Michigan cannabis sales slip for first time since legalization

May 23, 2025

Steve Neavling

One of three grow rooms for flowing plants at Green Dolphin Craft Cannabis, a small cultivator in Detroit.

For the first time since Michigan legalized recreational cannabis in 2019, the state’s adult-use industry is showing signs of contraction, a troubling shift for marijuana businesses and state and local governments that depend on the tax revenue.

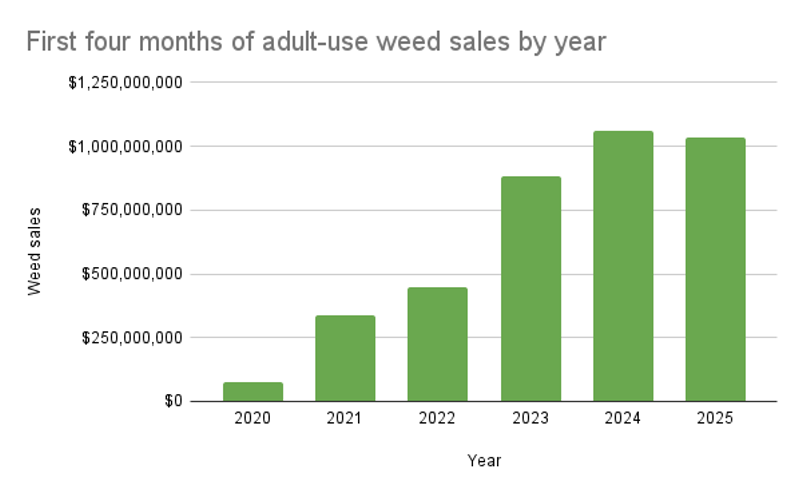

Between January and April 2025, dispensaries sold $1.03 billion in cannabis products, according to new data from the state’s Cannabis Regulatory Agency. That’s down from $1.06 billion during the same period last year, marking the first year-over-year decline.

The slide may seem minor, but it marks a turning point for an industry once defined by rapid growth. From 2022 to 2024, first-quarter sales rose sharply each year. In the first four months of 2024, for example, adult-use sales jumped 17% compared to the year before. In 2023, sales nearly doubled over 2022.

That pattern has now reversed, and the stakes go beyond businesses and consumers.

Adult-use cannabis is subject to a 10% excise tax and 6% sales tax. Since legal sales began, Michigan has collected more than $1.9 billion in cannabis-related tax revenue — money that helps fund schools, infrastructure, and local governments across the state.

In fiscal year 2024, roughly $116 million for both schools and roads, and nearly $100 million was distributed to 302 cities, townships, and counties. That money helped support local nonprofits and community projects. If sales and tax revenue continue to fall, communities across the state could feel the squeeze.

The good news for consumers is that prices are lower than they have ever been.

In April, the average price of an ounce of flower hit a record low of $62.23. A year earlier, the average was $86.61. When legal recreational sales launched in December 2019, the same product cost over $500. In total, flower prices have plummeted about 87% in less than five years.

A Metro Times analysis shows Michigan residents are buying more cannabis than ever — they’re just paying far less for it. In April alone, dispensaries moved significantly more flower, shake, concentrates, vape cartridges, kief, and edibles than they did the year prior, even though the total sales numbers were down. Flower sales rose 31.3%. Concentrate sales climbed 29.5%. Vape cartridges jumped 28.1%.

The problem is oversupply. Records show dispensaries held more than 160,000 pounds of flower in April, up from 143,300 pounds the prior year. Many of those growers were licensed during an aggressive expansion phase between 2020 and 2022, when the market was still maturing and few saw a ceiling.

Now, that ceiling is coming into view.

Data from the Cannabis Regulatory Agency

Cannabis sales have plateaued in Michigan.

“As production continues to go on indefinitely, the prices will continue to go down,” Robin Schneider, executive director of the Michigan Cannabis Industry Association, says. “It’s getting to the point where the compression is not only hurting businesses but state revenue. The state should be concerned.”

Schneider and others in the industry have urged lawmakers to impose a moratorium on new cultivation licenses. Under current law, the Cannabis Regulatory Agency is required to issue licenses to applicants that meet the criteria, leaving regulators with little flexibility.

“What I’m seeing is the smaller businesses are closing at a larger rate than the well-financed businesses,” Schneider said. “The businesses that have more financial backing and more investors are going to have funding to stay afloat longer than the smaller mom and pop businesses.”

And unlike other industries, cannabis companies don’t have access to bankruptcy protections because marijuana remains illegal under federal law.

“When these small mom and pops go down, they have no bankruptcy protection,” she says. “So what ends up happening is they lose not only their business but also their homes and personal assets.”

Joanne Manning, who co-owns Granny Farm, a small family-run cultivation business on Detroit’s east side, has felt that pressure. When the business opened in 2023, she could sell wholesale pounds for $2,500 to $3,000. Now, she’s sometimes forced to sell for as little as $600 “to keep the doors open.”

“The city would need two to three times the number of dispensaries to keep up with moving our product,” Manning says.

Even if the state doesn’t halt new grow licenses, Manning hopes the city imposes a moratorium on new grows and lifts its cap on dispensaries, even if the state doesn’t act.

Manning and her husband, both retired, spent two years navigating the licensing process to launch what she says is Detroit’s smallest licensed grow. Unlike large competitors, they don’t have investors outside of their family.

“We just kinda went for it,” she said. “These big-time dispensaries will wheel and deal us because they know it doesn’t take much to wipe us out.”

Still, she’s not giving up and is relying on the quality of her product to keep customers.

“We’re still in the race,” she says. “We’re still trying to make it through this industry.”

Jason Wilson, who operated Uncle J’s Joints in Detroit, closed in March. When he started in 2022, dispensaries were paying $2,200 per pound. Now, it’s as low as $500 — a 77% drop.

“That’s how much this industry lost in the last two or three years,” Wilson said. “It’s been very rough for a lot of us cultivators here. It’s been a rough journey.”

Related

Even larger operators are feeling the strain. At Puff Cannabis, which has 11 dispensaries and a 30,000-plant outdoor grow, partner and chief legal counsel Nick Hannawa says the cost of growing licenses alone reached $418,000 this year.

“The price of flower has decreased so substantially that an outdoor pound of flower is going for $100,” Hannawa says. “But the cost for licenses has gone up. The state is taxing the hell out of us, charging top dollar for these licenses, and they’re giving out more and more licenses, and we’re losing the value of our product. It’s killing the growers and the processors. And it’s killing the market.”

Hannawa says only the state can intervene now.

“We’re self-cannibalizing our industry in the state,” he said. “The state has to wake up. What the government doesn’t realize is they’re the only ones who can put a stop to this. They see it happening, they know it’s happening. It’s insanity.”

Despite the industry’s warning signs, state budget projections remain optimistic. The Michigan Department of Treasury anticipates a 4.4% increase in excise tax revenue in 2026 and a 3.2% increase in 2027.

Those projections depend on continued consumer demand and some level of price stabilization.

For now, the market is still flooded, prices remain low, and operators are struggling to stay afloat. What happens next will depend largely on what — if anything — lawmakers and regulators choose to do.

Related

Search

RECENT PRESS RELEASES

Related Post