Luxembourg Sovereign Fund Invests in Bitcoin: First in Europe

October 9, 2025

Luxembourg’s sovereign wealth fund has become the first in the Eurozone to invest in Bitcoin, allocating 1% of its $730 million portfolio to Bitcoin exchange-traded funds (ETFs). Finance Minister Gilles Roth announced the decision on Thursday, marking a turning point in how state capital interacts with digital assets.

The move highlights the cryptocurrency’s growing legitimacy among institutional allocators. Once treated as a speculative outlier, Bitcoin is now being evaluated alongside traditional stores of value and inflation-hedging instruments.

The Intergenerational Sovereign Wealth Fund (FSIL) made the investment under a revised mandate that allows up to 15% of assets in alternative holdings, including crypto. Jonathan Westhead, communications head at the Luxembourg Finance Agency, said the step reflects “measured confidence in a maturing digital-asset market.”

SponsoredSponsored

He explained that Bitcoin ETFs offer a regulated path to exposure without the operational complexity of custodying coins directly.

“Luxembourg wants innovation with accountability. This structure delivers both,” Westhead said.

The investment, worth roughly $7 million, may appear modest but carries symbolic weight. It establishes an institutional precedent within the Eurozone, a region still cautious toward crypto adoption. By opting for ETFs instead of direct purchases, Luxembourg has set a framework that other sovereign or pension funds can replicate within regulated limits.

Many investors on social media welcomed the decision. Analysts also noted that sovereign participation validates the infrastructure built by asset managers such as BlackRock and Fidelity.

Luxembourg’s entry could accelerate liquidity and demand across Bitcoin-linked products. ETFs tied to the asset have already absorbed more than $168 billion globally, accounting for nearly 7% of Bitcoin’s market capitalization. The FSIL’s investment reinforces this momentum and strengthens the asset’s position as a macro-relevant instrument.

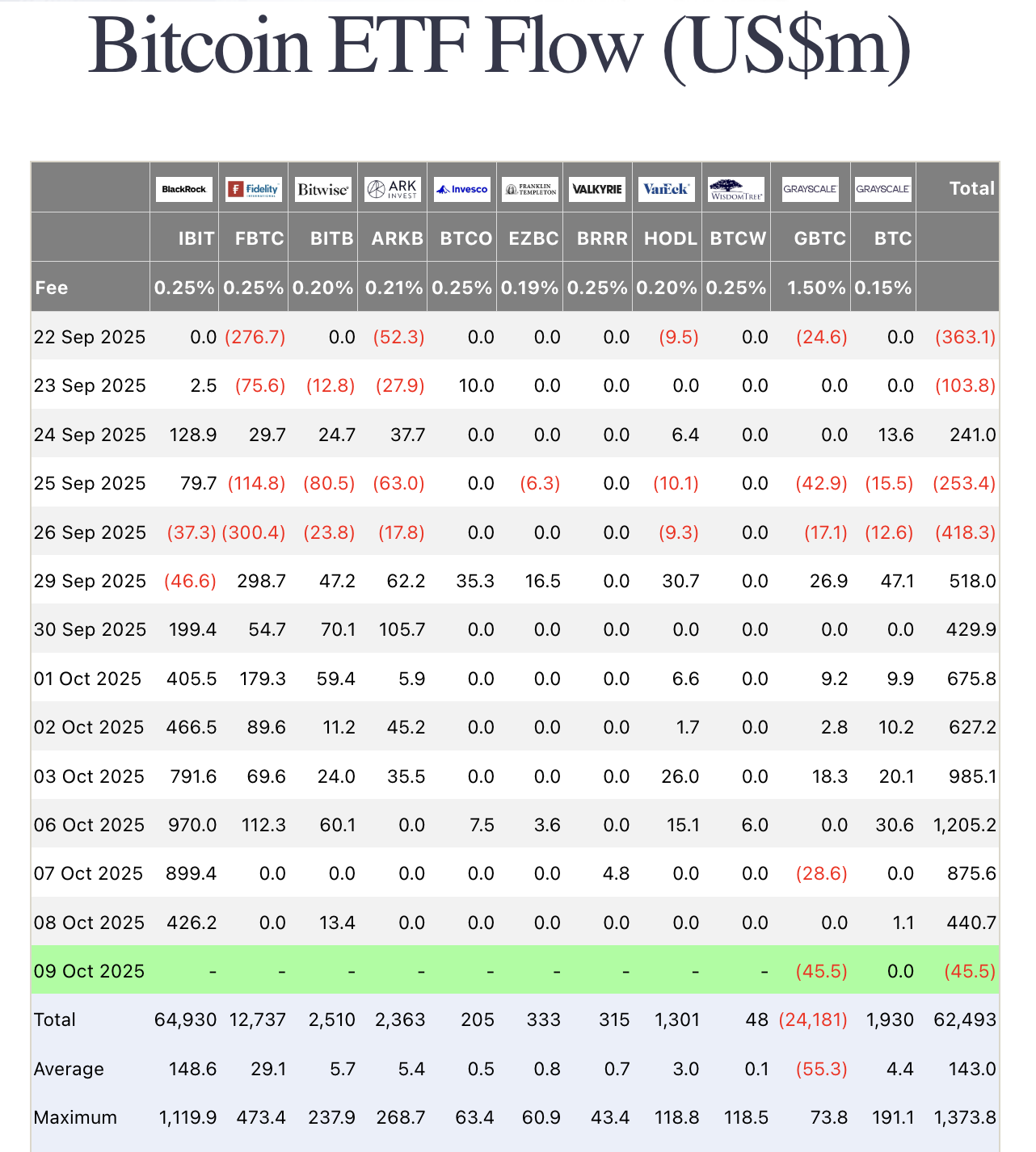

Spot Bitcoin ETFs in the US maintained momentum on October 8, registering another day of significant net inflows following robust weekend activity. According to Farside Investors, total net inflows for all funds reached $440.7 million that day, primarily driven by BlackRock’s iShares Bitcoin Trust (IBIT), which attracted $426.2 million. The Ark/21Shares ARKB fund also saw $13.4 million in inflows. For the week starting October 7, inflows have already approached $1.3 billion, underscoring persistent investor demand for Bitcoin exposure.

Across Europe, several nations have shown growing openness to Bitcoin. Althoughoutside the EU, Switzerland remains a hub for digital-asset banking and ETF issuance. Asset managers like DWS and Deutsche Digital Assets are expanding crypto offerings under BaFin’s oversight in Germany. Meanwhile, France has licensed multiple firms for crypto custody and tokenization, and Liechtenstein continues to pioneer blockchain regulation with its comprehensive Token Act. These developments suggest Luxembourg’s move fits into a broader regional trend toward structured, compliant exposure to Bitcoin.

Market participants say the signal effect matters more than the capital itself. Luxembourg may encourage other European state funds or central banks to consider similar diversification. This could, in turn, draw new service providers, custodians, and fintech startups into the region, deepening Bitcoin’s institutional infrastructure.

Search

RECENT PRESS RELEASES

Related Post