Microsoft’s $9.7 Billion AI Cloud Deal Might Change The Case For Investing In IREN (IREN)

November 9, 2025

- Earlier this month, Microsoft announced it has signed a US$9.7 billion, five-year cloud services agreement with IREN Limited, giving it access to NVIDIA GB300 GPUs at IREN’s Texas data centers as part of a major AI infrastructure push; IREN also secured a separate US$5.8 billion GPU and equipment purchase agreement with Dell Technologies to be rolled out through 2026.

- This deal accelerates IREN’s shift from Bitcoin mining to a global AI cloud provider, leveraging renewable-powered data centers and expected to significantly increase its AI cloud revenue run-rate.

- We’ll explore how becoming Microsoft’s largest AI infrastructure partner could reshape IREN’s long-term earnings outlook and market positioning.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Advertisement

IREN Investment Narrative Recap

For those considering IREN stock, the key belief centers on whether its transition from Bitcoin mining to AI cloud infrastructure, backed by large-scale data center investments, can be sustained by recurring, high-margin contracts with hyperscale clients like Microsoft. The recent US$9.7 billion cloud deal may provide a critical short-term revenue catalyst, but risks remain around substantial capital spending outpacing operating cash flow, which could pressure margins if demand or pricing weakens.

In context, the November announcement of IREN’s five-year GPU cloud contract with Microsoft is the most material news, as it elevates Microsoft’s role as IREN’s largest customer and solidifies the AI cloud shift. This deal directly addresses the need for longer-term, predictable revenue streams that are crucial to offset the volatility of its legacy Bitcoin mining base and support ongoing data center investments.

On the other hand, investors should watch closely for signals that rising capex, to fund expanded GPU and data center capacity, could start to outstrip operating cash flows, especially if…

Read the full narrative on IREN (it’s free!)

IREN’s narrative projects $1.5 billion in revenue and $1.0 billion in earnings by 2028. This requires 45.6% yearly revenue growth and an earnings increase of $913.1 million from current earnings of $86.9 million.

Uncover how IREN’s forecasts yield a $62.75 fair value, in line with its current price.

Exploring Other Perspectives

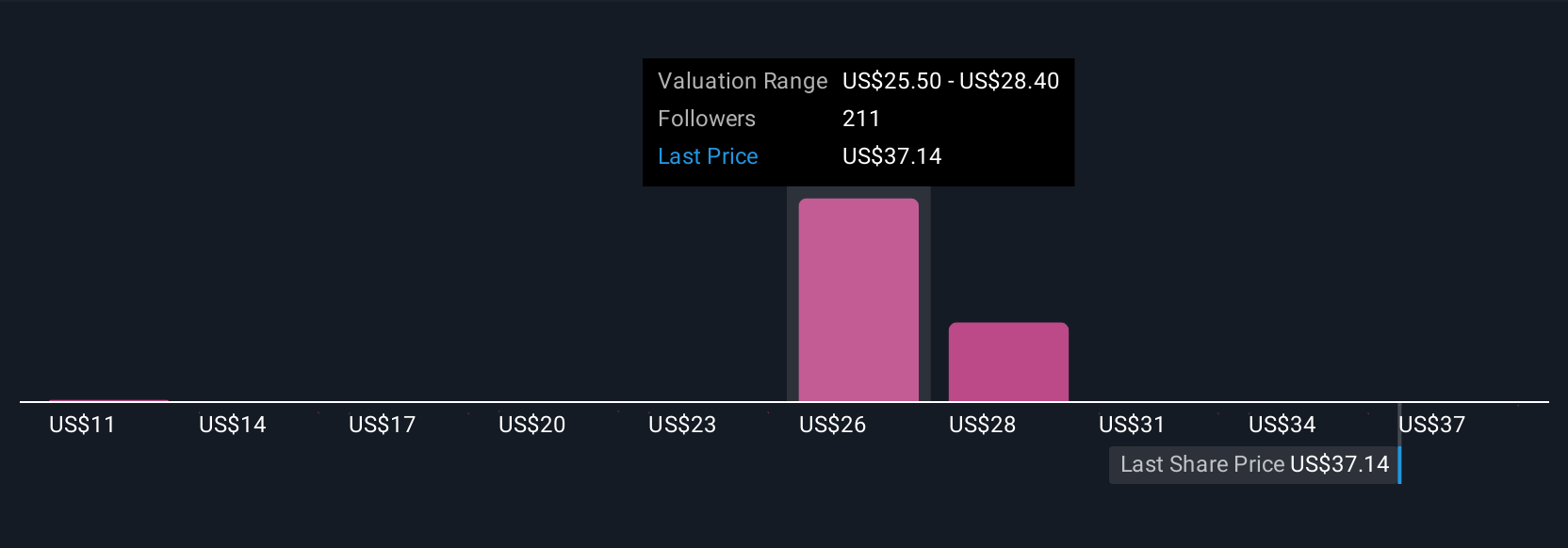

Twenty-four community members on Simply Wall St estimate IREN’s fair value anywhere from US$11 to US$112.27 per share. With massive new AI contracts adding significant growth, you might want to compare opinions on whether this rapid expansion justifies the risk of higher leverage and reduced margins.

Explore 24 other fair value estimates on IREN – why the stock might be worth less than half the current price!

Build Your Own IREN Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your IREN research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free IREN research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate IREN’s overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Related Post