Meta Q3 2025 earnings preview: AI monetisation and ROI concerns

October 23, 2025

Meta is investing heavily in infrastructure to expand its superintelligence capabilities. One key initiative includes building massive AI ‘titan clusters’ data centres.

The first cluster Prometheus in Ohio will go live in 2026 and will house at least one gigawatt of computing power. Hyperion will be the next and will scale up to five gigawatts over the next several years.

These projects have dramatically increased the company’s capital expenditure (capex). Year-to-date capex through June 2025 spiked to $30.7 billion, nearly double the spending in the same period in 2024. Full calendar year capex is projected to reach $66 to $72 billion. Free cashflow also declined 12% to $8.5 billion last quarter.

Investors will need evidence that infrastructure spending translates into revenue growth sufficient to justify the significant capital allocation shift and margin compression.

Meta’s heavy reliance on advertising revenue, which accounts for 98% of total revenue, creates vulnerability to economic downturns and shifts in advertiser spending. Any sustained weakness in the digital advertising market could significantly impact financial performance.

Regulatory challenges remain a persistent concern in both the US and European Union. Potential restrictions on data usage, content moderation requirements, and antitrust investigations could limit the company’s operational flexibility and revenue growth.

The timeline for meaningful revenue impact from AI features remains uncertain. While engagement metrics show positive signs, the sustainability and scalability of these gains over the longer term remain to be demonstrated.

Competition in the AI space continues to intensify, with rivals investing heavily in similar capabilities. Meta’s ability to maintain its competitive position depends on successful execution of its AI strategy and continued user engagement across its family of apps.

Wall Street sentiment has remained constructive, with 59 of 68 analysts assigning ‘buy‘ or ‘strong buy’ ratings according to LSEG data, and one ‘sell’ recommendation.

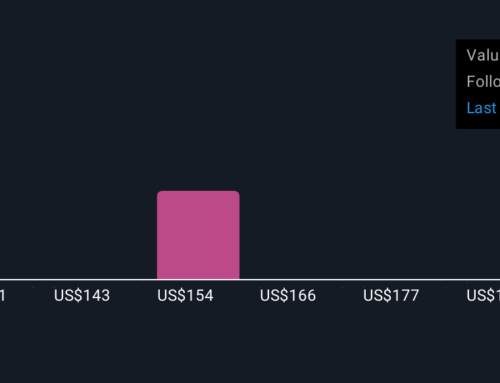

Average target price has been revised materially upwards in late July from below $700 to $860 currently. This suggests approximately 17% upside from current levels. However, these targets reflect assumptions about successful AI monetisation that have yet to be fully validated by financial results (as of 22 October 2025).

Wall Street analyst estimates

Search

RECENT PRESS RELEASES

Related Post