Meta Platforms Stock: Should You Buy the Post-Earnings Dip?

November 11, 2025

Despite beating expectations, the stock has been sliding since releasing its latest quarterly numbers.

Meta Platforms (META 1.25%) stock has been on an impressive run over the past couple of years, rising from a low of $120 in early 2023 to a high of $790 earlier this year. Investors have been largely convinced the business has been on the right path, with sales growth looking solid and the company’s investments and opportunities in artificial intelligence (AI) also appearing promising.

Recently, however, the company released its latest quarterly results, and the stock has been going on a bit of a tailspin ever since. On Nov. 6, it closed at just under $619 — the lowest level it has been at since back in May. Could this be a great time to invest in the social media giant?

Image source: Getty Images.

Were Meta’s earnings really that bad?

On Oct. 29, Meta reported its third-quarter earnings for the period ended Sept. 30. Net income fell a staggering 83% year over year to $2.7 billion. The chief reason for the decline was a one-time tax charge of over $15.9 billion, related to the One Big Beautiful Bill Act. On an adjusted basis, the company’s earnings per share of $7.25 actually came in higher than analysts’ estimates of $6.69. Revenue rose 26% to $51.2 billion, surpassing Wall Street expectations of $49.4 billion.

Investors may have been concerned with the company’s continued heavy spending on AI. Meta boosted the low end of its guidance for capital expenditures this year, now expecting to spend at least $70 billion, versus $66 billion previously. This is as it’s still spending heavily on its metaverse business, Reality Labs, which incurred a $4.4 billion operating loss for the period — similar to what it reported in the same quarter last year.

At a time when investors may be growing concerned with rising valuations and the possibility of an AI bubble, Meta showing no signs of slowing down on spending could be a key reason why the stock has been under significant pressure of late.

A look at the stock’s valuation

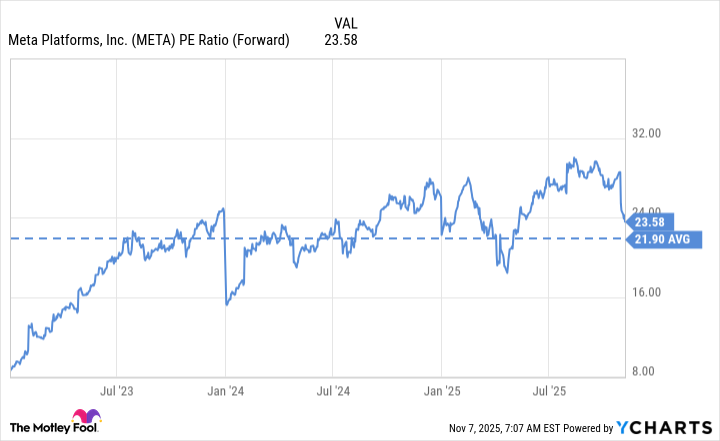

Currently, Meta Platforms’ stock trades at a forward price-to-earnings (P/E) multiple of around 24, based on analysts’ estimates. That’s higher than what it has averaged in the past five years, despite its recent fall in value.

META PE Ratio (Forward) data by YCharts

By comparison, the average stock on the S&P 500 trades at 23 times its future earnings. Meta remains priced at a bit of a premium, but not by much. And with its high growth rate, investors may see justification in buying at these levels.

Analysts covering the tech stock largely lowered and downgraded their price targets for Meta recently. But even with the reductions, the consensus analyst price target is $827.60, suggesting an upside of around 35% from where it trades today.

Meta Platforms

Today’s Change

(-1.25%) $-7.88

Current Price

$623.88

Why I’d hold off on buying Meta at these levels

This recent decline in Meta’s price isn’t large enough to make the stock look like a bargain buy. The company’s aggressive spending is a concern, as it already has a significant money pit in Reality Labs. Even though AI may enhance its ad business and lead to new growth opportunities, the payoff is still debatable.

Plus, economic conditions aren’t ideal, and if a recession takes place in the near future, a reduction in advertising spend may take place, which will impact its financial results.

Meta’s valuation, which remains relatively high, doesn’t leave a whole lot of margin of safety for investors right now. Given the uncertainty and Meta’s heavy spending on the latest trends, I wouldn’t rush to buy the stock amid this recent tailspin.

Search

RECENT PRESS RELEASES

Related Post