LinkedIn: A Good Buy For Long-Term Investors

July 17, 2014

Summary

- LinkedIn has a very small share of net US digital revenue but it’s gaining more market share with passing time.

- LinkedIn produced explosive top line growth, but its earnings growth is not in line with this.

- It is expected that the bottom line will begin to show significant growth in the next year.

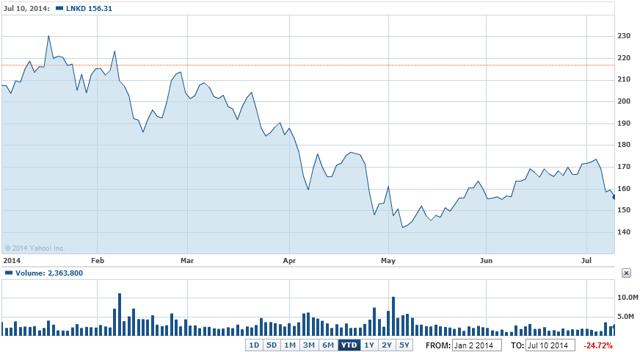

- LinkedIn’s share lost 24%of its value so far in 2014. This was a much-need correction, as speculation caused the price to increase too high too quick.

LinkedIn (NYSE:LNKD) is not like any other social media network, as it is especially designed to cater to the networking needs of professionals. Its focus on professionals is its strength, and it has set out to change the way job hunting and recruitment is carried out.

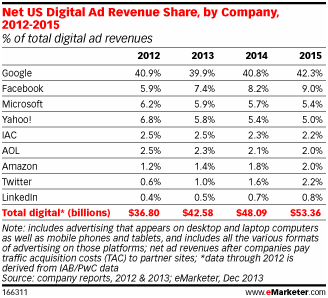

The following is the comparison of LNKD to other social media networks on the basis of market share each network has in Net US digital ad revenue. LNKD is presently a very small player in the social media industry, with less than a one percent share. LNKD has shown progress in increasing its percentage of the net ad market. In 2012, LNKD had a 0.4% share that grew to 0.5% in 2013. According to eMarketers.com, LNKD’s share is expected to be 0.7% in 2014, and in 2015, it is expected to rise further to 0.8%. The ad market is expected to grow in the coming years, and LNKD’s growing share is an indication of good prospects.

An Exploding Top Line

LNKD’s top line has shown explosive growth in the past few years after it went public. In 2012, it grew 86% YOY and reached $972.3 million. In 2013, it grew by 57% YOY to $1.53 billion.

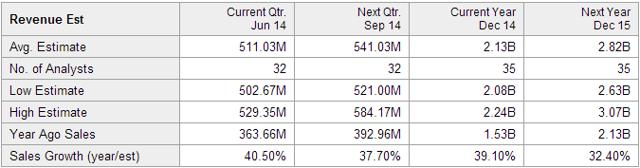

If we look at the average analyst estimate for the current year ending December 14th, we see that analysts expect 39.10% growth in the top line, on average, and expect the top line to reach $2.13 billion. For the next year, the average estimate of revenues is $2.82 billion, that reflects 32.40% of growth compared to this year’s average forecast.

Source: Yahoo Finance

For the quarter ending June 14th, analysts expected revenue growth of 40.50% compared to the same period last year, and in the quarter ending September 14th, analysts expect on average 37.7% growth compared to the same period last year. The revenue growth rate is decreasing with passing time, as expected.

Bottom Line Explosion Expected Next Year

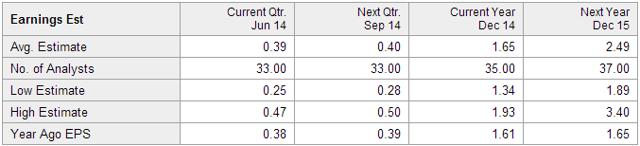

LNKD is in its rapid growth phase, so we should have low expectations from the bottom line. Average EPS estimate for the current year ending December 14 is $1.65, with only 2.5% growth YOY. But if we look at the analysts’ average EPS estimate for the next year ending December 15th, a growth of 50% is expected. Analysts, on average, expect the EPS to reach $2.49 from this year’s expected level of$1.65. LNKD creates value for its users, and it is expected that LNKD will be able to create meaningful value for its shareholders by the end of the next year.

Share Price: The Landslide Appears to be Over

The ride is over for short-term speculative investors. At the beginning of 2014, LNKD’s share price hovered around the $220 mark, but the share price has fallen by 24.72%in 2014. LNKD’s stock grew by too much too quick without producing earnings, and this YTD fall in price is a logical outcome. Now it appears that the correction is complete, and long-term investors that want to invest in LNKD for a longer time period and realize the value created by LNKD should consider taking a position on its current price. Long-term investors should take a position before the retail herd causes the share price to rise again by too much too quick.

Target price

The average price estimate of 34 brokers offers a price return of around 40% on the current price. This is a good return for those who want to invest in LNKD for its business model, service, and future growth prospects. It is not for investors who only want to take a ride when the share price starts to brew once again.

Search

RECENT PRESS RELEASES

Related Post