NextEra Energy Taps AI Data Center Boom With Meta And Tech Giants

January 26, 2026

- NextEra Energy (NYSE:NEE) has entered clean energy agreements totaling 2.5 GW with Meta Platforms across 13 projects.

- The company is working with Google and ExxonMobil on new power infrastructure for the fast growing data center market.

- These multi year collaborations focus on supplying low carbon power to hyperscale data centers in North America.

NextEra Energy, traded on the NYSE under the ticker NEE, is a large US based clean energy company with utility and renewable generation operations. Its latest agreements with Meta, Google and ExxonMobil are tied to one of the most closely watched electricity demand stories in the market: the expansion of AI and cloud focused data centers. For investors, this connects NEE to both digital infrastructure development and the broader shift toward lower carbon power sources.

These partnerships are structured around building and supplying new clean energy assets over multiple years, rather than emphasizing one off power sales. The scale of 2.5 GW with Meta, together with additional work with Google and ExxonMobil, indicates that NEE is positioning itself as a power provider to large hyperscale operators, a theme many investors are tracking.

Stay updated on the most important news stories for NextEra Energy by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on NextEra Energy.

How NextEra Energy stacks up against its biggest competitors

The Meta, Google, and ExxonMobil agreements tie NextEra directly to long duration power needs for AI and cloud data centers, giving the company line of sight on multiple gigawatts of contracted demand between 2026 and 2028 and beyond. For you as an investor, that links NEE not only to renewables growth but also to the build out of power hungry hyperscale campuses where reliability, scale, and low carbon credentials all matter.

Advertisement

NextEra Energy narrative, now firmly linked to AI data centers

Recent commentary from several brokers already frames NEE as sitting at the center of US power demand tied to AI infrastructure and population growth, with a combination of a large regulated utility and a faster growing renewables arm. These latest data center focused deals with Meta, Google, and ExxonMobil fit cleanly into that story of a company aiming for high single digit earnings growth over a long horizon, supported by long term contracts with cash rich technology and industrial customers.

Risks and rewards investors are weighing

- Large, multi year contracts with Meta and other hyperscalers provide visibility on future power sales and help support expectations for earnings growth.

- The mix of renewables, nuclear, and gas projects positions NEE across several low carbon and baseload solutions that data centers are seeking.

- Analysts have pointed to valuation as a key watchpoint, suggesting the share price already reflects strong execution and leaving less room for disappointment.

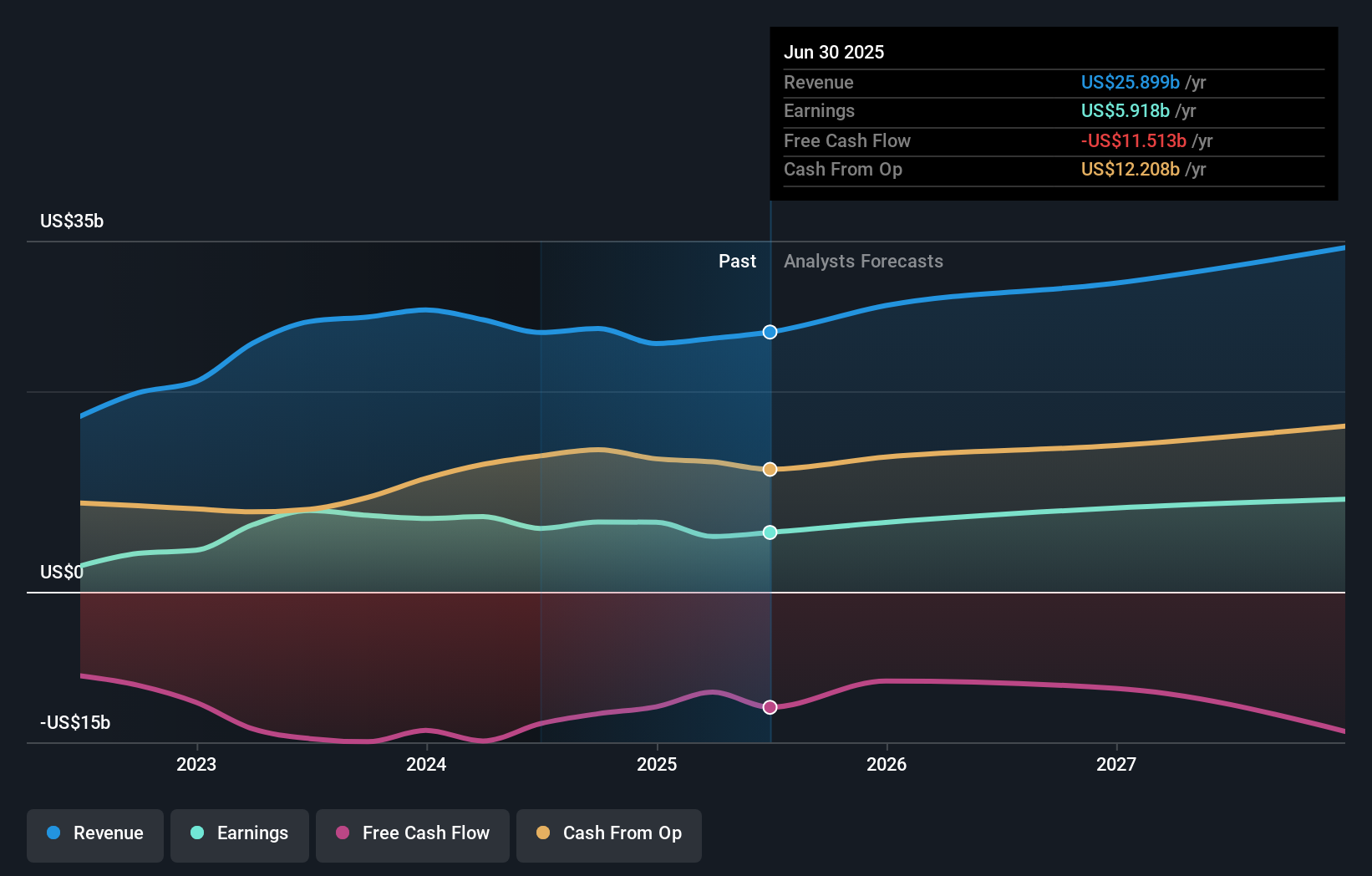

- Existing flags around interest coverage and dividend coverage by free cash flow remain relevant as NEE commits capital to build out these projects.

What to watch next

From here, it is worth tracking how quickly these contracts convert into shovel ready projects, any updates to capital spending plans, and whether similar agreements follow with other large tech customers. To keep up with how different investors interpret this story, you can follow community narratives that track how sentiment around NextEra Energy evolves as these projects move forward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post