Liquidity Builds Near $100K Bitcoin and $3,500 Ethereum—Can Prices Reach the Zone?

January 11, 2026

-

The Bitcoin price is jiggling around $91,000 while the Ethereum price remains stuck above $3000, displaying stability

-

This appears to be a strong bullish set-up for the top cryptos, which may invalidate the bearish trajectory and ignite a fresh bull run

After months of consolidation, the top two cryptos seem to be experiencing a strong breakout in the coming days. Bitcoin and Ethereum are moving closer to price levels that could trigger a sharp shift in market behaviour. The latest liquidation data suggests, the future traders have set a strong resistance wall, slightly higher than the current range. Hence, if the BTC price and ETH price manage to break above the range, they both may eventually reclaim and surge above previous highs.

The liquidation map for Bitcoin shows a heavy concentration of short liquidation leverage stacked above the current price, with a major cluster forming just below and around $95,000. Moreover, the cumulative short liquidation leverage has surged above $5 billion at $100,000 and above.

This means many traders are positioned against further upside. If Bitcoin starts moving higher with momentum, those short positions can be forced to close automatically. Each forced close becomes a market buy, which can push the price even higher, called a short squeeze. If Bitcoin breaks above nearby resistance and enters this liquidity zone, the price could move quickly, not gradually.

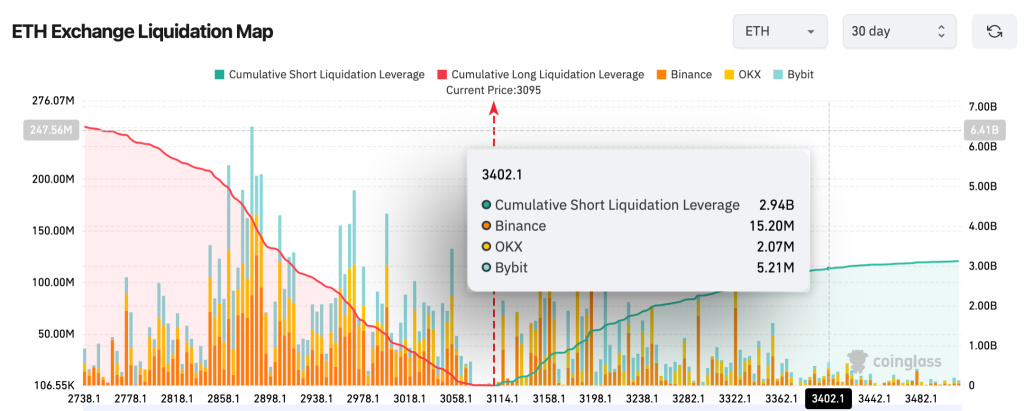

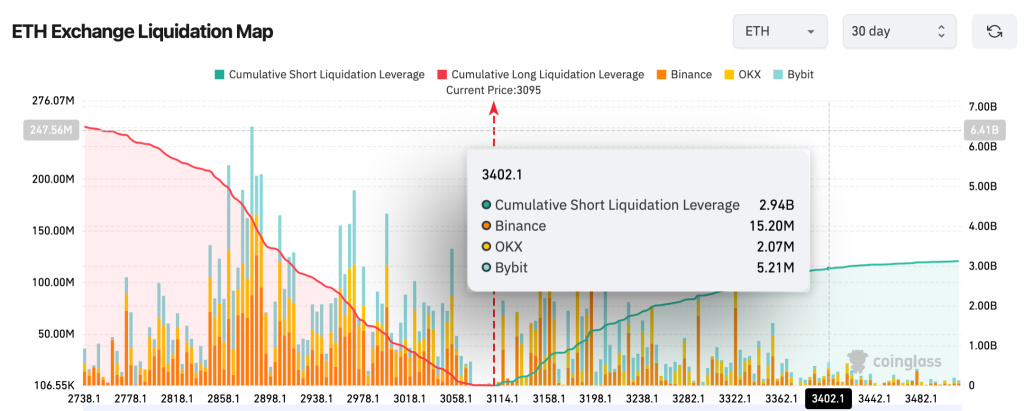

The Ethereum setup also looks very similar to Bitcoin. The traders have piled up billions in shorts, which is believed to have become a major threshold. If these liquidation zones are hit, the ETH price may eventually break the cluster at $3400 or $3500 and rise above $4000. The only thing that differentiates Ethereum from Bitcoin is that it reacts faster than the BTC price once the liquidation zones are hit.

The liquidation map for Ethereum shows a dense short-side cluster building from $3,400, with more than $3 billion in potential liquidations stacked above the range. If ETH pushes into this zone, forced liquidations could trigger a fast upside expansion. That makes $3,500 a key level not just for ETH traders but for the broader altcoin market.

$100,000 for Bitcoin and $3,500 for Ethereum are not price targets—they are pressure points.

If price is pushed into these zones, forced liquidations could turn a steady move into a fast, momentum-driven surge, with volatility spilling across the entire market. These are the moments when trends accelerate, and positions get tested quickly. But if momentum fades before those levels are reached, the stacked liquidity remains untouched, and the market may continue to grind sideways longer than most expect.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Search

RECENT PRESS RELEASES

Related Post