“It’s The Easiest Way To Invest In International Stocks Right Now”

January 10, 2026

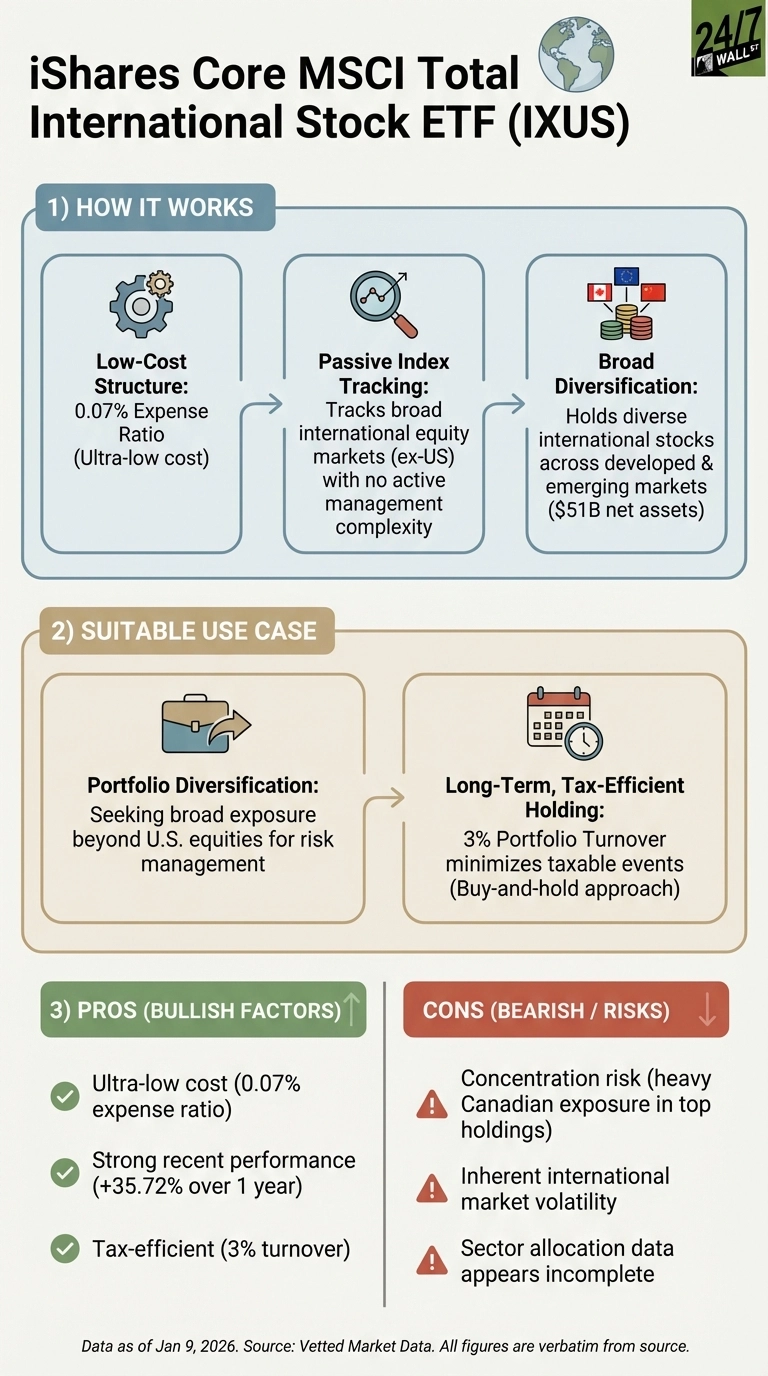

International stocks are having their moment, and the iShares Core MSCI Total International Stock ETF (NYSEARCA:IXUS) is riding the wave. With a 36% gain over the past year, this $51 billion fund has nearly doubled the S&P 500’s returns. The fund’s ultra-low 0.07% expense ratio and massive diversification across developed and emerging markets have made it a go-to vehicle for investors looking beyond U.S. borders.

Understanding what could move IXUS over the next 12 months matters more than celebrating last year’s gains.

The Dollar’s Direction Matters More Than You Think

The biggest macro factor for IXUS is U.S. dollar weakness. When the dollar declines against foreign currencies, international stocks get a tailwind because those companies’ earnings translate back into more dollars for U.S. investors. Reuters polling of currency strategists in early January 2026 shows a bearish dollar outlook, with expectations for modest declines throughout the year.

The MSCI All Country World ex-USA Index gained 29% in 2025, handily outpacing the S&P 500’s 18% return, according to CNN reporting. Much of that outperformance came as the dollar weakened on expectations of Federal Reserve rate cuts and narrowing interest rate differentials between the U.S. and other major economies.

Watch the DXY Dollar Index weekly. When it trends lower, international stocks typically benefit. JPMorgan Chase (NYSE:JPM) Global Research maintains a bearish dollar outlook for 2026, citing expansionary U.S. fiscal policy and persistent deficits. If that view proves correct, IXUS could continue outperforming. But if the dollar strengthens unexpectedly due to renewed inflation concerns or geopolitical shocks, international stocks would face headwinds regardless of underlying business performance.

What’s Actually Inside This Fund

The micro factor to watch is geographic concentration, particularly the fund’s heavy Canadian exposure. Seven of IXUS’s top 10 holdings are Canadian companies, including Royal Bank of Canada (NYSE:RY), Shopify (NYSE:SHOP), and Toronto-Dominion Bank (NYSE:TD). This means the fund’s performance is more tied to Canadian economic conditions and the loonie’s strength than many investors realize.

Check the fund’s quarterly holdings file on the iShares website to monitor how this concentration evolves. If Canadian banks face headwinds from a housing market correction or if commodity prices weaken, that could disproportionately impact IXUS relative to other international funds with different geographic mixes. The fund also includes meaningful exposure to Chinese tech through holdings like PDD (NASDAQ:PDD) and European names like Ferrari (NYSE:RACE), creating a genuinely global but somewhat lopsided portfolio.

Consider This Alternative Instead

For investors seeking similar exposure with different characteristics, the Schwab International Equity ETF (NYSEARCA:SCHF) deserves attention. With $53.5 billion in assets and an even lower 0.03% expense ratio, SCHF focuses exclusively on developed international markets, excluding emerging economies. Its top holdings lean more heavily toward European and Asian giants like ASML Holding (NASDAQ:ASML) rather than Canadian banks. For investors who want international exposure without emerging market volatility, SCHF’s developed-markets-only approach might prove more stable during periods of global uncertainty.

The Bottom Line

Over the next 12 months, watch the dollar’s trajectory for macro direction and monitor IXUS’s Canadian concentration for fund-specific risks that could create performance divergence from broader international indexes.

Search

RECENT PRESS RELEASES

Related Post