Onchain Odyssey: Ethereum in Korea Q1 2025

May 10, 2025

This report by Tiger Research examines Korean users’ onchain activities in the Ethereum ecosystem during Q1 2025.

Audio playback is not supported on your browser. Please upgrade.

-

The Korean cryptocurrency market continues its expansion from centralized exchanges to onchain environments. Multiple factors drive this shift, including limited investment opportunities in the domestic market.

-

Korean users demonstrate increasing long-term participation in the Ethereum ecosystem. Market downturn reduced overall transaction volumes in Q1 2025. Large investors significantly decreased their activity during this period. Retail investors maintain steady growth in their engagement.

-

Boundaries between domestic and international cryptocurrency markets will blur further. Users will actively pursue better investment opportunities. Their cross-border onchain activities will continue to expand.

A wind of change sweeps through the Korean cryptocurrency market. Users now expand their activities from centralized exchanges to onchain environments. This marks the beginning of a new trend. Multiple interconnected factors drive this shift.

Former President Yoon Suk-yeol’s declaration of martial law in December significantly impacted the cryptocurrency market. Domestic exchange servers crashed as investors rushed to exchanges during price volatility. Many investors lost trust in centralized systems when they couldn’t access trading accounts at critical moments. Political uncertainty also devalued KRW-based assets significantly. This increased demand for cryptocurrencies and stablecoins on global exchanges rather than Korean platforms.

Korea’s strict regulatory environment accelerates this market transformation. Domestic exchanges offer limited investment opportunities while global exchanges and onchain environments unlock new possibilities for investors. These expanded environments enable more diverse investment strategies. Investors can now access arbitrage opportunities between global exchanges, leveraged derivative trading, onchain meme coin launchpads, and decentralized finance (DeFi).

This report analyzes the activity patterns and characteristics of Korean users expanding into onchain environments. We base our analysis on data from approximately 60,000 Korean user wallets in the Ethereum ecosystem to provide meaningful insights into the Korean market.

Ethereum transactions represent all trades and interactions on the blockchain. These include various activities from simple asset transfers to interactions with DeFi and dApps.

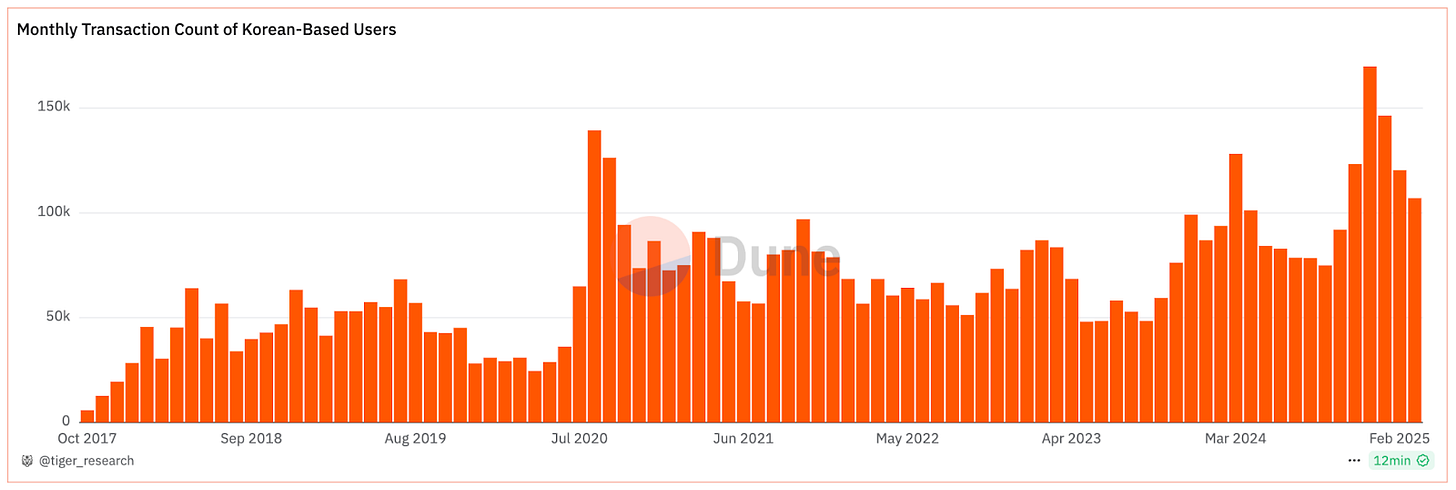

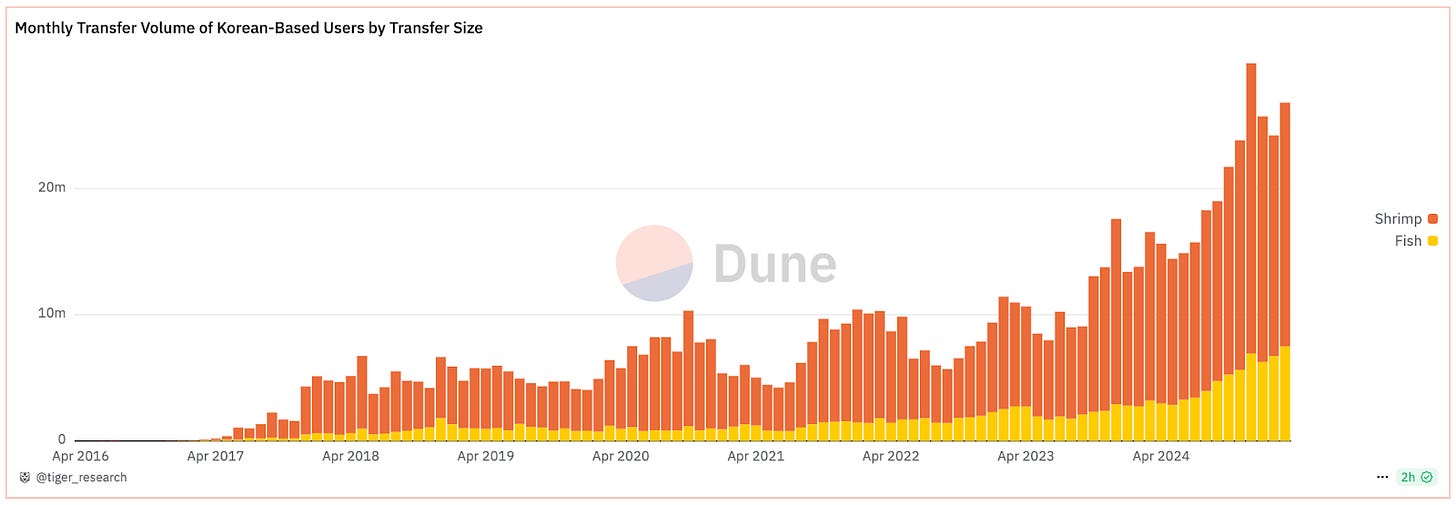

Onchain data shows Korean users’ Ethereum transactions have maintained steady growth since 2016. Notable is the fact that transaction numbers reached their peak in December 2024. This period witnessed explosive popularity of tokens issued through launchpads. Investors moved heavily to onchain environments to build positions on decentralized platforms rather than waiting for centralized listings. During this period, funds flowing from Korean crypto trading platforms to external wallets hit all-time highs.This clearly indicates investors actively venture beyond domestic boundaries to find alpha.

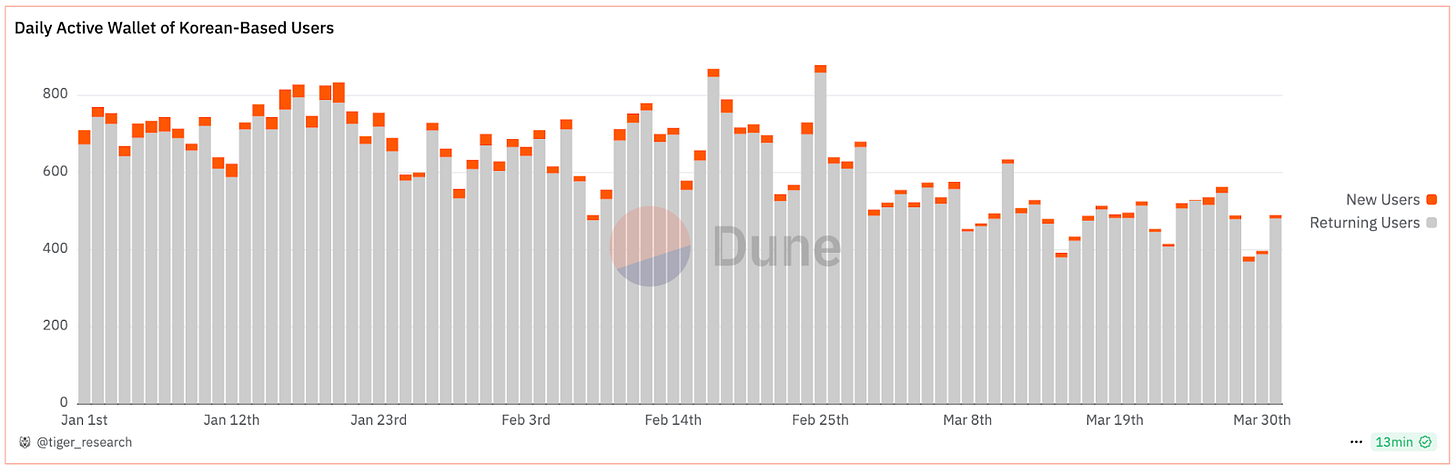

However, the number of active wallet addresses showed a decline in Q1 2025, with a notable decrease in new user acquisition. Cryptocurrency market downturn combined with various macroeconomic factors led investors to exhibit more conservative investment behaviors.

Despite this overall downward trend, a noteworthy pattern emerges. When analyzed by transaction size, both high-value transactions (over $1,000) and their volumes decreased. In contrast, small-value transactions (under $1,000) and their volumes actually increased. This indicates that while large investors reduced their activity to avoid risk, retail investors continued their onchain activities regardless of market conditions. These retail investors are establishing a stable presence within the ecosystem.

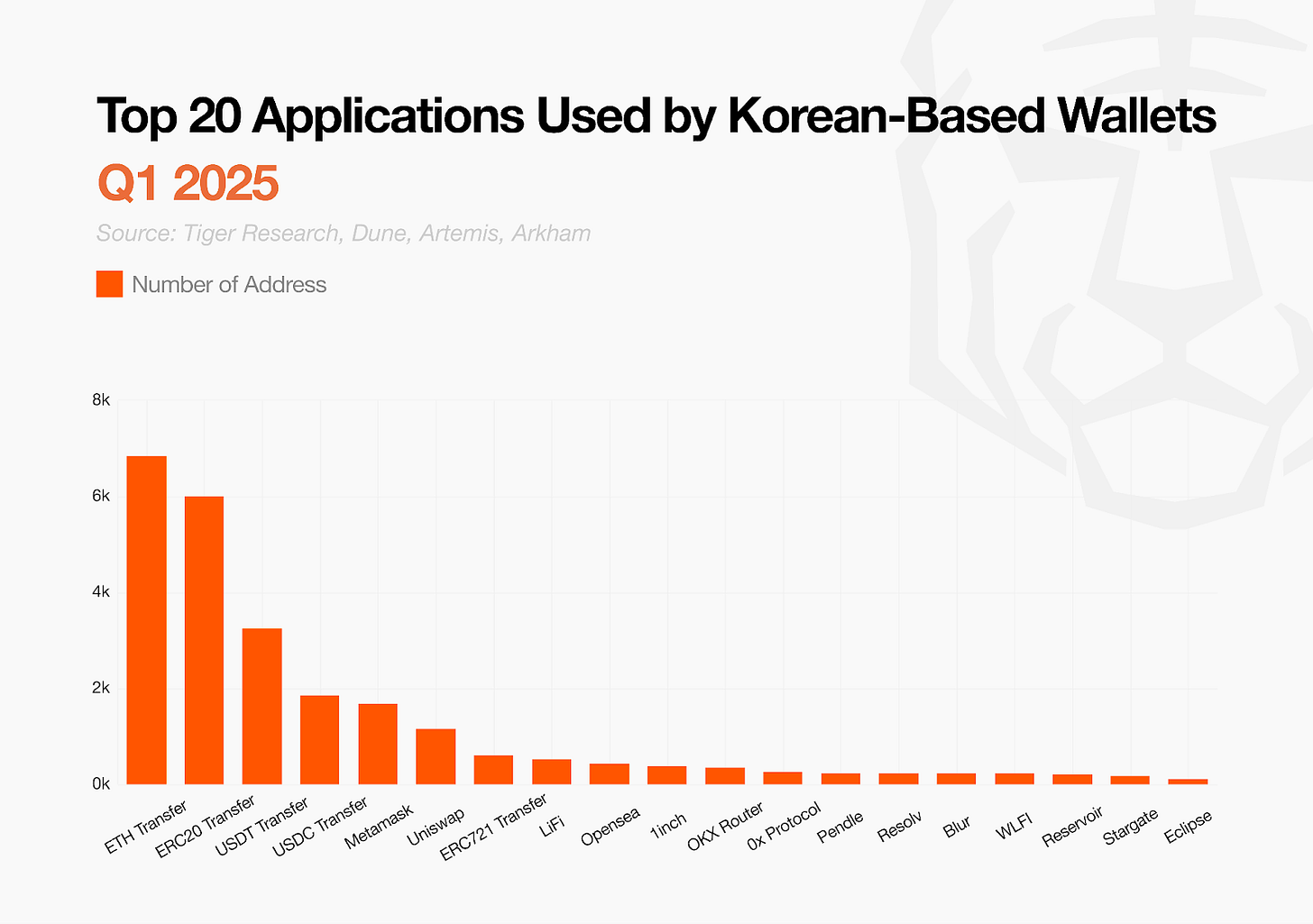

Our research on Korean users active in the Ethereum ecosystem during Q1 2025 compiled data from approximately 10,000 users who showed substantial onchain activity among all monitored subjects. Korean users primarily engaged in ‘asset transfers’ during this period. Ethereum and ERC20-based token transfers (excluding USDT, USDC) dominated activity, primarily representing fund movements for investments in global trading platforms or DeFi ecosystems.

Metamask leads in cryptocurrency swap and bridge-related activities. Most Korean users employ Metamask as their primary wallet and prefer its built-in swap and bridge functionalities for convenience. Uniswap, 1inch, and OKX Swap follow as the next most utilized services.

NFT market participation numbers remain significant considering global NFT market stagnation and infrequent trading due to low liquidity of NFT assets. Approximately 6% of all active users engaged in NFT-related activities. Major NFT projects such as Opensea and Azuki significantly boosted this participation with their token airdrop announcements. Users likely pursued additional rewards like airdrops rather than pure collection purposes or long-term investments, driving this relatively high participation rate.

In terms of stablecoin usage, USDT shows overwhelming preference among Korean users. USDT user numbers exceed USDC by approximately 1.8 times. This preference persists despite USDT facing delisting movements in certain regions and controversies regarding MiCA regulation non-compliance. USDT maintains this advantage due to its high market share, abundant liquidity, and support for more trading pairs across exchanges (both CEX and DEX).

This report provides objective information about Korean cryptocurrency users’ actual activity patterns and preferences using onchain data. We analyzed approximately 60,000 Korean user wallets. However, more sophisticated analysis requires continuous improvements in advanced filtering models and enriched labeling data.

Nevertheless, this analysis offers valuable baseline information for understanding Korean users’ onchain activity flows. Korea’s largest crypto Telegram channel has 50,000 users, indicating our analysis scope represents a significant portion of domestic cryptocurrency active users.

In the future, we will expand our analysis beyond Ethereum to include various ecosystems such as Base and Solana. This comprehensive study will track Korean users’ onchain activities across platforms. Through these efforts, we will continuously monitor changes in the domestic cryptocurrency market and provide more accurate insights.

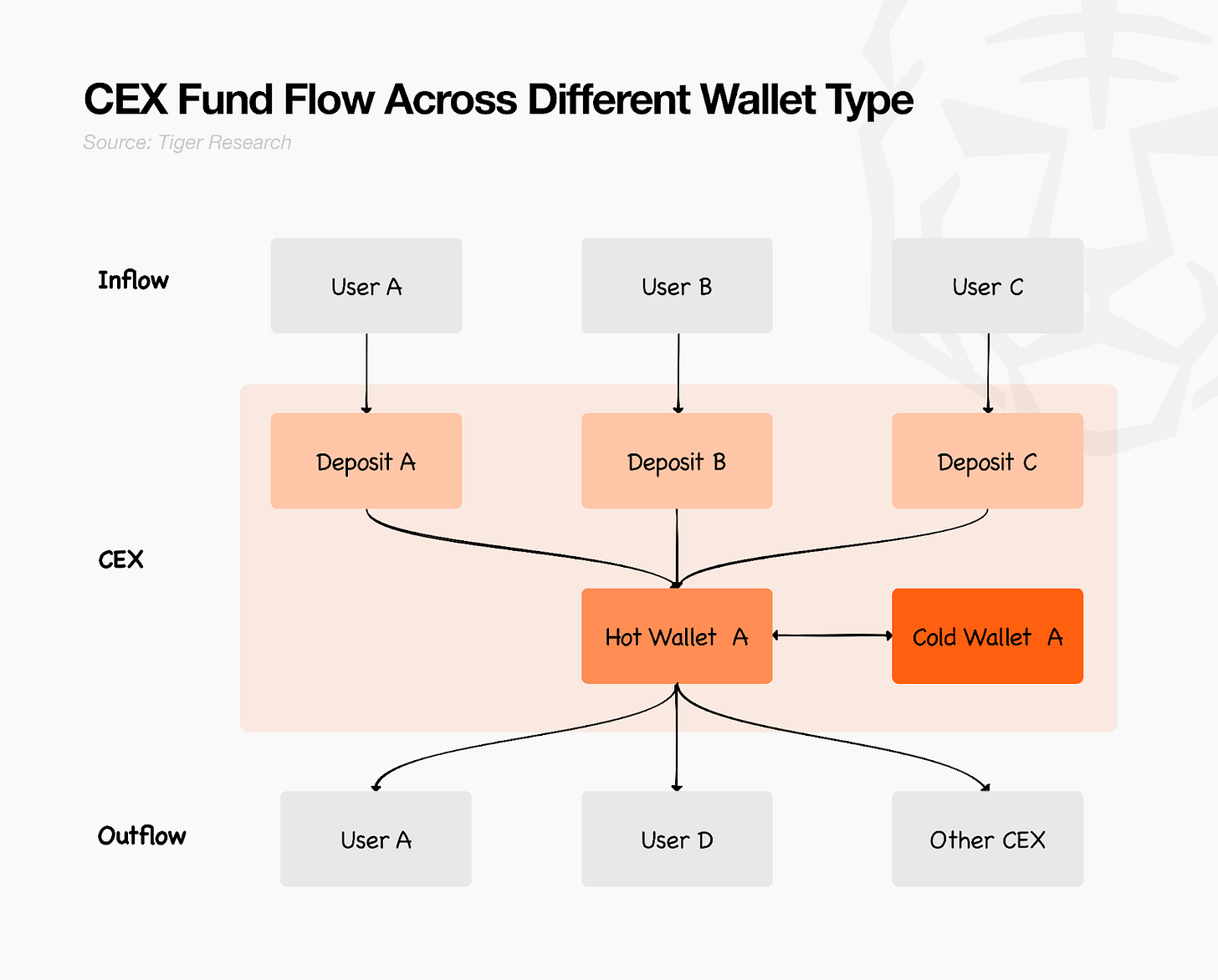

Korean cryptocurrency wallet address filtering primarily focuses on interactions with domestic major exchanges Upbit and Bithumb. Exchange wallets divide into deposit wallets, hot wallets, and cold wallets. Withdrawal patterns from hot wallets provide the most reliable identification criteria.

Addresses interacting with deposit wallets receive funds from various sources (other exchanges, non-registered self-custody wallets, etc.), making it difficult to clearly identify Korean users. Hot wallets, however, only transfer assets to external wallets directly registered by users. Therefore, transfer records from hot wallets (From) to user wallets (To) serve as the key indicator for primary filtering.

We enhanced accuracy using labeling data provided by blockchain analysis platforms such as Dune, Arkham and Artemis. We also built a scoring system for additional verification that evaluates usage patterns including smart contract interactions, CNS (Crypto Name Service) registration information, and wallet activity time zone analysis. Through this multi-layered filtering approach, we selectively extracted approximately 60,000 wallet addresses with high probability of Korean ownership for analysis in this report.

Read more reports related to this research.

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.

Search

RECENT PRESS RELEASES

Related Post