Layoffs and LNG Push Might Change the Case for Investing in ConocoPhillips (COP)

October 5, 2025

- In recent days, ConocoPhillips announced plans to lay off up to a quarter of its global workforce amid industry-wide cost-cutting and market volatility, while simultaneously advancing long-term LNG supply agreements and delivering liquefaction technology for major export projects.

- This combination of organizational restructuring and new LNG commitments highlights the company’s dual focus on operational efficiency and expanding its role in the global gas market.

- We’ll explore how ConocoPhillips’ large-scale layoffs might affect its investment narrative and reshape expectations for long-term earnings growth.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Advertisement

ConocoPhillips Investment Narrative Recap

To invest in ConocoPhillips, you need to believe in the company’s ability to translate large-scale LNG projects, a deep asset base, and operational streamlining into stable cash flow and earnings, despite significant exposure to volatile oil and gas prices. The recent news of up to 25% workforce reductions signals management’s intent to cut costs amid industry consolidation and short-term oil market challenges but does not materially shift the primary near-term catalysts or heighten the biggest execution risks already in focus.

Among the recent announcements, ConocoPhillips’ deal to supply proprietary liquefaction technology to new LNG export facilities stands out. This initiative reinforces the company’s positioning to capture demand in flexible global gas markets and underpins the narrative that progress on LNG projects remains a central business driver, even as restructuring efforts take the spotlight.

Yet, despite these positives, investors should be aware that continued volatility in oil and gas prices could…

Read the full narrative on ConocoPhillips (it’s free!)

ConocoPhillips’ narrative projects $57.6 billion revenue and $10.4 billion earnings by 2028. This requires a 1.0% annual revenue decline and a $1.2 billion increase in earnings from $9.2 billion today.

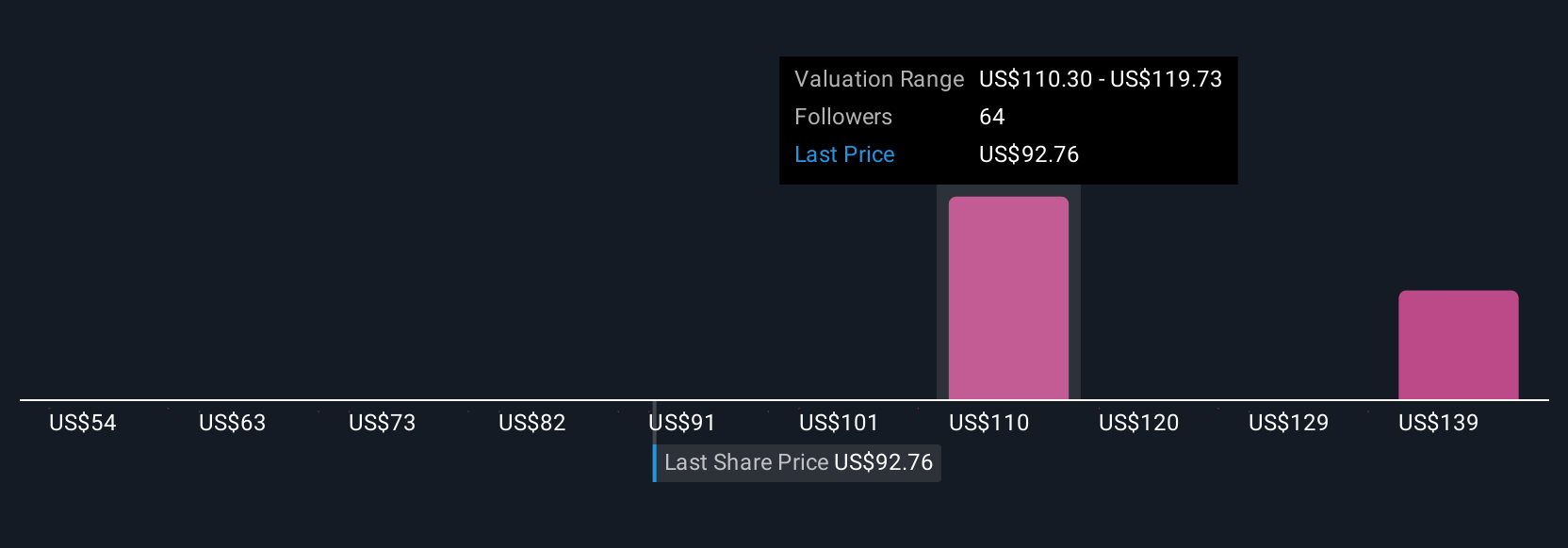

Uncover how ConocoPhillips’ forecasts yield a $116.54 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community estimate ConocoPhillips’ fair value from US$110 to US$236.41 per share. With this breadth of opinion, consider also that sustained low energy prices could squeeze margin expectations, so be sure to explore a variety of market viewpoints.

Explore 4 other fair value estimates on ConocoPhillips – why the stock might be worth over 2x more than the current price!

Build Your Own ConocoPhillips Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your ConocoPhillips research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ConocoPhillips research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate ConocoPhillips’ overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post