Kansas City cannabis businesses hope the new year brings marijuana rescheduling and tax relief

January 2, 2025

A steady stream of customers walk into the From the Earth dispensary on Southwest Boulevard each day. They present IDs, make their selections from a large menu of options and leave with small brown paper bags of weed.

Though business is usually brisk at this and other Kansas City weed shops — reflected in Missouri’s legal weed trade topping $1 billion in sales in 2024 — cannabis business owners say they struggle to turn a profit.

“We’re paying about double the (federal) tax of a traditional business,” said John Mueller, CEO of Greenlight, a Kansas City company that owns 32 dispensaries nationwide, including five around Kansas City.

Because the federal government classifies cannabis as a Schedule I drug — defined as having no medical value and a high risk of abuse — legal cannabis businesses can’t deduct normal business expenses on their tax forms. That’s making it harder for state-licensed marijuana businesses across the country to turn a profit and compete against blackmarket weed sellers.

That could change in the new year if the U.S. Department of Justice follows through with a plan to reclassify cannabis from the Schedule I, the same as LSD and heroinunder the Controlled Substances Act, to Schedule III, the same as Tylenol with codeine.

Kansas City cannabis business owners said the change would immediately put their businesses on dramatically more profitable footing.

“That’s the biggest restriction on expanding the business and profitability,” Mueller said.

The U.S. Drug Enforcement Agency is slated to begin hearings on the proposal Jan. 21.

Rescheduling cannabis could immediately do away with a federal tax rule — known as 280E — that forces cannabis companies to fork over an estimated $2 billion extra to the federal government every year.

Under the tax rule, businesses that sell illegal drugs can’t deduct ordinary business expenses like marketing, insurance and rent before declaring their income. Because federal law classifies marijuana as Schedule I and illegal, cannabis businesses pay federal taxes on a much bigger chunk of their income.

Mueller said his business faces an effective federal tax rate of 50%, compared to a rate of 21% other C corporations pay.

Adam Hoffer, director of excise tax policy at the Tax Foundation, said without 280E, more marijuana businesses could turn a profit. And many don’t. A survey conducted by Whitney Economics and released this summer showed that less than a third said they were in the black.

“If cannabis businesses were allowed to take the same deductions as normal businesses,” Hoffer said in an email response, “they would be about $2 billion more profitable.”

Missouri is one of the states that let legal marijuana businesses base state taxes on a lower declared income that excludes normal business expenses. But many states assess state income tax on the federally taxed amount, making the picture even worse for cannabis businesses that operate in those states.

“A lot of people think, ‘Wow. The cannabis industry makes so much money, these people must be rolling in dough,’” said David Craig, vice president of marketing for Illicit Gardens, which owns From the Earth dispensaries. “But that’s not true.”

Even with rescheduling, cannabis businesses will still find it more expensive, and sometimes impossible, to get banking services. The industry also has to follow expensive regulatory requirements related to testing and security. Rescheduling won’t bring relief to these and other financial burdens.

But the tax rate would immediately be improved, said Bryan Barash, a vice president of Massachusetts technology company Dutchie that serves the industry. And high taxes, he said, are sinking many marijuana businesses in states like California and Colorado that have had legal weed longer.

“It is the biggest reason that in many states … a lot of stores are struggling,” Barash said. “Competing with the illicit market at the prices people want to pay, while paying your taxes appropriately, is a very difficult thing for companies to do.”

Federal regulators should realize that there’s a public health interest in helping legal cannabis businesses shore up profits and stay in business, cannabis industry executives said. It’s better, they said, for people to have a legal option for buying the drug.

“Everybody wants to buy something that’s tested and regulated,” Mueller said.

Weed purchased on the street comes with many unknowns. It could be tainted with dangerous drugs and other contaminants. But weed purchased in the 38 states where it is legal is tested, labeled and heavily regulated. At a dispensary, you know the precise strength and blend of the weed you’re getting.

Mark Jones, a regional general manager for Illicit Gardens, said his company’s budtenders are trained to answer questions, offer advice and urge safe use.

“It becomes a consultation process,” he said.

MoCannTrade, a Missouri cannabis trade association, filed comments with the DEA in support of rescheduling that argue the legal market in Missouri is making products safer. And rescheduling, the statement said, would be “a long overdue step in the right direction.”

But as more adults use the drug on a regular basis, and as marijuana products increase in potency, anti-cannabis sentiment grows. A growing number of health experts warn about rising addiction rates and serious health consequences related to increased cannabis use.

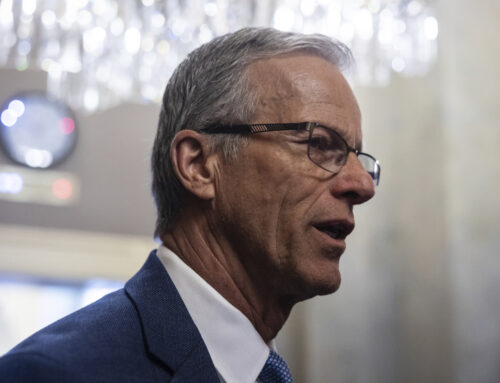

Luke Niforatos, executive vice president at Smart Approaches to Marijuana, a nonprofit that opposes marijuana legalization, is staunchly against rescheduling cannabis. He agreed that the move would likely help the industry’s bottom line. And as far as he’s concerned, that’s the problem.

“Marijuana, if anything, has gotten more harmful since states started legalizing it,” Niforatos said, citing addiction rates, the availability of much more potent ways to consume the drug and other health concerns.

“We think the science is very clear that marijuana should remain Schedule I,” he said, “and this push to move it to Schedule III has been really marred by politics since the beginning.”

Search

RECENT PRESS RELEASES

Related Post