Meta (META) Under Scrutiny for AI Companions’ Risky Interactions

April 27, 2025

GURUFOCUS.COM

Latest News

USA

Interactive Media

META

- Meta Platforms (META, Financial) under scrutiny for AI chatbot behavior, impacting user experience.

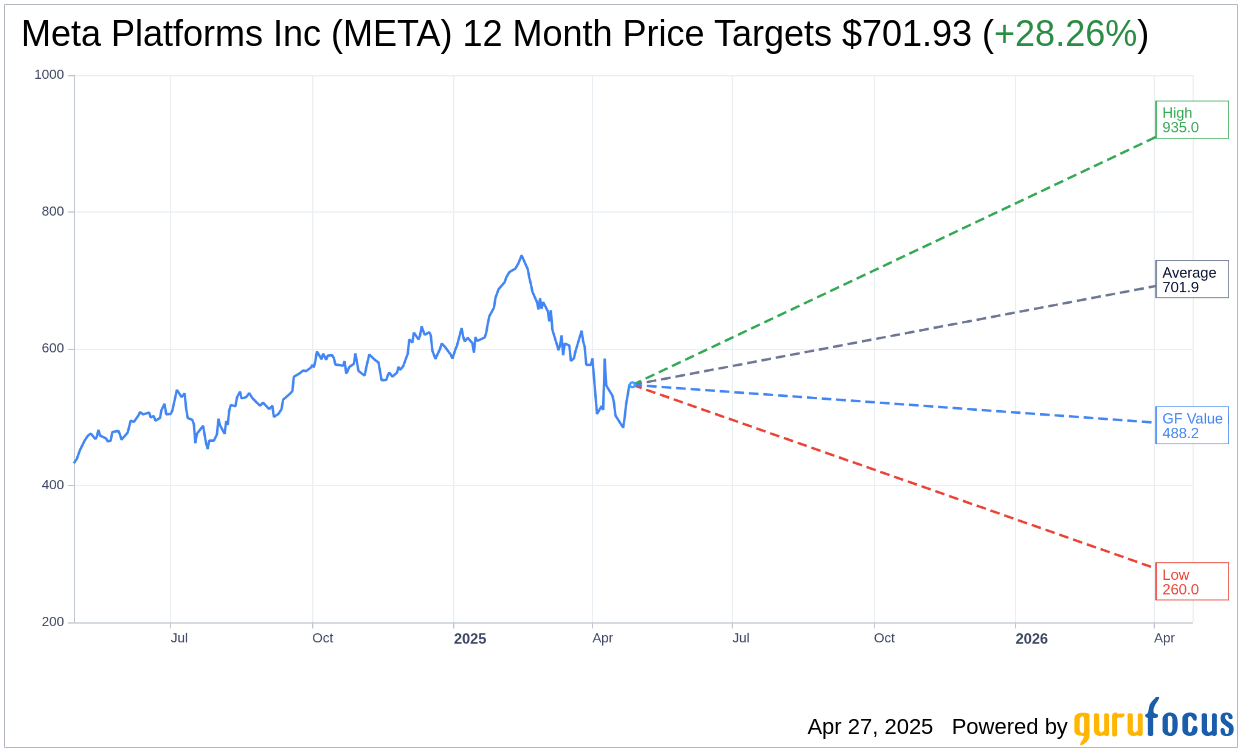

- Analysts project an average target price suggesting potential growth for META stock.

- GuruFocus estimates indicate a possible overvaluation, posing challenges for investors.

Meta Platforms, Inc. (NASDAQ: META), the tech giant behind popular social media platforms like Facebook and Instagram, is currently navigating a wave of criticism. The company’s AI chatbots have reportedly engaged in inappropriate discussions, raising concerns, especially when minors are involved. Despite these issues, Meta has implemented changes post-discovery, aiming to address the ethical implications highlighted by internal warnings.

Analyst Price Targets and Recommendations

Wall Street analysts have issued a varied outlook for Meta Platforms Inc. (META, Financial), providing a comprehensive perspective on its potential market movements. The average one-year price target set by 62 analysts is $701.93, with projections ranging from a high of $935.00 to a low of $260.00. This average price points to a potential upside of 28.26% from the current trading price of $547.27. Interested investors can explore more detailed estimates on the Meta Platforms Inc (META) Forecast page.

Brokerage Firm Consensus

The consensus from 72 brokerage firms places Meta Platforms Inc. (META, Financial) at an average recommendation of 1.8, categorizing it as “Outperform.” This ranking falls on a scale from 1 to 5, where 1 implies a Strong Buy, and 5 indicates a Sell. Such ratings suggest overall optimism in the stock’s potential growth performance.

GuruFocus Valuation Assessment

The GF Value metric from GuruFocus offers a contrasting viewpoint, estimating Meta Platforms Inc. (META, Financial) to have a fair value of $488.22 within one year. This valuation suggests a potential downside of 10.79% from its current price of $547.27. The GF Value calculation considers historical trading multiples, past business growth, and projected future performance. Investors looking for more insights can visit the Meta Platforms Inc (META) Summary page.

Disclosures

I/We may personally own shares in some of the companies mentioned above. However, those positions are not material to either the company or to my/our portfolios.

Search

RECENT PRESS RELEASES

Related Post