Major Buyback and Supply Chain Flexibility Might Change The Case For Investing In Texas In

August 11, 2025

- Between April and June 2025, Texas Instruments repurchased 1,847,766 shares for US$289.59 million, completing its buyback program from 2018 with a total of 49,938,873 shares repurchased for US$7.70 billion.

- This significant buyback coincided with Texas Instruments being recognized by a major investment fund for effectively managing tariff risks through flexible manufacturing across global regions.

- We’ll now examine how Texas Instruments’ agile supply chain management could influence its broader investment narrative and outlook.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Advertisement

Texas Instruments Investment Narrative Recap

To be a Texas Instruments shareholder, you need to have confidence in the company’s robust position in analog and embedded markets, its ability to manage manufacturing and supply chain risks, and its consistent capital returns to shareholders. The recently completed buyback program highlights continued confidence, yet its real impact on near-term performance and the central catalyst, industrial and automotive sector recovery, is likely limited. The most significant immediate risk remains the threat of further commoditization and overcapacity in a competitive market.

Among recent corporate actions, the headline announcement is the historic US$60 billion investment in U.S. semiconductor fabs. This scale of manufacturing expansion directly connects to both the short-term catalyst of increased chip demand for industrial and automotive recovery, and to the risk of underutilized capacity should those end markets stall. For investors tracking capacity and demand, these capital commitments are crucial to watch.

However, it’s equally important for investors to be aware that rising competition, especially from fast-moving Chinese and global rivals, could soon…

Read the full narrative on Texas Instruments (it’s free!)

Texas Instruments’ outlook predicts $22.3 billion in revenue and $7.9 billion in earnings by 2028. This is based on an annual revenue growth rate of 10.1% and a $2.9 billion increase in earnings from the current $5.0 billion.

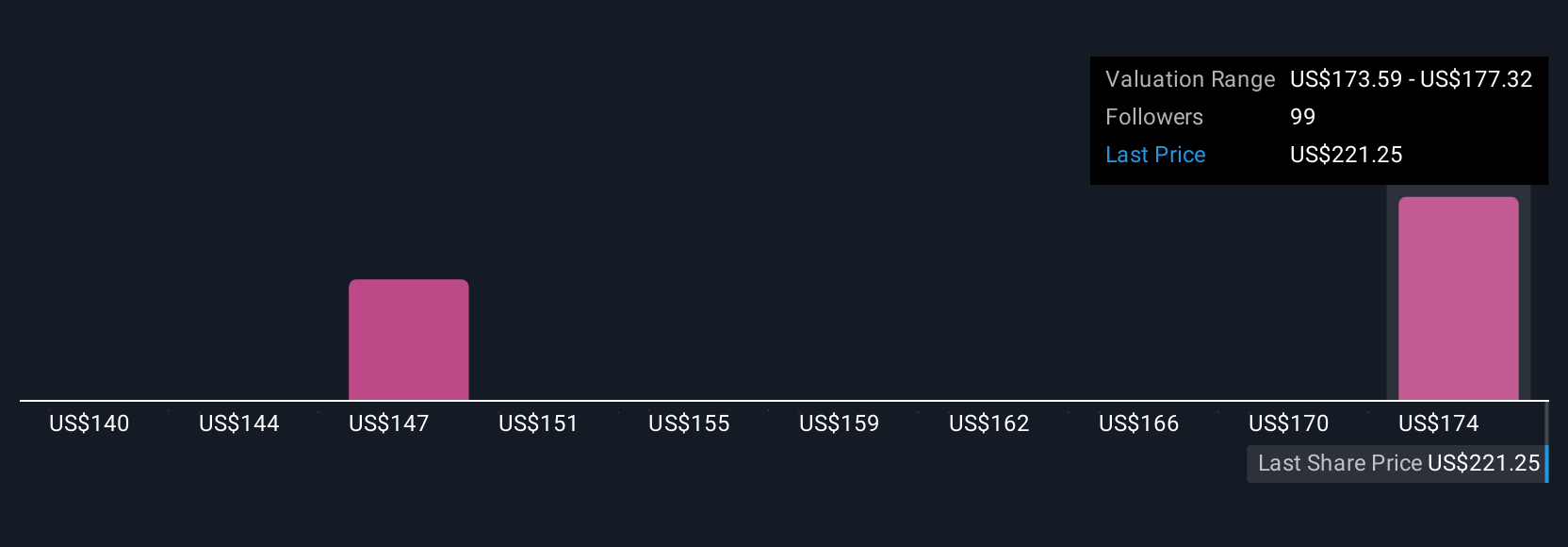

Uncover how Texas Instruments’ forecasts yield a $205.73 fair value, a 10% upside to its current price.

Exploring Other Perspectives

If you take the most optimistic forecasts before this news, some analysts were expecting annual revenues to reach US$27.7 billion and profits to more than double by 2028. These estimates bet on manufacturing investments rapidly boosting margins and growth. This is a much more upbeat outlook than consensus, so as the story evolves, it’s worth considering which view matches your expectations for Texas Instruments and why opinions can differ so widely.

Explore 7 other fair value estimates on Texas Instruments – why the stock might be worth as much as 10% more than the current price!

Build Your Own Texas Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Instruments research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Texas Instruments research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Texas Instruments’ overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post