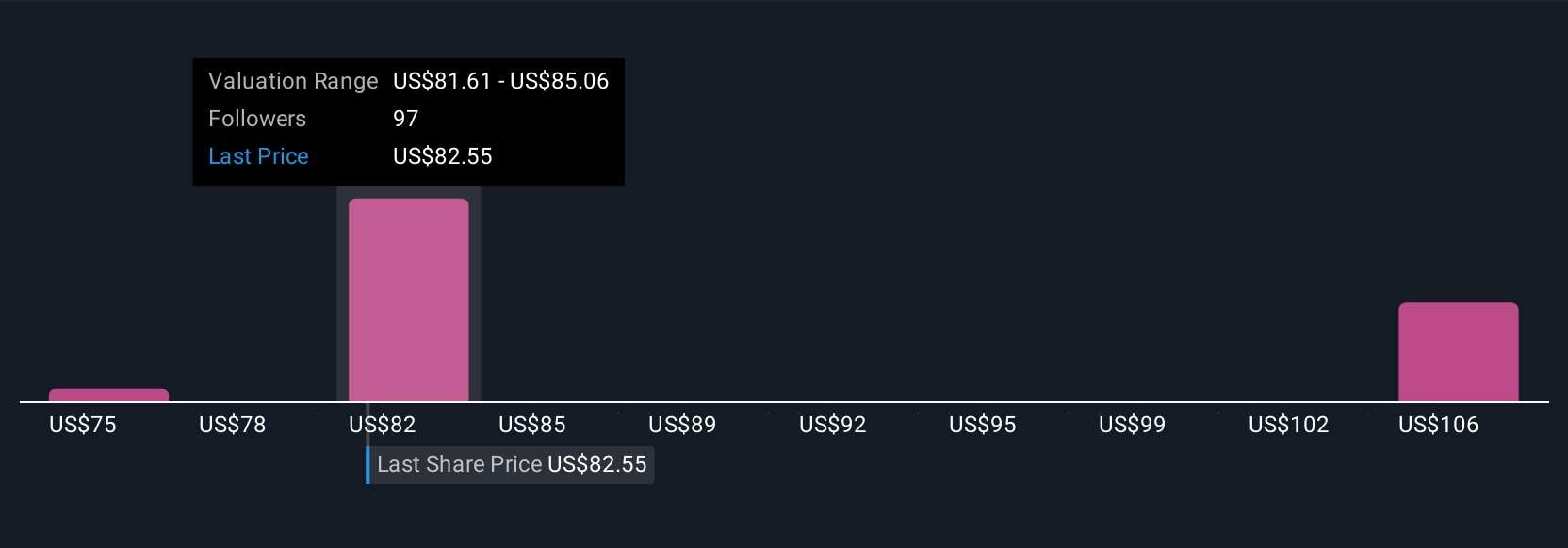

The Simply Wall St Community’s fair value estimates for Wells Fargo range from US$74.70 to US$100.94, based on 5 different forecasts. As regulatory requirements remain a key challenge, it is important to see how differing outlooks reflect the bank’s progress and potential obstacles ahead.

Explore 5 other fair value estimates on Wells Fargo – why the stock might be worth 7% less than the current price!

Build Your Own Wells Fargo Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wells Fargo research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Wells Fargo’s overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post