Nobody is interested in Bitcoin, thus a rally to $165K is shaping up

June 10, 2025

In our previous update, when Bitcoin (BTC) was trading at $104K, we demonstrated that the ideal upside target zone is $164-216K with an outside chance of as high as $337K.

Thus, we should expect an extension of the green waves: W-3 will likely target the 2.618x extension instead of the standard 1.618x, which points to $155K. W-5 will likely target the 3.00x extension instead of the standard 2.00x, which points to $164K.

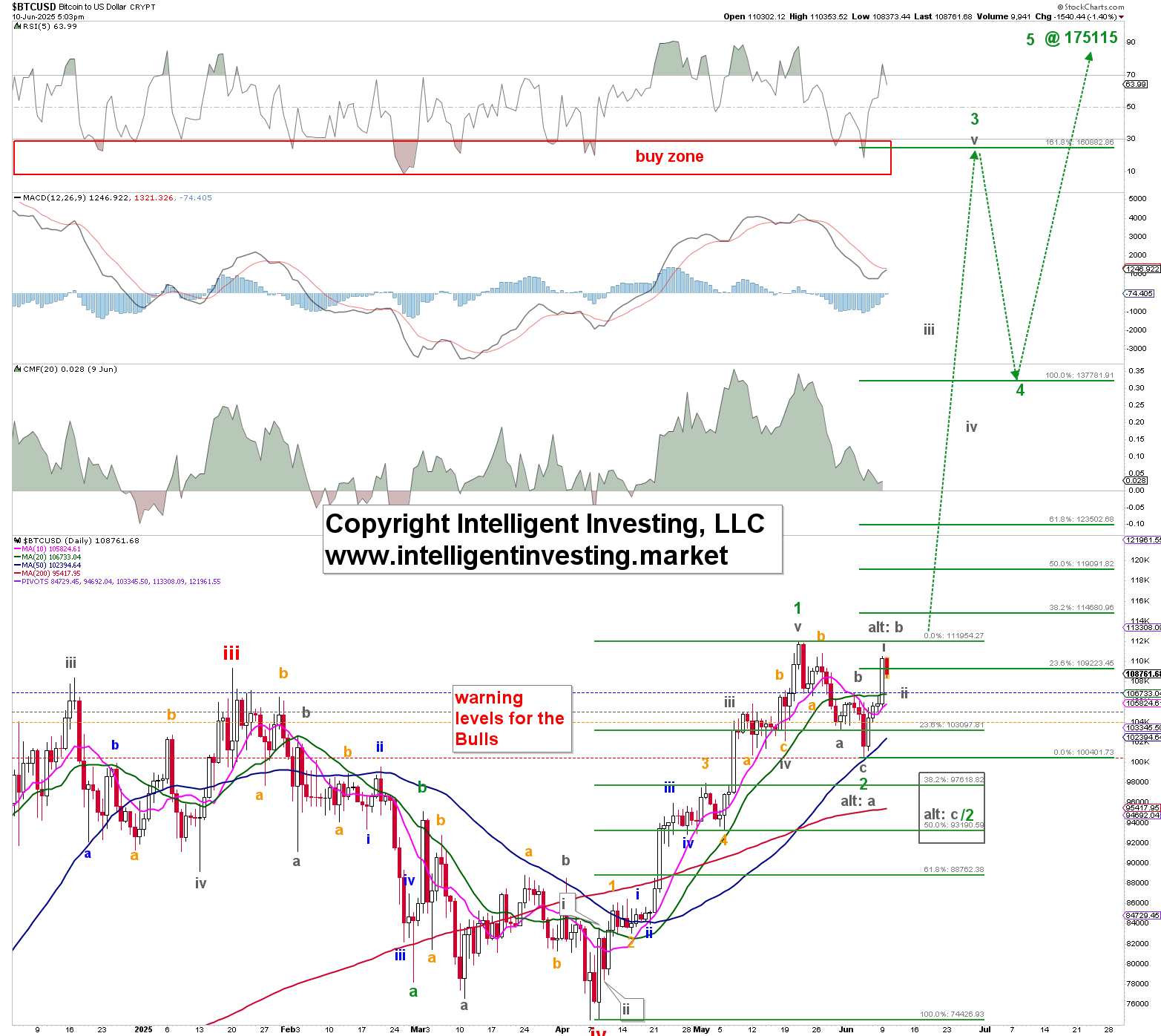

Fast forward nearly four weeks, and BTC has already achieved a new all-time high (ATH) on May 22 at $111,999. Therefore, we can begin refining our price targets. See Figure 1 below.

Up to this point, we can count five upward waves moving from the April low to the May ATH. Since then, it has corrected that rally in five overlapping waves to the June 5th low at $100,419. Consequently, either Bitcoin’s correction is over (green W-2 low) or it will subdivide into the gray “alt: a, alt: b, alt: c” path.

Figure 1. Bitcoin’s daily price chart with our preferred EW count

Although it’s shallow, the green W-2 is acceptable, and W-3 is starting, ideally reaching $166K. However, it requires a daily close above the green W-1 high for confirmation.

A drop below last week’s low would put us in the alternative Elliott Wave count: a prolonged second wave aiming ideally for $95 +/- 3K before the third wave begins, which could then lead to at least $156K.

It’s honestly a “pay me now vs. pay me later” issue, as we focus on the risk vs. reward: $15K risk vs. $50K reward. This means we see the forest for the trees: any deeper pullback is still a buying opportunity that will result in increased reward.

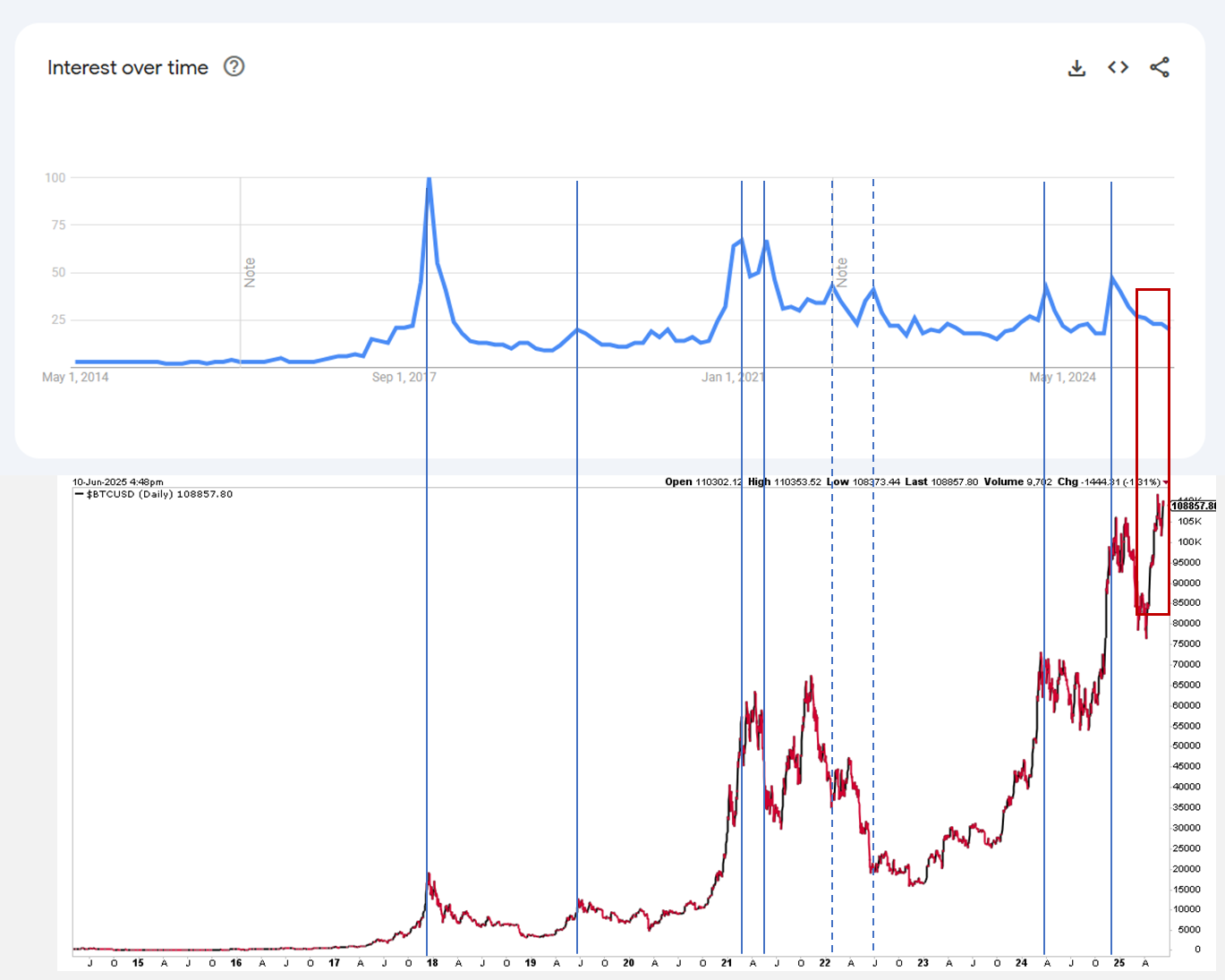

Meanwhile, a rally to $164-216K with a slight chance of reaching as high as $337K is likely based on sentiment. Specifically, a Google Trends search for the term “Bitcoin” since May 1, 2014, shows that there’s very little general interest in Bitcoin. See Figure 2 below.

Figure 2. Google Trends data for “Bitcoin” since May 1, 2014, overlaid with Bitcoin’s price.

When we overlay Google Trends search results with BTC’s price, we notice a strong correlation between the two: search terms and Bitcoin’s price tend to peak simultaneously. However, interest is currently waning, while BTC’s price has just reached a new all-time high and is now as low as it was in 2023. We all know what happened then.

Therefore, while we remain somewhat uncertain in the short term, our intermediate and long-term Elliott wave counts align with overall public sentiment: expect significantly higher prices in the coming weeks to months.

Search

RECENT PRESS RELEASES

Related Post