Myriad Moves: Will Santa Bring a Pump or Dump for Bitcoin, Ethereum and Solana?

December 11, 2025

In brief

- The Fed cut rates on Wednesday, but crypto is lower on Thursday with predictors becoming more bearish.

- This has predictors on Myriad split on Ethereum’s next move, with odds nearly even for a pump to $4K or dump to $2.5K.

- On the other hand, predictors are more certain a pump is the next move for Bitcoin and Solana, though odds are falling.

A tight trading range for crypto’s top assets hasn’t impacted the volatility of prediction markets.

Small daily price moves have led to more drastic changes in odds on Myriad, particularly in markets focused on the price of Ethereum and Bitcoin. After this week’s rate cut, traders are now weighing whether a so-called Santa rally will arrive by Christmas for crypto markets.

Below, we’ll look at some of this week’s top markets on Myriad, including those centered on ETH’s next stop, BTC reclaiming $100K, and where Solana is headed.

(Disclaimer: Myriad Markets is a product of Decrypt’s parent company, Dastan.)

Ethereum’s next move: Pump to $4K or dump to $2.5K?

Market Open: November 5

Market Close: Open until resolution

Volume: $157K

Link: See the latest odds on the “Ethereum’s next move: Pump to $4K or dump to $2.5K?” market on Myriad

Ethereum continues to outperform majors, notching the only weekly gain of the top 10 crypto assets by market cap.

Despite that move, predictors have become less certain of a leg upward to $4,000, particularly in the last 24 hours. Following the Fed’s rate cut announcement on Wednesday, ETH briefly jumped before retracing—now down 5.3% in the last 24 hours to trade at $3,203.

That’s led to a nearly 9% drop in odds, after predictors favored a pump to the tune of around 60% on Thursday afternoon With the rate cut now official, there are fewer near-term headline catalysts for the asset and network, which just completed its Fusaka upgrade last week.

Nevertheless, BitMine Immersion Technologies Chairman Tom Lee thinks ETH has bottomed, signaling a move back to $2,500 wouldn’t be in the cards. Granted, his firm is sitting on more than $12 billion worth of Ethereum, so he’s inclined to think the worst is over.

Even so, predictors are less confident than Lee, giving odds of a dump a 49% chance as of Thursday afternoon.

What’s Next? After Wednesday’s rate cut, could another be in store at the end of January? The next FOMC meeting will take place on January 27-28.

Bitcoin’s next move: Pump to $100K or dump to $69K?

Market Open: November 21

Market Close: Open until resolution

Volume: $43.9K

Link: See the latest odds on the “Bitcoin’s next move: Pump to $100K or dump to $69K?” market on Myriad

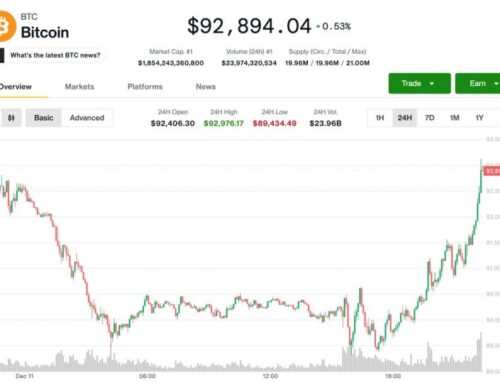

Bitcoin briefly rallied above $94,000 earlier this week, but has since retraced to $91,092. That’s toned down the bullishness of Myriad predictors, who placed odds of a jump to $100K before a dump to $69K at around 80% on Tuesday.

After the Fed rate cut on Wednesday and continued sell-off from Bitcoin holders, those odds are now down to 69.7% on Thursday afternoon.

The top crypto asset is nearly 29% off its all-time high, and popular year-end price predictions of $150,000 seem increasingly unlikely with each passing day. Given the sell-off, some firms that previously added BTC at higher marks are now selling to capitalize on losses.

Technical analysis indicates that BTC is still beholden to a descending trendline since its October peak above $126,000—but will it be enough to falter all the way to $69,000?

BTC would need to drop around 24% to hit the mark. On the other hand, it will only require a 9.74% move to regain $100K.

What’s Next? Another FOMC meeting is on the books for the end of January, potentially impacting crypto in the near-term.

Solana’s next move: Pump to $150 or dump to $100?

Market Open: November 21

Market Close: Open until resolution

Volume: $36.2K

Link: See the latest odds on the “Solana’s next move: Pump to $150 or dump to $100?” market on Myriad

Solana made a new all-time high above $293 in January… but it’s fallen more than 54% since that time to change hands at a recent price of $134. That’s despite the fact that digital asset treasuries lined up to add the asset, and Solana ETFs finally hit the market.

With a new all-time high price record incredibly unlikely anytime soon, predictors on Myriad are instead asked whether SOL will pump to $150 or dump to $100 first.

As of Thursday afternoon, predictors favor the jump to $150, with odds sitting around 68% towards the higher mark. Those odds are down about 10% in the last two days, though, all while Solana builders and developers gather to discuss the future of the network and its apps at the annual Breakpoint conference.

Often a period of excitement for the network, the early hours of Breakpoint-aligned trading have not yielded benefits for SOL, which has instead followed the rest of the crypto market down, selling off around 2.5% in the last 24 hours.

If SOL leaps to $150, then holders of the token will gain around 11.8% from its current mark. But those who take a position on Myriad stand to gain closer to 33% on the move.

What’s Next? Solana breakpoint began on Thursday in Abu Dhabi and will continue until Saturday.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Search

RECENT PRESS RELEASES

Upgrading the grid: the great energy transition in numbers

SWI Editorial Staff2025-12-11T14:12:40-08:00December 11, 2025|

Urban Outfitters Tackles Complex Regulatory Environment with AI-Powered Supply Chain Platf

SWI Editorial Staff2025-12-11T14:12:25-08:00December 11, 2025|

Bitcoin’s $732B Capital Inflow Proves This Isn’t Crypto Winter But a Mid-Cycle Reset

SWI Editorial Staff2025-12-11T14:12:14-08:00December 11, 2025|

How integration of national grids can power Africa’s future

SWI Editorial Staff2025-12-11T14:12:14-08:00December 11, 2025|

Historic Step Forward to Secure Environmental Flows in the Colorado River

SWI Editorial Staff2025-12-11T14:11:53-08:00December 11, 2025|

‘Not Worth Anything’: Michael Burry Says Bitcoin Is The ‘Tulip Bulb Of Our Time’

SWI Editorial Staff2025-12-11T14:11:42-08:00December 11, 2025|

Related Post