Largest Public Ethereum Holder SharpLink Gaming Expands Treasury to 198,167 ETH, Generates

July 1, 2025

Company Appoints Elevate IR as Investor Relations Firm of Record

MINNEAPOLIS, MN, July 01, 2025 (GLOBE NEWSWIRE) — SharpLink Gaming, Inc. (Nasdaq: SBET) (“SharpLink” or the “Company”), the largest publicly traded holder of Ethereum (“ETH”) in the world, today announced that the Company has strategically increased its total holdings of ETH to 198,167, acquiring an additional 9,468 ETH for $22,825,734 (inclusive of fees and expenses) at a weighted average price of $2,411 per ETH (inclusive of fees and expenses) during the period June 23, 2025 through June 27, 2025.

In addition, during that same period SharpLink raised approximately $24.4 million in net proceeds through its At-The-Market facility (“ATM”), selling 2,525,637 shares of the Company’s common stock. A majority of the ATM proceeds from these sales will be used to further increase SharpLink’s ETH treasury holdings.

Joseph Lubin, SharpLink Chairman and Co-Founder of Ethereum, stated, “We are entering a new era where digital assets like Ethereum are no longer speculative instruments – they are fast becoming the strategic currency of the modern digital economy. By embedding Ethereum at the core of our capital strategy, we are doing more than optimizing SharpLink’s balance sheet. We are positioning the Company to command global leadership of the evolution of digital commerce.”

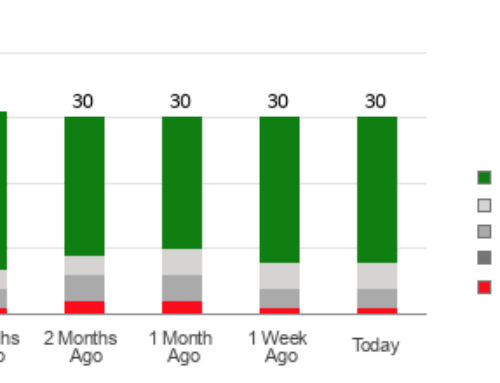

As of June 30, 2025, 100% of SharpLink’s ETH reserves have been deployed in staking protocols. During the period June 21, 2025 through June 27, 2025, SharpLink earned 102 ETH in rewards.

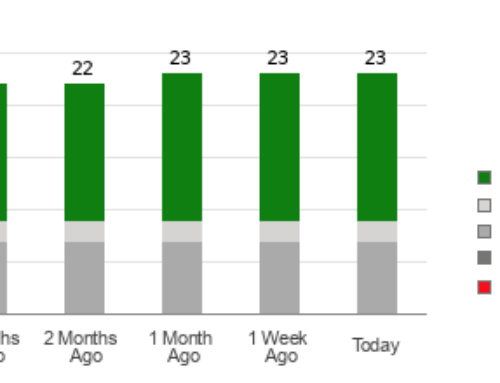

To enhance transparency into the Company’s yield performance, SharpLink introduced a new reporting metric called “ETH Concentration.” This metric is calculated by dividing the number of ETH SharpLink holds by 1,000 assumed diluted shares issued and outstanding (“Assumed Diluted Shares Outstanding”). Assumed Diluted Shares Outstanding represents the sum of (i) SharpLink’s actual shares of common stock issued and outstanding as of the end of each reporting period, inclusive of disclosed ATM sales, plus (ii) the additional shares that would be issued upon the assumed exercise or settlement of all outstanding warrants, pre-funded warrants, stock option awards, and restricted stock units. Notably, Assumed Diluted Shares Outstanding is not calculated using the treasury stock method. It does not account for equity award vesting conditions, stock option exercise prices, or contractual restrictions limiting the convertibility of debt instruments. Additionally, it excludes any assumed share repurchases that would ordinarily be considered under the treasury stock method.

Based on the Company’s first aggregated acquisitions of ETH announced on June 13, 2025, SharpLink’s initial ETH Concentration was 2.00 ETH and has since increased each week, now up 17.7% to 2.35 ETH as of June 27, 2025.

SharpLink also announced the engagement of Elevate IR, a premier financial communications and capital markets advisory firm, as its investor relations agency of record. As part of the engagement, Elevate IR will collaborate closely with SharpLink’s executive leadership to craft and execute a comprehensive investor relations and communications strategy tailored to the Company’s evolving priorities.

“Ethereum is more than a treasury asset — it’s the financial foundation for what we believe will become the next generation of capital management and online gaming infrastructure,” said Rob Phythian, CEO of SharpLink Gaming. “To support our accelerating growth, we’re committed to working with sophisticated partners like Elevate IR to ensure that our story, strategy and shareholder value proposition are clearly communicated to all stakeholders.”

About SharpLink Gaming, Inc.

Headquartered in Minneapolis, Minnesota, SharpLink Gaming, Inc. (Nasdaq: SBET) is the world’s largest publicly traded company to adopt Ethereum (ETH) as its primary treasury reserve asset – a move that aligns the Company with the future of digital capital and gives investors direct exposure to the world’s leading smart-contract platform and second largest digital asset.

SharpLink is also reimagining the future of online gaming and sports betting. Backed by a veteran team with deep roots in sports media, gaming and technology, SharpLink is charting a new course – building scalable, secure and transparent solutions that challenge outdated models and bring real innovation to the betting experience. By leveraging smart contracts, DeFi protocols and Web3 infrastructure, SharpLink intends to assume the lead in transforming the multi-billion-dollar iGaming industry into a more dynamic, efficient and equitable ecosystem. Learn more at www.sharplink.com.

Forward-Looking Statement

Statements in this press release about future expectations, plans and prospects, as well as any other statements regarding matters that are not historical facts, may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and these forward-looking statements are subject to various risks and uncertainties. Such statements include, but are not limited to, the execution of the Company’s treasury strategy and other statements that are not historical facts, including statements which may be accompanied by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including without limitation, the Company’s ability to achieve profitable operations, fluctuations in the market price of ETH that will impact the Company’s accounting and financial reporting (see accounting rules discussed below), government regulation of cryptocurrencies and online betting, changes in securities laws or regulations, customer acceptance of new products and services, the demand for its products and its customers’ economic condition, the impact of competitive products and pricing, the lengthy sales cycle, proprietary rights of the Company, changes in applicable laws or regulations, and its competitors, general economic conditions and other risk factors detailed in the Company’s annual report and other filings with the SEC. Under U.S. generally accepted accounting principles, entities are required to measure certain crypto assets at fair value, with changes reflected in net income each reporting period. Changes in the fair value of crypto assets could result in significant fluctuations to the income statement results. Any forward-looking statements contained in this press release speak only as of the date hereof, and the Company does not undertake any responsibility to update the forward-looking statements in this press release.

Investor Relations Contact

Sean Mansouri, CFA or Aaron D’Souza

Elevate IR

(720) 330-2829

ir@sharplink.com

Media Contact:

media@sharplink.com

How many Ethereum (ETH) tokens does SharpLink Gaming (SBET) currently hold?

SharpLink Gaming holds 198,167 ETH in its treasury as of June 27, 2025, after acquiring an additional 9,468 ETH.

What is SharpLink Gaming’s (SBET) average purchase price for its recent Ethereum acquisition?

SharpLink acquired the additional ETH at a weighted average price of $2,411 per ETH (inclusive of fees and expenses) during June 23-27, 2025.

How much did SharpLink Gaming (SBET) raise through its ATM facility?

SharpLink raised approximately $24.4 million in net proceeds through its ATM facility by selling 2,525,637 shares of common stock.

What are SharpLink Gaming’s (SBET) staking rewards from Ethereum?

SharpLink earned 102 ETH in staking rewards during the period of June 21-27, 2025, with 100% of its ETH reserves deployed in staking protocols.

What is SharpLink Gaming’s (SBET) current ETH Concentration metric?

SharpLink’s ETH Concentration increased to 2.35 ETH per 1,000 assumed diluted shares, up 17.7% from its initial 2.00 ETH.

Search

RECENT PRESS RELEASES

Related Post