Meta Deal and Token Factory Launch Could Be a Game Changer for Nebius Group (NBIS)

November 23, 2025

- Nebius Group N.V. recently announced a major agreement with Meta Platforms to deliver AI infrastructure valued at approximately US$3 billion over five years, coinciding with the launch of its Nebius Token Factory platform and a follow-on equity offering of Class A Ordinary Shares.

- This series of developments highlights Nebius’s deepening role within the AI infrastructure industry and signals a rising level of confidence from leading technology customers in its service capabilities.

- We’ll explore how the Meta Platforms contract reinforces Nebius Group’s investment story amid surging enterprise demand for AI compute solutions.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

Advertisement

Nebius Group Investment Narrative Recap

To be a shareholder in Nebius Group today, you need to believe in the enduring demand for high-performance AI infrastructure and the company’s ability to sustain rapid growth against fierce global competition. The recent US$3 billion Meta Platforms contract strengthens Nebius’s client roster and adds credibility but does not fundamentally alter the biggest near-term catalyst, continued acceleration in enterprise AI adoption. The largest immediate risk remains the scale and management of ongoing capital expenditures rather than the Meta news itself.

Among Nebius’s recent announcements, the launch of the Nebius Token Factory stands out for its relevance to major client wins. This new platform is designed for high-efficiency AI model deployment and access management, highlighting Nebius’s technical strengths and serving as a key differentiator as enterprise demand for AI solutions continues to surge.

Contrast this optimism, however, with the substantial risks tied to capital intensity and cash burn that investors need to consider…

Read the full narrative on Nebius Group (it’s free!)

Nebius Group’s narrative projects $3.2 billion revenue and $428.7 million earnings by 2028. This requires 133.9% yearly revenue growth and a $238.5 million increase in earnings from the current $190.2 million.

Uncover how Nebius Group’s forecasts yield a $166.00 fair value, a 99% upside to its current price.

Exploring Other Perspectives

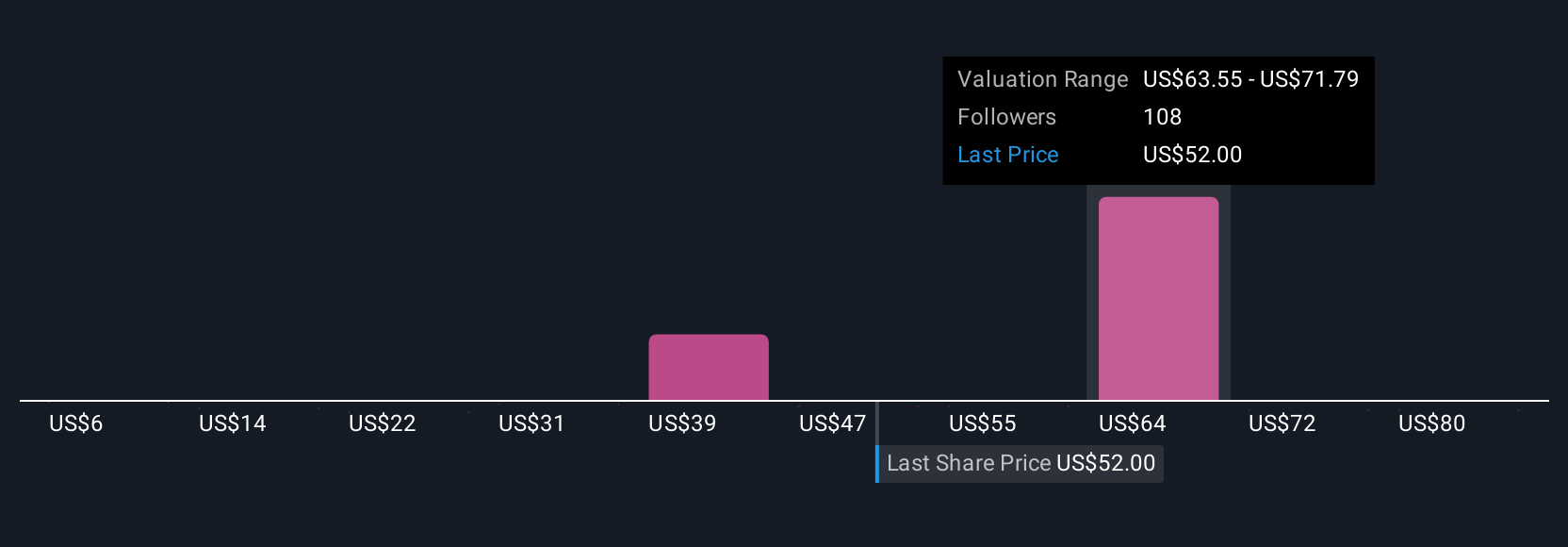

Over 34 individual fair value estimates from the Simply Wall St Community range from just US$10.97 up to US$166 per share. Against this diversity of outlooks, keep in mind Nebius’s capital intensity and cash management challenges as key themes affecting future performance.

Explore 34 other fair value estimates on Nebius Group – why the stock might be worth as much as 99% more than the current price!

Build Your Own Nebius Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Nebius Group’s overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post