Lowered Guidance and Regulatory Scrutiny Might Change the Case for Investing in Trex Compa

November 15, 2025

- Earlier this month, Trex Company reported third quarter 2025 results showing sales of US$285.35 million and lowered its full-year sales expectations, while law firms launched investigations into its inventory and sales disclosures following the announcement.

- An important insight is that, alongside updated forecasts and planned share buybacks, Trex is also enhancing its Midwest distribution network through an expanded partnership with Specialty Building Products, aiming to strengthen access for its decking and railing products across Michigan.

- We’ll examine how the combination of lowered sales guidance and regulatory scrutiny could impact Trex’s previously upbeat investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Advertisement

Trex Company Investment Narrative Recap

To have confidence as a Trex shareholder, you need to believe the long-term shift from wood to composite decking, along with Trex’s innovation and channel strength, will offset current market weakness and intense competition. The recent news, including lowered sales guidance, regulatory investigations, and a steep share price decline, raises questions about short-term demand visibility, making the pace of inventory normalization a vital catalyst, while reputational risk from ongoing investigations looms as a key concern.

The company’s expanded partnership with Specialty Building Products in Michigan stands out, as it increases Midwest distribution reach for its decking and railing products. While this move supports long-term growth by strengthening Trex’s channel presence, it does not materially alter the biggest near-term risk: the effect of inventory reductions and unsettled regulatory scrutiny on momentum.

However, investors should also be aware that ongoing regulatory investigations represent a new layer of risk that could …

Read the full narrative on Trex Company (it’s free!)

Trex Company’s narrative projects $1.5 billion revenue and $333.1 million earnings by 2028. This requires 10.2% yearly revenue growth and a $146.4 million earnings increase from $186.7 million.

Uncover how Trex Company’s forecasts yield a $43.74 fair value, a 38% upside to its current price.

Exploring Other Perspectives

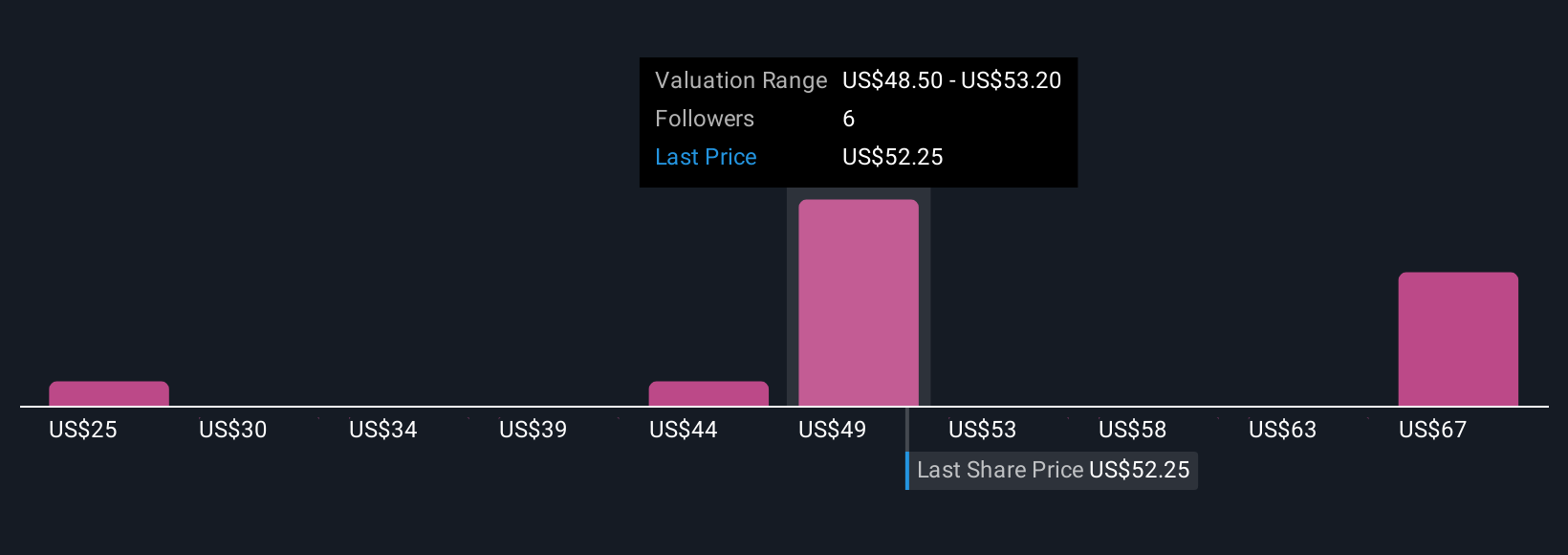

Fair value estimates from four Simply Wall St Community members span US$25 to US$45.15 per share. Some expect sustained market share gains to drive improvement, while others worry about near-term profit declines, review more perspectives inside.

Explore 4 other fair value estimates on Trex Company – why the stock might be worth as much as 42% more than the current price!

Build Your Own Trex Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trex Company research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trex Company research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Trex Company’s overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Trex Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post