Meta Platforms Stock Signal 07/01: Trading $2 Billion AI

January 7, 2026

Long Trade Idea

Enter your long position between $643.50 (Friday’s intra-day low) and $664.54 (Monday’s intra-day high).

Market Index Analysis

- Meta Platforms (META) is a member of the NASDAQ 100, the S&P 100, and the S&P 500.

- The NASDAQ 100, S&P 100, and S&P 500 all pushed cautiously higher to start 2026, with AI stocks surging on renewed euphoria following strong Micron and Nvidia earnings, even as broader market breadth deteriorated and trading volumes declined, signalling that gains are increasingly concentrated in mega-cap tech names.

- The Bull Bear Power Indicator of the NASDAQ 100 is bullish but remains structurally below its descending trendline, suggesting that while early-year strength persists, the reliability of the rally is questionable as volume divergences widen and retail participation lags.

Market Sentiment Analysis

Meta has captured Wall Street’s imagination with its aggressive push into advanced AI and superintelligence, culminating in the announcement of a $2 billion acquisition of Manus, a Singapore-based AI agent startup, which immediately sparked analyst upgrades and strong buy ratings despite emerging concerns about Manus’s Chinese founding team and potential regulatory scrutiny in Washington. The delayed global rollout of Ray-Ban Display smartglasses—now paused due to “unprecedented demand and limited supply” in the U.S.—removes a near-term uncertainty but also suggests that Reality Labs’ hardware ambitions may face execution and manufacturing challenges that keep capital-intensive losses intact.

Market sentiment on Meta is decidedly bullish, underpinned by the company’s extraordinary success in monetizing AI through Advantage+, its AI-powered advertising suite, which now operates at a $60 billion annual run rate and drove a 26% year-over-year increase in ad revenue in Q3 2025. However, the concentration of bullish bets and the sharp rally in AI stocks to start the year suggest that much of the good news may already be priced in, particularly with Meta’s earnings call scheduled for January 28, 2026, where any disappointment in guidance or competitive threats from TikTok’s algorithm or emerging AI advertising alternatives could trigger sharper-than-expected pullbacks.

Meta Platforms Fundamental Analysis

Meta Platforms is one of the world’s biggest spenders on research & development, a member of the US Big Five Tech Companies, and the Magnificent Seven. It is an industry leader in the metaverse and has now embarked on a hiring spree to become a leader in advanced AI and superintelligence.

So, why am I bullish on META following its breakout?

Meta’s fundamental narrative centers on 20%+ quarterly revenue growth driven by explosive AI monetization through Advantage+, which has scaled to a staggering $60 billion annual run rate by capturing 98.6% of the company’s total advertising revenue and delivering a 4.52:1 return on ad spend for advertisers. The $2 billion Manus acquisition, while drawing regulatory scrutiny over its Chinese founding team, represents a strategic bet on agentic AI capabilities that could significantly enhance both Meta’s advertising precision and future product capabilities, with Wall Street analysts assigning 25%+ upside scenarios if the integration proves successful.

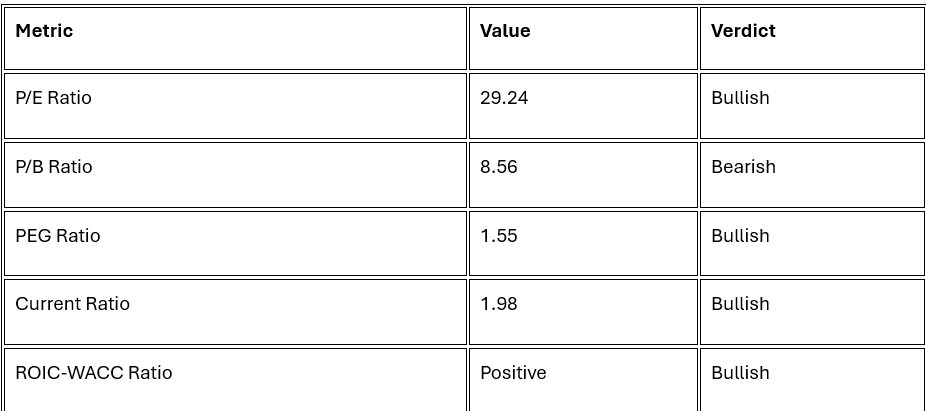

The delayed global launch of Ray-Ban smartglasses, paradoxically, is a bullish sign for earnings trajectory because it removes the near-term drain of Reality Labs losses from investor focus, allowing Meta to demonstrate margin expansion and cash generation without the quarterly headwind of VR hardware losses. The Advantage+ platform itself is undervalued by the market, as it represents a defensible moat that competitors like TikTok lack the data scale and AI sophistication to replicate, and as generative AI creative tools penetrate advertiser bases further, incremental margin leverage could propel Meta toward 45%+ operating margins by 2027. With excellent profit margins of 43% operating margins and strong balance sheet liquidity (Current Ratio 1.98), Meta possesses the capital to fund $66-72 billion in AI infrastructure investments while simultaneously returning cash to shareholders.

Meta Platforms Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 29.24 makes META an inexpensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 33.82.

The average analyst price target for META is $837.15. This suggests excellent upside potential and acceptable downside risk, with some Wall Street strategists calling for $845+ targets if AI scaling materializes as expected.

Meta Platforms Technical Analysis

Today’s META Signal

- The META D1 chart shows price action consolidating just above the $660.00 psychological level after a sharp intra-week rally, with buyers defending the $643.50–$650.00 support zone aggressively, confirming that institutional accumulation remains intact despite the recent pause in momentum.

- META now trades above its 20-day and 50-day moving averages with rising volume on the recent bounce, indicating that the pullback that preceded the Manus announcement was a healthy consolidation rather than a trend reversal, and dip-buyers continue to emerge on weakness.

- The Bull Bear Power Indicator on the META daily chart has turned bullish with an ascending trendline, signalling strengthening buyer dominance and suggesting that recent dips continue to attract institutional accumulation rather than capitulation selling.

- Average trading volumes on the recent breakout above $658.00 are above the 20-day average, a constructive sign that suggests the stock’s rally is supported by real money flows rather than retail euphoria alone.

- META has begun to materially outperform the broader NASDAQ 100 and S&P 500 indices on a relative strength basis, a constructive signal that underscores the stock’s preferred positioning within the AI and mega-cap technology rotation, supporting continued strength as the January 28th earnings report approaches.

META Price Chart

My META Long Stock Levels and R/R

- META Entry Level: Between $643.50 and $664.54

- META Take Profit: Between $796.25 and $837.15

- META Stop Loss: Between $581.25 and $601.20

- Risk/Reward Ratio: 2.45

Ready to trade our analysis of META? Here is our list of the best stock brokers worth checking out.

Search

RECENT PRESS RELEASES

Related Post