Meet the Spectacular Vanguard ETF With 46.7% of Its Portfolio Invested in Nvidia, Apple, M

January 9, 2026

This Vanguard ETF is packed with America’s most prominent growth stocks, and it can supercharge a diversified portfolio.

The CRSP U.S. Total Market Index is made up of all 3,498 companies listed on American stock exchanges. The CRSP U.S. Mega Cap Growth Index, on the other hand, covers 70% of the market capitalization of the Total Market Index. In other words, if we ranked all 3,498 stocks from largest to smallest, the Mega Cap Growth Index would start at the top of the list and work its way down until it captured 70% of its total value.

Remarkably, the Mega Cap Growth Index holds just 66 stocks. That’s right, a mere 66 companies account for 70% of the total value of the entire U.S. stock market. Perhaps it shouldn’t be surprising given Nvidia, Apple, Microsoft, and Alphabet — which are America’s four largest companies — are worth a whopping $15.9 trillion combined.

The Vanguard Mega Cap Growth ETF (MGK 0.81%) is an exchange-traded fund (ETF) which tracks the performance of the CRSP U.S. Mega Cap Growth Index, and it consistently beats the market thanks to its highly concentrated portfolio of America’s largest tech stocks. Here’s how it can help investors supercharge their returns.

Image source: Getty Images.

Large positions in America’s flagship tech companies

The artificial intelligence (AI) boom has created trillions of dollars in value since it started gathering momentum in early 2023. At first, suppliers of data center chips and components like Nvidia were the biggest winners, but providers of cloud computing services and developers of AI software quickly joined the party.

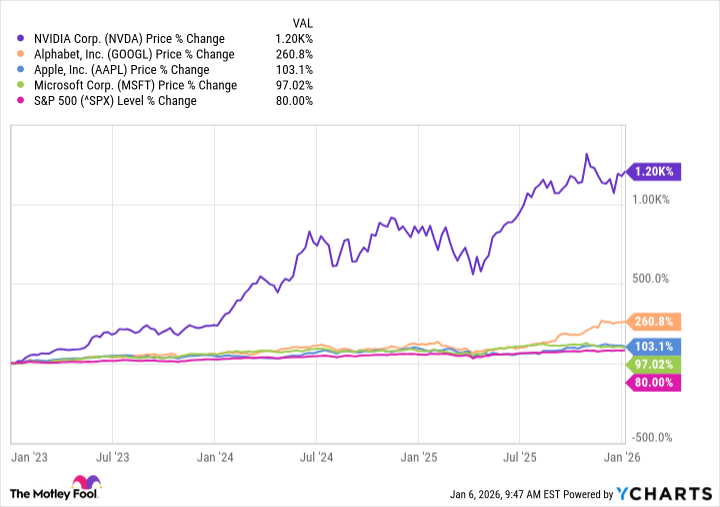

Nvidia, Apple, Microsoft, and Alphabet each fall into one of those buckets, so it’s no surprise they have comfortably beaten the benchmark S&P 500 (^GSPC +0.01%) index over the last few years:

Advertisement

Those four stocks have a combined weighting of 46.7% in the Vanguard Mega Cap Growth ETF, so they have a significant influence over its performance.

|

Stock |

Vanguard ETF Portfolio Weighting |

|---|---|

|

1. Apple |

12.77% |

|

2. Nvidia |

12.67% |

|

3. Microsoft |

11.31% |

|

4. Alphabet |

10.02% |

Data source: Vanguard. Portfolio weightings are accurate as of Nov. 30, 2025, and are subject to change.

However, they aren’t the only megacap growth stocks in the Vanguard ETF benefiting from the AI revolution. Others include:

- Broadcom, which supplies AI chips and networking equipment for data centers. Thanks to surging sales, its stock has soared by more than 500% since the beginning of 2023.

- Amazon, which operates the world’s largest cloud computing platform, where it rents data center capacity and other services to AI developers. It has also integrated AI applications into its e-commerce, streaming, and digital advertising businesses.

- Tesla, which is no longer the electric vehicle industry’s largest manufacturer, but it has turned its attention to dominating AI subsegments like autonomous driving and robotics.

- Meta Platforms, which operates social networks like Facebook, Instagram, and WhatsApp. It’s using AI to boost engagement and improve monetization, which is boosting its advertising revenue.

The Vanguard ETF can boost the returns of a diversified portfolio

The Vanguard Mega Cap Growth ETF has delivered a compound annual return of 13.7% since it was established in 2007, and an accelerated annual return of 18.3% over the last 10 years, specifically, thanks to the growing adoption of technologies like cloud computing and AI.

Vanguard World Fund – Vanguard Mega Cap Growth ETF

Today’s Change

(-0.81%) $-3.35

Current Price

$412.03

However, investors shouldn’t bet the farm on this ETF given its highly concentrated portfolio, because it could experience significant volatility if an industry like AI were to hit a speed bump. Instead, investors should consider adding this ETF to a diversified portfolio, where it can potentially supercharge returns while keeping the risks in check.

For example, had an investor parked $10,000 in the Vanguard Total Stock Market ETF 10 years ago, they would be sitting on $37,727 today. However, had they split the $10,000 by placing $5,000 in the Vanguard Total Stock Market ETF and the other $5,000 in the Vanguard Mega Cap Growth ETF, they would have $45,705 today instead.

This strategy allows investors to remain somewhat diversified, while still reaping significant rewards from hypergrowth trends like AI.

Search

RECENT PRESS RELEASES

Related Post