Meta (META): Evaluating Valuation After AI Glasses Unveiling and UK Subscription Shift at

September 28, 2025

If you’re tracking Meta Platforms (META) lately, the latest Connect 2025 showcase probably made you sit up and rethink what’s coming next for your investment. This year’s event was packed with announcements. Meta debuted new AI-powered wearable tech, such as the Ray-Ban Display and Oakley Meta Vanguard smart glasses, and revealed headline-making features from advanced gesture controls to real-time fitness data integrations through its partnership with Garmin. The company is not just retooling the future of how we interact with technology but is also responding to regulatory headwinds, announcing an ad-free subscription option for UK users of Facebook and Instagram. Both moves highlight how Meta is doubling down on new revenue channels and user engagement, even as the broader tech sector continues to evolve.

All of this is happening against a backdrop of shifting sentiment in tech stocks. Meta’s share price performance this year has remained positive, with a 24% year-to-date gain and a 32% return over twelve months. This has outpaced many peers and reflects ongoing confidence in its long-term strategy. The new product launches and strong focus on AI signal a company eager to defend its growth narrative, while also taking steps to comply with regulatory demands and offer options for users concerned about data privacy. Recent moves suggest that momentum is building, even as questions about regulatory risk and AI spending remain significant.

With so much already factored into the current stock price, the real question for investors is whether Meta still has room to surprise on the upside, or if all potential future growth is already fully accounted for.

Advertisement

Most Popular Narrative: 38.2% Overvalued

According to the most widely followed narrative, Meta is currently priced well above its determined fair value. The narrative weighs a mix of ambitious growth assumptions and major investments, expressing doubt about whether all of Meta’s initiatives will deliver the returns investors expect.

Meta plans to invest between 60 and 65 billion in AI infrastructure in 2025, almost double its spending in 2024. This investment includes the deployment of over 1.3 million GPUs, focusing on custom silicon like MTIA to optimize compute efficiency. The company’s commitment to AI infrastructure aims to maintain its competitive edge in the rapidly evolving AI landscape.

Could Meta’s staggering investment in next-generation technology really pay off, or is it just adding more risk to an already lofty valuation? Want to see which bold financial moves and future profit targets support this market view? The real story is hidden beneath the headlines. Discover what factors could make or break Meta’s future valuation in the full narrative.

Result: Fair Value of $538.09 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, risks like regulatory pressure or weaker than expected success from Meta’s AI and hardware efforts could quickly shift investor sentiment and challenge growth expectations.

Find out about the key risks to this Meta Platforms narrative.

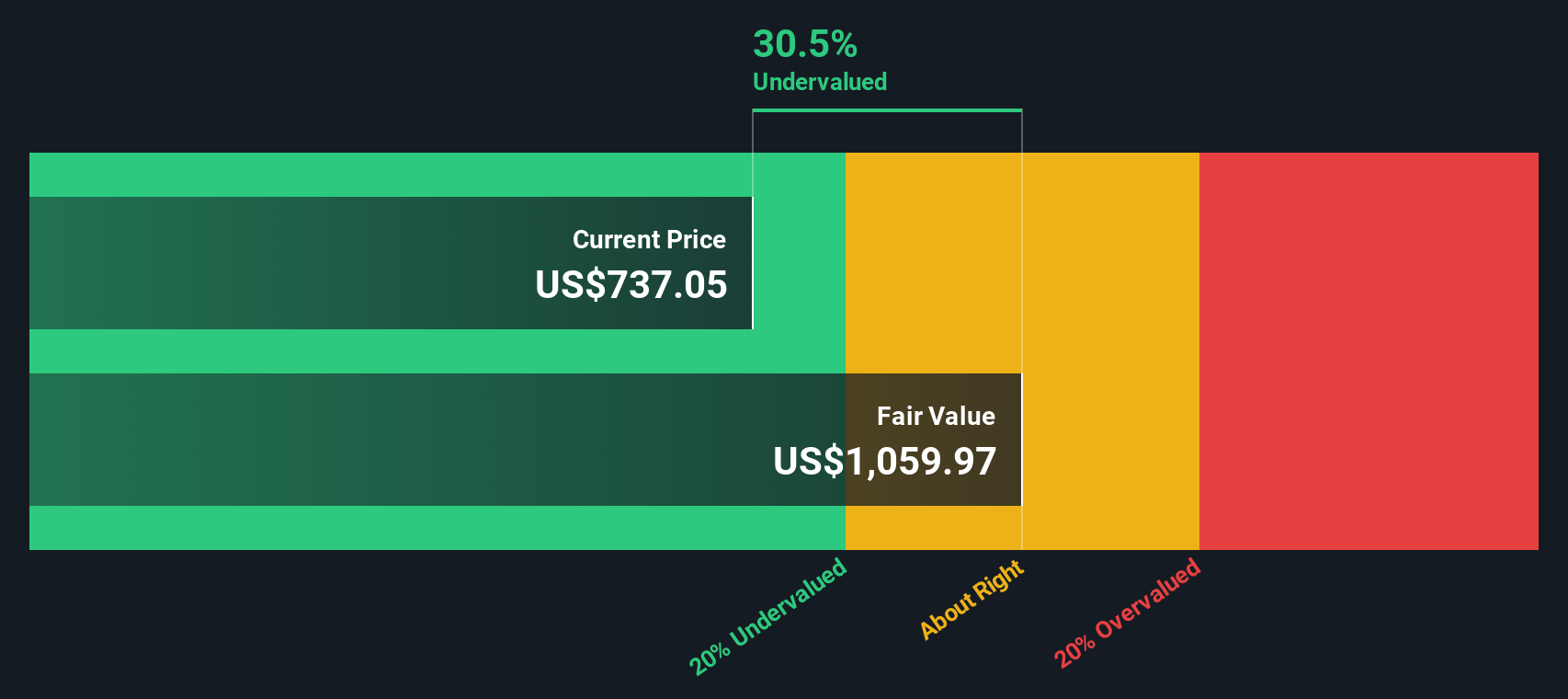

Another View: Discounted Cash Flow Tells a Different Story

While the market seems to think Meta is overvalued right now, our DCF model offers a much more optimistic picture, suggesting the company is trading below its true worth. Which assessment better reflects reality as Meta continues evolving?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Meta Platforms for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Meta Platforms Narrative

If you see things differently or want to base your outlook on your own research, why not put together your own view in just a few minutes? Do it your way

A great starting point for your Meta Platforms research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

If you don’t check out these unique stock ideas, you could miss some of the most exciting opportunities Simply Wall Street’s Screener uncovers every week.

- Tap into untapped gems offering rapid growth by finding penny stocks with strong financials that fuel innovation and push the boundaries in emerging sectors.

- Boost your portfolio with high-yield potential by uncovering dividend stocks with yields > 3% that feature companies consistently rewarding shareholders with strong and stable dividends.

- Stay ahead of the curve in artificial intelligence by targeting AI penny stocks positioned at the forefront of data, automation, and machine learning breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post