JPMorgan says bitcoin miners are decoupling from the bitcoin price as they pivot to AI

October 23, 2025

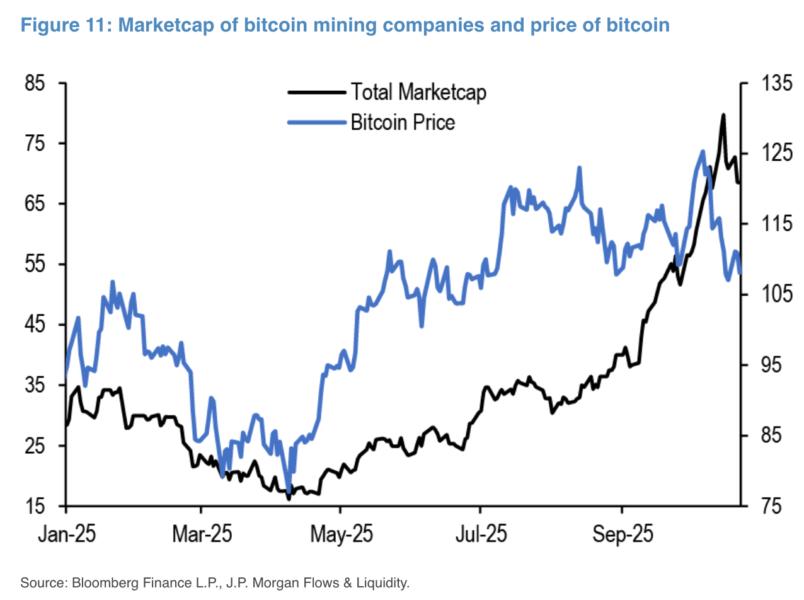

Publicly listed bitcoin mining firms have diverged from bitcoin’s price performance in recent months, with their combined market capitalization climbing sharply since July even as bitcoin has traded sideways, according to JPMorgan analysts.

The shift marks a “clear breakdown” in the correlation between bitcoin mining stocks and the cryptocurrency’s price, JPMorgan analysts led by managing director Nikolaos Panigirtzoglou said in a report on Wednesday.

Mining stocks once moved closely in line with bitcoin and were often viewed as proxies for exposure to the asset before the launch of spot bitcoin exchange-traded funds. Now, with major bitcoin miners pivoting their business toward artificial intelligence infrastructure, their stocks are more driven by the AI theme rather than the bitcoin price, the analysts said.

The move into AI is offering miners more stable and higher-margin revenue streams compared to the more volatile and increasingly less profitable business of bitcoin mining, according to the analysts. As a result, equity markets have started to re-rate these companies based on AI potential rather than their bitcoin exposure, causing decoupling from bitcoin price movements.

The shift comes amid growing pressure on miners’ profitability after the April 2024 bitcoin halving, which cut block rewards in half from 6.25 BTC to 3.125 BTC. The JPMorgan analysts estimate the current average cost to mine one bitcoin is around $92,000, projected to rise to about $180,000 after the next halving in April 2028 — well above the current price of about $109,700. Higher energy and hardware costs, along with power contract renewals, are also expected to keep production costs elevated for bitcoin miners, the analysts said, implying tougher profitability conditions ahead for miners.

As miners allocate more resources to AI computing, the growth in bitcoin’s network hashrate is likely to slow, which could limit further increases in production costs. The trend favors large, well-capitalized miners that can flexibly shift capacity between bitcoin and AI, while smaller firms may struggle to adapt and have begun exploring other areas, including setting up Ethereum and Solana treasuries, such as BitMine and BIT Mining, the analysts said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Search

RECENT PRESS RELEASES

Related Post