Kevin Durant Recovers Bitcoin Bought at $650, Now Up Over 17,700%, After Nearly a Decade

September 20, 2025

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

The episode comes amid growing frustration among Coinbase users, many of whom alleged they’ve faced similar issues retrieving account access.

By Francisco Rodrigues, AI Boost|Edited by Aoyon Ashraf

Sep 20, 2025, 2:46 p.m.

- NBA forward Kevin Durant had been locked out of his Coinbase account for nearly a decade, but has now regained access to his bitcoin holdings, which he purchased in 2016 at an estimated $650 per coin.

- Durant’s bitcoin holdings have appreciated significantly, with the price of BTC rising over 17,700% since 2016, and are now valued at around $116,000 per coin.

NBA forward Kevin Durant has access to his bitcoin again, after being locked out of his Coinbase account for nearly a decade. In that time, the price of BTC rose by more than 17,700%.

“We got this fixed. Account recovery complete,” Coinbase CEO Brian Armstrong posted on X, responding to a viral tweet about Durant’s access issues.

STORY CONTINUES BELOW

The recovery comes days after Durant and his business partner, Rich Kleiman, discussed the lockout at CNBC’s Game Plan conference. “It’s just a process we haven’t been able to figure out,” Kleiman said. Still, he noted, “bitcoin keeps going up… so, I mean, it’s only benefited us.”

Durant bought bitcoin in 2016 after hearing about it from then-teammates on the Golden State Warriors. At the time, bitcoin traded between $360 and $1,000 and Durant is estimated to have bought at around $650 per coin.

It’s now hovering near $116,000, according to CoinMarketCap data. Neither Durant nor Kleiman disclosed the size of his holdings.

Durant and Kleiman are investors in Coinbase and have promoted the company through their media outlet, Boardroom.

The episode comes amid growing frustration among some Coinbase users, who alleged they’ve faced similar issues retrieving account access or getting help from customer support. Armstrong acknowledged the criticism on social media, saying the company is “putting a big focus” on improving customer support.

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By Francisco Rodrigues|Edited by Aoyon Ashraf

57 minutes ago

The company plans to list on the New York Stock Exchange under the ticker BTGO.

What to know:

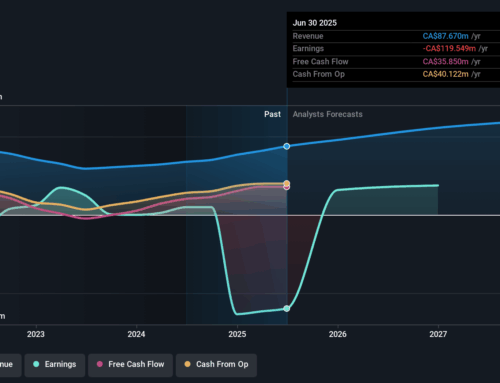

- Crypto custodian BitGo has filed its first public S-1 registration statement with the SEC, planning to list Class A common stock on the NYSE under the ticker BTGO.

- The company’s profitability has decreased, with net income for the half-year falling to $12.6 million, down from $30.9 million in the same period a year earlier.

- BitGo manages over $90 billion in cryptocurrency on its platform, with a concentrated client base and a majority of assets held in a few cryptocurrencies.

Search

RECENT PRESS RELEASES

Related Post