Jim Cramer Bans ‘Magnificent Seven’ – Is Meta (META) Still a Buy?

March 14, 2025

We recently published a list of Jim Cramer Discussed These 7 Stocks. In this article, we are going to take a look at where Meta (NASDAQ:META) stands against other stocks that Jim Cramer discussed.

Jim Cramer, host of Mad Money, advised investors on Monday against exiting the market entirely, despite the sharp sell-off that has rattled many. He reminded viewers that, historically, the market has always found its bottom, and stocks can rebound over time. Cramer acknowledged that selling everything might feel like a relief in the short term, but he raised an important question and said:

“Sure you can get out, but can you get back in? Selling everything right now feels great. We know that President Trump is now hanging with the bears… As he himself said you can’t really watch the stock market, the stock market’s the problems of the rich, and they don’t matter as long as it, they can take a hit. And that’s a zeitgeist from the Walmart White House where Trump’s giving us everyday lower prices for stocks.”

READ ALSO: 10 Stocks on Jim Cramer and Wall Street’s Radar and Jim Cramer Put These 8 Stocks Under the Microscope

Cramer pointed out that Trump’s approach reflects a mindset that he does not believe is the right course of action for investors focused on long-term growth. In the past, Cramer noted, figures like Trump and Federal Reserve Chairman Jerome Powell were seen as stabilizers, or “puts,” that would help cushion the market’s downward moves. However, no one seems to be talking about that kind of support lately. He added:

“People are capitulating because they want to get rid of the pain and they don’t want to lose the game… See, there’s just one problem. How do you get back in?”

Cramer made a compelling case for why investors should actually consider buying during times like this, even though it might seem counterintuitive. He acknowledged that on a day when the market is being hammered, the idea of buying may feel strange. However, he emphasized that focusing on preserving capital rather than chasing quick gains is crucial during turbulent times.

Cramer also highlighted a common pitfall: many investors get scared off during market downturns and fail to seize the opportunity to buy strong companies at lower prices. He pointed out that this fear leads people to miss out on significant future gains, leaving them on the sidelines while others take advantage of lower stock prices and reap substantial rewards.

“It’s why you should be thinking of buying the great companies here, not selling them. To not get good merchandise as it starts being really cheap is a failure of imagination, to not have held them all the way could be a failure of recognition.”

For this article, we compiled a list of 7 stocks that were discussed by Jim Cramer during the episode of Mad Money aired on March 10. We listed the stocks in the order that Cramer mentioned them. We also provided hedge fund sentiment for each stock as of the fourth quarter of 2024, which was taken from Insider Monkey’s database of over 1,000 hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

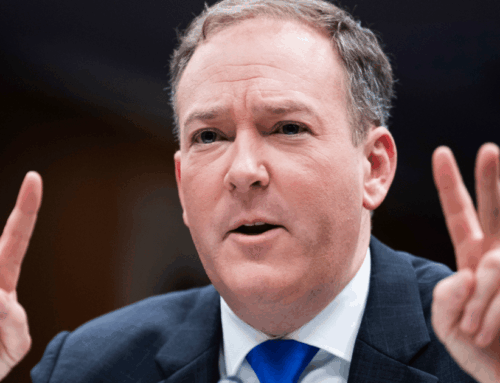

d8nn / Shutterstock.com

Number of Hedge Fund Holders: 262

Mentioning Meta Platforms, Inc. (NASDAQ:META), Cramer said that he is banning the term Magnificent Seven from Mad Money.

“The whole day was obvious that only consumer products and healthcare stocks make you money. There haven’t been many days like this, so people sell their losers out of fear so out goes Apple or Microsoft and Netflix and Meta, why not? You don’t want to give up the gain and there is no Magnificent Seven anymore. Scrap it right now, okay? I’m banning the term from the show as of this evening.”

Meta (NASDAQ:META) develops products that allow people to connect and share through various devices, including mobile phones, personal computers, and VR/AR headsets. Its offerings include social media apps like Facebook, Instagram, Messenger, Threads, and WhatsApp, as well as virtual and augmented reality hardware, software, and content.

Rowan Street Capital stated the following regarding Meta Platforms, Inc. (NASDAQ:META) in its Q4 2024 investor letter:

“Meta Platforms, Inc. (NASDAQ:META): Investment Initiated: April 2018: Internal Rate of Return (IRR*): 22% *IRR represents the annualized rate of return on an investment, accounting for the timing and magnitude of cash flows over the holding period.

Overall, META ranks 7th on our list of stocks that Jim Cramer discussed. While we acknowledge the potential of META as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than META but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires

Disclosure: None. This article is originally published at Insider Monkey.

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post