Oklo Versus Bitcoin: Which Has Been the Better Investment During the Artificial Intelligen

September 25, 2025

Oklo and Bitcoin have been two opportunities that have experienced outsize momentum throughout the artificial intelligence (AI) movement.

Over the last three years, investors have watched artificial intelligence (AI) evolve from a promising concept into a full-blown megatrend that continues to push the stock market to new highs. Like many disruptive themes, the AI revolution is not confined to the technology sector alone. As new AI models and data centers come online, adjacent opportunities are emerging — and speculative capital is pouring into them.

Two of the most surprising beneficiaries of the AI boom have been nuclear energy and cryptocurrency. Oklo (OKLO -8.09%), a next-generation nuclear power company, and Bitcoin, the world’s largest decentralized currency, have both become rallying cries for investors seeking asymmetric upside in the AI era.

Let’s take a closer look at how Oklo and Bitcoin stack up, and assess which opportunity offers better long-term value in the AI era.

Oklo soars on energy demand

AI demands energy consumption on an unprecedented scale. Data centers powered by clusters of GPUs from Nvidia and Advanced Micro Devices require enormous amounts of electricity, forcing companies to look beyond traditional power sources.

This is where nuclear enters the conversation. With its ability to provide reliable baseload power and its low-carbon profile, nuclear is increasingly viewed as a compelling candidate for long-term AI infrastructure investment.

Oklo has emerged at the center of this narrative. The company is developing next-generation microreactors designed to address AI’s looming energy bottleneck. The excitement around this vision has propelled Oklo into meme stock territory — fueled more by investor enthusiasm than measurable results.

For instance, shares surged nearly 20% in a single day last week after the United States and the United Kingdom announced a $350 billion AI infrastructure venture. While the deal includes energy initiatives, Oklo was not explicitly mentioned.

Image source: Getty Images.

Why Bitcoin’s ascent matters in the AI age

On the other side of the speculative spectrum is Bitcoin. Where Oklo represents a potential solution to AI’s energy requirements, Bitcoin offers something entirely different: digital scarcity. With a hard-capped supply of just 21 million coins, Bitcoin fits neatly into the “digital gold” narrative — cementing itself as a modern store of value.

What makes Bitcoin’s rise during the AI revolution especially meaningful is the policy and institutional backdrop. A pro-crypto Trump administration, treasury strategies that add Bitcoin to corporate balance sheets, sovereign nations exploring the creation of strategic reserves, and the approval of spot Bitcoin exchange-traded funds (ETFs) have all converged to accelerate mainstream adoption. Together, these factors are fueling Bitcoin’s momentum across Wall Street, corporate America, and retail investors like never before.

Bitcoin also benefits from its perception as a hedge against inflation. In a market where investments are increasingly concentrated among big tech, some are seeking alternative assets that can thrive alongside the AI boom.

Speculation, utility, and reality

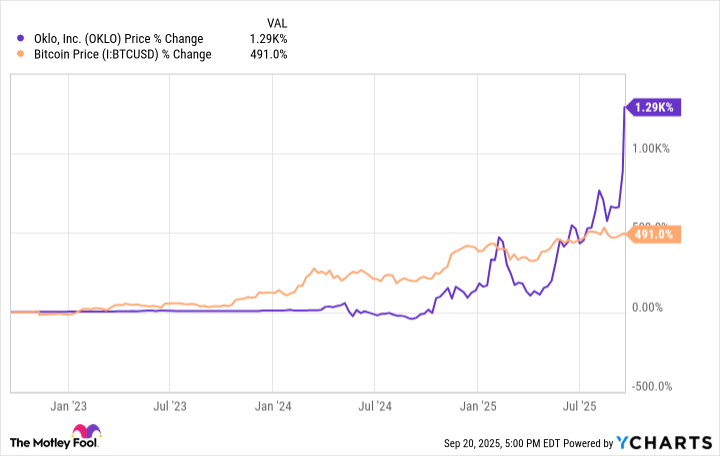

The performance gap between Oklo and Bitcoin is startling. Since the dawn of the AI boom, Oklo stock has skyrocketed by an astonishing 1,290% as of market close on Sept. 19. Over the same period, Bitcoin has gained 491%.

Even more striking, since Oklo went public through a special purpose acquisition company (SPAC) last May, its shares have outperformed Bitcoin nearly sevenfold.

On the surface, it looks as though Oklo is leaving Bitcoin in the dust. But does this really make the red-hot energy stock a better investment?

Oklo has yet to deliver a commercial product and tangible results are still years away. Its meteoric rise highlights a broader truth about today’s growth investors: Many are no longer chasing profits — they are chasing narratives. The reality is that Oklo remains a high-risk gamble on the future of AI infrastructure.

On the other hand, Bitcoin already has proven utility, global liquidity, and increasing adoption. Looked at differently, this means that Bitcoin’s value isn’t stemming solely from speculative hype-driven narratives. In my view, this makes Bitcoin’s place in institutional and retail portfolios more legitimate compared to Oklo, which largely remains a pipe dream.

As financial services and payments infrastructure are disrupted by AI, Bitcoin should continue evolving from a peripheral novelty into a legitimate global asset class. While investing in cryptocurrency still carries its share of risk, Bitcoin offers a more grounded opportunity with measurable upside compared to Oklo at the moment.

Search

RECENT PRESS RELEASES

Related Post