Michigan to add 24% marijuana tax to fix the roads

October 1, 2025

Buying legal marijuana in Michigan will likely cost about 24% more starting next year, thanks to a tax hike meant to fill potholes.

Michigan’s political leaders have agreed not to shut down the state government over a budget impasse, but not all lawmakers are on board with upcoming tax hikes.

The statement claims that Gov. Gretchen Whitmer, Senate Majority Leader Winnie Brinks, and House Speaker Matt Hall have agreed to pass a budget with road funding before Oct. 1.

The leaders agreed to pass the School Aid budget and state budget, including long-term road funding, before the end of the fiscal year.

Michigan Republicans and Democrats agreed to enact a 24% wholesale tax on marijuana. That tax will add to the already 10% excise tax for recreational marijuana and a 6% sales tax.

Whitmer proposed a 32% tax on marijuana earlier this year, Michigan Capitol Confidential reported.

The House approved House Bill 4951, which is meant to raise $420 million annually to fix the roads. However, it’s unclear whether a 24% price increase will turn marijuana users back to the black market, which would give the government no revenue. The bill moves to the Senate.

States like Illinois and California have legalized marijuana but taxed it so much that users still choose to buy from the black market.

“The literature on the price of marijuana and demand for it is mixed, as academic literature often is,” Michael LaFaive, the senior director of fiscal policy at the Mackinac Center for Public Policy, told Michigan Capitol Confidential in an email. “Theory tells us, however, that an increase in the price of just about anything leads to a decline in the quantity demanded of it. Part of that is a decline in the demand for legal marijuana, as individuals may substitute that legal, taxable product for the illegal, untaxed one.”

Hiking taxes threatens Michigan’s legal marijuana market, State Senator Jeff Irwin, D-Ann Arbor, posted on social media.

“When Michigan residents approved legal cannabis, we set up a system that was the most successful cannabis market in the nation. Our low taxes and opportunities for real competition meant that consumers flocked to legal dispensaries. We learned from California and Colorado that high taxes on cannabis drive people into the illicit market. As a result of our Michigan model, 75% of sales in Michigan happen in legal shops. By contrast, in California, only about 35% of sales happen legally. This is why Michigan’s cannabis market is larger than California’s.

Republicans jammed through this huge tax increase intending to raise money for roads. Unfortunately, this bill won’t raise the projected revenue and will diminish revenue to roads and schools through the excise tax. The real winners in the House today were illicit drug dealers.”

The marijuana industry opposes this new tax, which would add to an already 16% tax on marijuana, according to a post from the Dykema law firm.

“What the Mi Road Ahead Plan references is Michigan’s Tobacco Products Tax Act, which was enacted in 1993—25 years before marijuana was ever legalized. The TPTA does not contain a “loophole” for marijuana products; it addresses an entirely different product and industry. Quite simply, the Mi Roads Plan proposes levying a new 32% wholesale tax on the marijuana industry.”

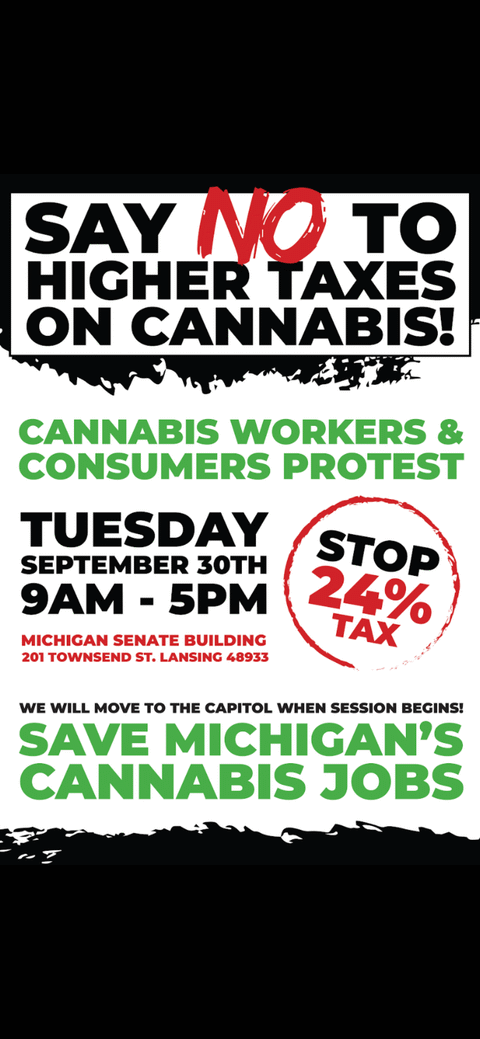

Those opposed to the tax increase protested at the Capitol on Tuesday.

The tax hike could cost up to 47,000 jobs, according to Robin Schneider, the director of the Michigan Cannabis Industry of Michigan.

This insane tax hike puts 47,000 legitimate jobs on the line! We are paying VERY close attention to how our lawmakers vote,” Schneider posted on social media. “Call your Senators today and show up to the Capitol tomorrow. We pass ballot initiatives, we get out the vote! WE WILL ORGANIZE AND VOTE YOU OUT!

Below are the statements as released.

“Today’s agreement in the legislature puts us on a path to lower costs, fix the damn roads, and pass a balanced, bipartisan budget by October 1,” Whitmer said. “I am grateful to Majority Leader Brinks, Speaker Hall, and legislators on both sides of the aisle for working hard to move this budget forward. In Michigan, we’ve proven again and again that we can work together to get things done by staying focused on the kitchen-table issues that make a real difference in people’s lives.”

House Speaker Matt Hall

“We have an opportunity here to reform Michigan’s broken process and get much better value for the taxpayers,” said Speaker of the House Matt Hall. “There is still work to be done, but it is an important step that all of us are agreeing to implement meaningful tax relief for Michigan workers and seniors, bring transparency and accountability to the earmark process for the first time, and eliminate ghost employees. Government has grown far too much in recent years, and we need to trim the waste, fraud and abuse in Lansing. That’s how we can afford the real priorities of Michigan families – like education, public safety, and fixing our local roads and bridges. This agreement puts us in position to do just that.”

Senate Majority Leader Winnie Brinks:

“The people of Michigan deserve a budget that makes their daily lives better — a budget that boosts education, improves roads, and protects healthcare,” said Senate Majority Leader Winnie Brinks. “The framework we have agreed to reflects the priorities of Michiganders from every region, and while no budget will be a perfect product, I am confident that the final result we vote on next week will have features that benefit every resident.”

The administration and legislative leaders will continue meeting to pass the budget.

Search

RECENT PRESS RELEASES

Related Post