Meta Platforms, Inc. $META is CWA Asset Management Group LLC’s 8th Largest Position

January 12, 2026

CWA Asset Management Group LLC increased its stake in shares of Meta Platforms, Inc. (NASDAQ:META – Free Report) by 10.8% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 58,716 shares of the social networking company’s stock after purchasing an additional 5,720 shares during the quarter. Meta Platforms accounts for 1.6% of CWA Asset Management Group LLC’s holdings, making the stock its 8th largest holding. CWA Asset Management Group LLC’s holdings in Meta Platforms were worth $43,120,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds also recently bought and sold shares of the stock. Goldstone Financial Group LLC grew its stake in shares of Meta Platforms by 44.4% during the third quarter. Goldstone Financial Group LLC now owns 3,752 shares of the social networking company’s stock worth $2,756,000 after purchasing an additional 1,153 shares in the last quarter. Spirepoint Private Client LLC raised its stake in Meta Platforms by 2.7% in the second quarter. Spirepoint Private Client LLC now owns 4,080 shares of the social networking company’s stock valued at $3,011,000 after buying an additional 109 shares in the last quarter. Diversify Advisory Services LLC lifted its holdings in Meta Platforms by 10.4% during the 2nd quarter. Diversify Advisory Services LLC now owns 55,431 shares of the social networking company’s stock worth $43,790,000 after buying an additional 5,224 shares during the last quarter. CW Advisors LLC boosted its position in shares of Meta Platforms by 27.8% during the 2nd quarter. CW Advisors LLC now owns 176,762 shares of the social networking company’s stock worth $130,467,000 after acquiring an additional 38,432 shares in the last quarter. Finally, Sequoia Financial Advisors LLC boosted its position in shares of Meta Platforms by 11.0% during the 2nd quarter. Sequoia Financial Advisors LLC now owns 210,526 shares of the social networking company’s stock worth $155,387,000 after acquiring an additional 20,912 shares in the last quarter. Institutional investors and hedge funds own 79.91% of the company’s stock.

Meta Platforms Stock Up 1.1%

META stock opened at $653.06 on Monday. The company has a market cap of $1.65 trillion, a price-to-earnings ratio of 28.85, a price-to-earnings-growth ratio of 1.29 and a beta of 1.29. The company has a fifty day moving average price of $641.26 and a 200 day moving average price of $703.52. The company has a debt-to-equity ratio of 0.15, a current ratio of 1.98 and a quick ratio of 1.98. Meta Platforms, Inc. has a 12 month low of $479.80 and a 12 month high of $796.25.

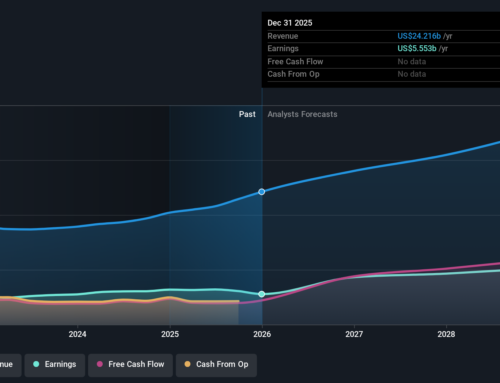

Meta Platforms (NASDAQ:META – Get Free Report) last posted its quarterly earnings data on Wednesday, October 29th. The social networking company reported $7.25 EPS for the quarter, beating analysts’ consensus estimates of $6.74 by $0.51. Meta Platforms had a net margin of 30.89% and a return on equity of 39.35%. The company had revenue of $51.24 billion for the quarter, compared to analyst estimates of $49.34 billion. During the same period in the previous year, the business posted $6.03 earnings per share. Meta Platforms’s quarterly revenue was up 26.2% on a year-over-year basis. Sell-side analysts expect that Meta Platforms, Inc. will post 26.7 earnings per share for the current year.

Meta Platforms Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, December 23rd. Shareholders of record on Monday, December 15th were given a dividend of $0.525 per share. This represents a $2.10 dividend on an annualized basis and a yield of 0.3%. The ex-dividend date of this dividend was Monday, December 15th. Meta Platforms’s dividend payout ratio (DPR) is presently 9.28%.

Analyst Upgrades and Downgrades

Several equities research analysts recently weighed in on META shares. Arete Research set a $718.00 target price on Meta Platforms in a research note on Thursday, December 4th. Roth Capital reissued a “buy” rating on shares of Meta Platforms in a report on Thursday, October 30th. Raymond James Financial restated a “strong-buy” rating and set a $825.00 price objective (down previously from $900.00) on shares of Meta Platforms in a research report on Thursday, October 30th. Benchmark downgraded shares of Meta Platforms from a “buy” rating to a “hold” rating in a research report on Thursday, October 30th. Finally, Weiss Ratings reiterated a “buy (b)” rating on shares of Meta Platforms in a research note on Monday, December 29th. Four investment analysts have rated the stock with a Strong Buy rating, thirty-eight have assigned a Buy rating and seven have assigned a Hold rating to the stock. According to data from MarketBeat, the stock presently has an average rating of “Moderate Buy” and an average price target of $822.89.

Read Our Latest Report on Meta Platforms

Insider Buying and Selling

In other news, Director Robert M. Kimmitt sold 600 shares of the business’s stock in a transaction that occurred on Monday, November 17th. The stock was sold at an average price of $609.35, for a total value of $365,610.00. Following the transaction, the director owned 7,347 shares of the company’s stock, valued at approximately $4,476,894.45. The trade was a 7.55% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, COO Javier Olivan sold 2,610 shares of the stock in a transaction on Saturday, November 15th. The stock was sold at an average price of $609.46, for a total value of $1,590,690.60. Following the sale, the chief operating officer directly owned 9,784 shares of the company’s stock, valued at approximately $5,962,956.64. This represents a 21.06% decrease in their ownership of the stock. Additional details regarding this sale are available in the official SEC disclosure. In the last ninety days, insiders sold 41,038 shares of company stock worth $25,500,705. 13.61% of the stock is currently owned by insiders.

Trending Headlines about Meta Platforms

Here are the key news stories impacting Meta Platforms this week:

- Positive Sentiment: Secured multi‑gigawatt nuclear power deals (Vistra, TerraPower, Oklo) to supply Meta’s Prometheus AI data center — long‑dated agreements help lock in reliable, low‑carbon capacity for heavy AI compute and reduce power‑supply risk for future growth. Meta strikes nuclear power agreements with three companies

- Positive Sentiment: Nuclear deals receive broad coverage (TechCrunch, Bloomberg) and have already lifted shares of partners (Oklo, Vistra) — a signal markets view the agreements as material to Meta’s AI infrastructure buildout and future margins. Meta signs deals with three nuclear companies for 6+ GW

- Positive Sentiment: Strong demand signals for Meta’s Ray‑Ban Display AI glasses — company paused international rollout because U.S. demand outstripped limited inventory, which supports upside for Reality Labs if Meta can scale production. Meta’s New AI Glasses See “Unprecedented Demand”

- Neutral Sentiment: Analyst activity mixed but constructive: some price targets trimmed (Guggenheim lowered its target) yet many firms retain Buy/Outperform views given AI growth and healthy fundamentals — watch updates for guidance impact. Guggenheim price target note

- Negative Sentiment: Regulatory risk in China — Beijing announced a probe/assessment of Meta’s ~$2B Manus acquisition to check export/security compliance; this creates near‑term transaction uncertainty and geopolitical headline risk. China to assess/investigate Manus deal

- Negative Sentiment: Insider selling: COO Javier Oliván disclosed small, regular share sales — routine but sometimes interpreted by market participants as a mild near‑term negative signal. SEC filing: Javier Oliván sale

About Meta Platforms

Meta Platforms, Inc NASDAQ: META, formerly Facebook, Inc, is a global technology company best known for building social networking services and immersive computing platforms. Founded in 2004 and headquartered in Menlo Park, California, the company operates a family of consumer-facing products and services that connect users, creators and businesses. In October 2021 the company rebranded as Meta to reflect an expanded strategic focus on augmented and virtual reality technologies alongside its social media businesses.

Meta’s core consumer products include Facebook, Instagram, WhatsApp and Messenger, which enable social networking, messaging, content sharing and community building across mobile and desktop devices.

Featured Stories

Want to see what other hedge funds are holding META? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Meta Platforms, Inc. (NASDAQ:META – Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest reporting and unbiased coverage. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Meta Platforms, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Meta Platforms wasn’t on the list.

While Meta Platforms currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

Search

RECENT PRESS RELEASES

Related Post