Pitch Deck: How Amazon plans to turn Q3’s $17 billion ad haul into Q4’s next big DSP push

October 30, 2025

Amazon is leaning hard on a familiar message this holiday season: its ad tech isn’t just for buying its ad inventory. The company wants advertisers to see its demand-side platform as the backbone for buying across the open web.

A new pitch deck making the rounds at agencies drives that point home.

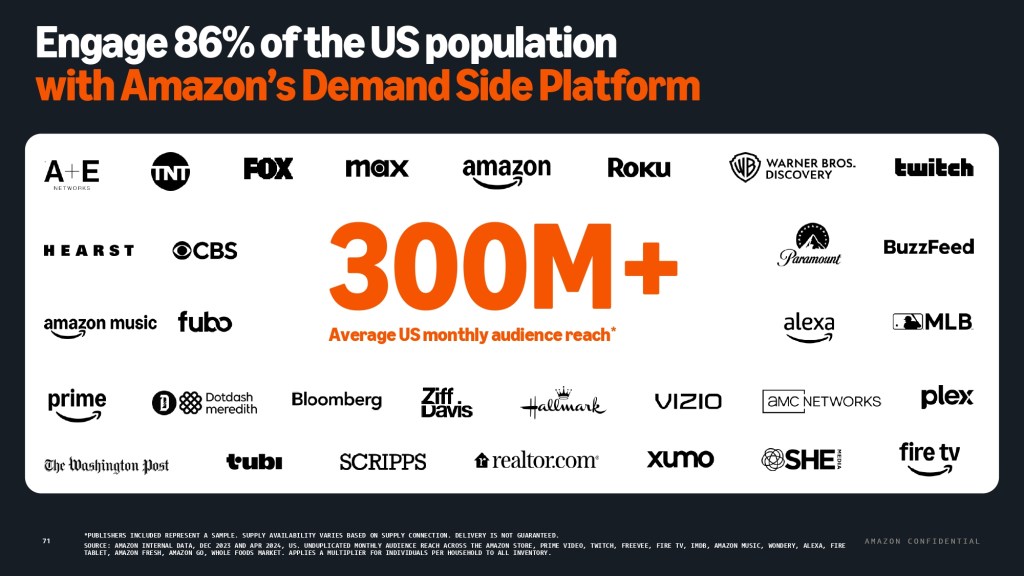

To get there, Amazon has been piecing together partnerships with publishers like Hearst and gaining access to premium inventory from media owners including Netflix, NBCU, Disney, and Spotify. The result, according to the company, is monthly reach across 86% of the U.S. population — over 300 million.

Still, reach alone won’t make Amazon a true rival to The Trade Desk. Many of those inventory deals aren’t exclusive, which limits how far the company can differentiate from other platforms. The real difference will come down to performance — how much more effective Amazon can make ad buying through its platform. That’s where it believes it can start to chip away at The Trade Desk’s lead.

As W Media Research’s principal and chief analyst Karsten Weide put it, Amazon Ads’ main growth engine is CTV, The Trade Desk’s main business. Almost half of TTD’s revenue comes from CTV.

Ad tech consultant Jonathan D’Souza Rauto agreed. “I think the timing is key, TTD are in the midst of pushing their OpenAds/PubDesk offering for publishers, leaving a little door open for the buy side,” he said.

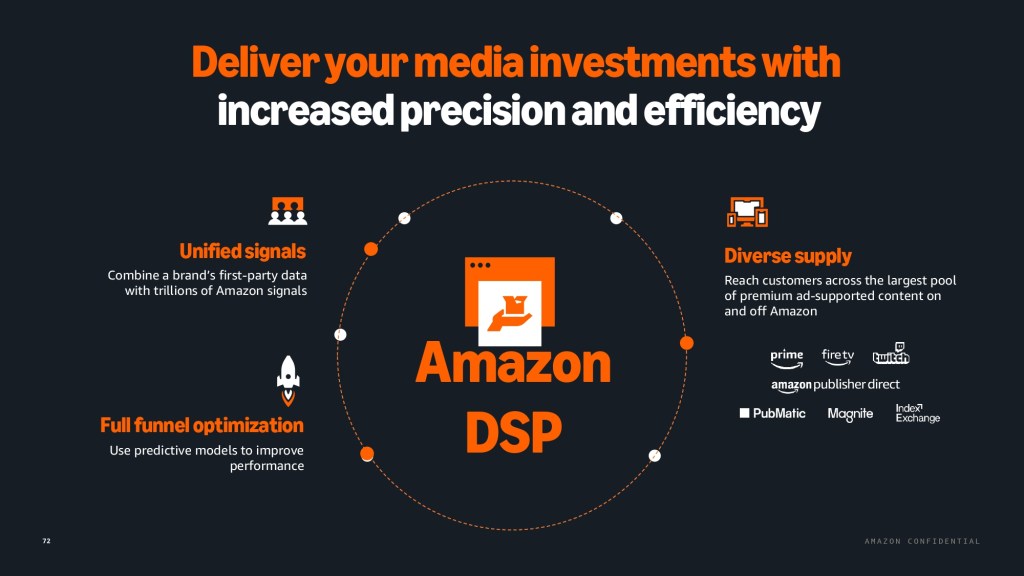

To that end, Amazon ad execs have been highlighting the data signals it can pull not just from its own vast retail base but also from ad tech partners like PubMatic, Index Exchange and TripleLift.

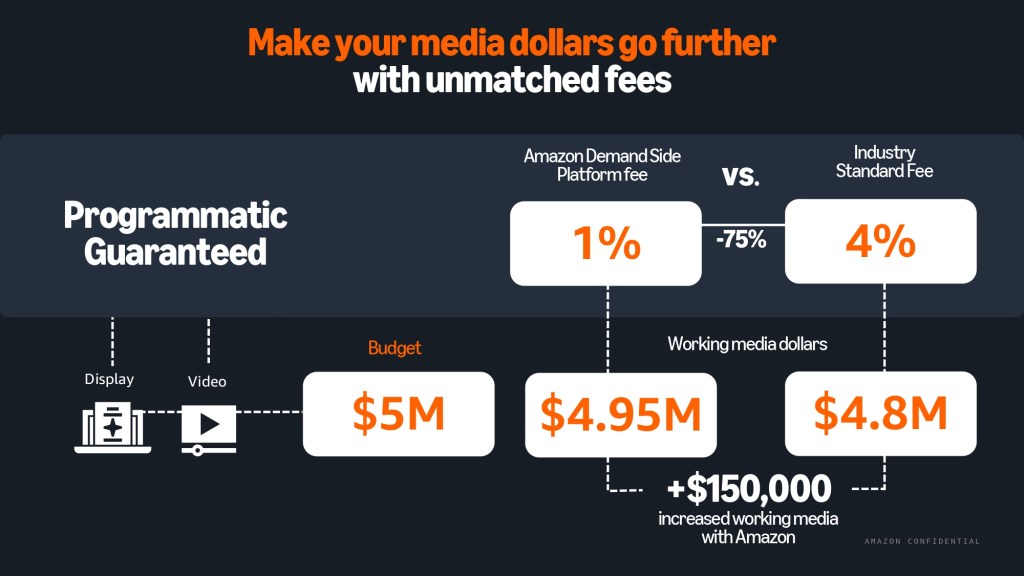

And beyond claiming better performance, they’re also telling agencies it’s cheaper to buy the open web through Amazon’s DSP — claiming fees as low as 1% on Programmatic Guaranteed deals compared to what it says is an industry average of around 4%.

“When it comes to platform fees, Amazon has lower rates,” said Haley Feazell, vp of global media at Mindgruve. “Depending on volume of spend, Amazon is typically between 4% and 6% more efficient than The Trade Desk,” though she didn’t share specific figures.

On top of that, Mindgruve’s chief commercial officer, Stephen Reagan, did note that Amazon has made its DSP more accessible to advertisers by lowering the barrier to entry too.

“Several years ago, you had to be willing to spend $50,000 a month before you could even get a seat with Amazon’s DSP,” he said. “But now, you can open up your DSP advertising account with a couple of bucks. It all goes in tandem with Amazon trying to be the biggest DSP there is.”

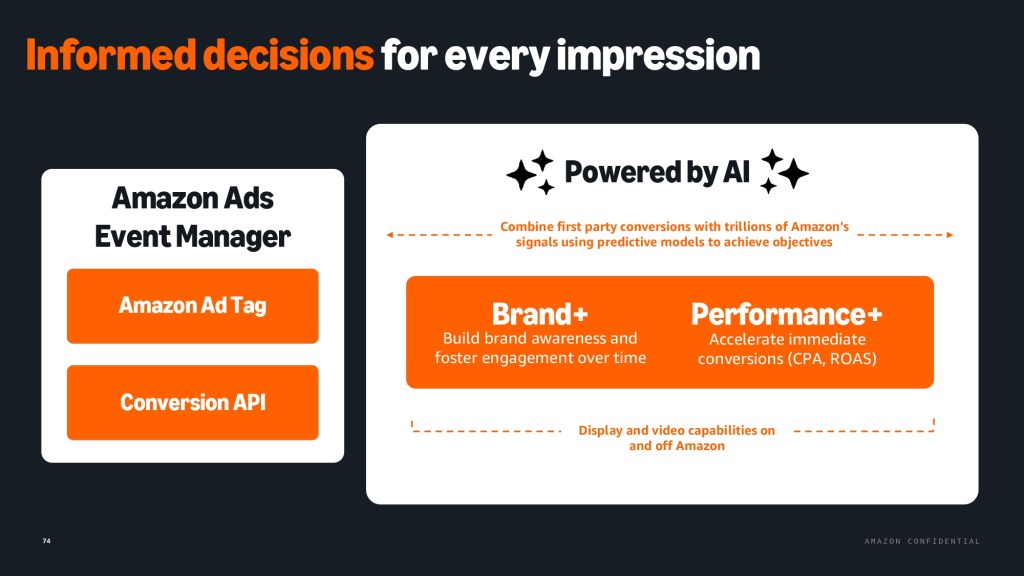

And, of course, there’s an AI layer too. No modern pitch is complete without it. Amazon is telling marketers they can use its AI tools to blend their own data with the trillions of signals it collects to run brand and performance campaigns — another way it’s trying to prove its DSP can do it all.

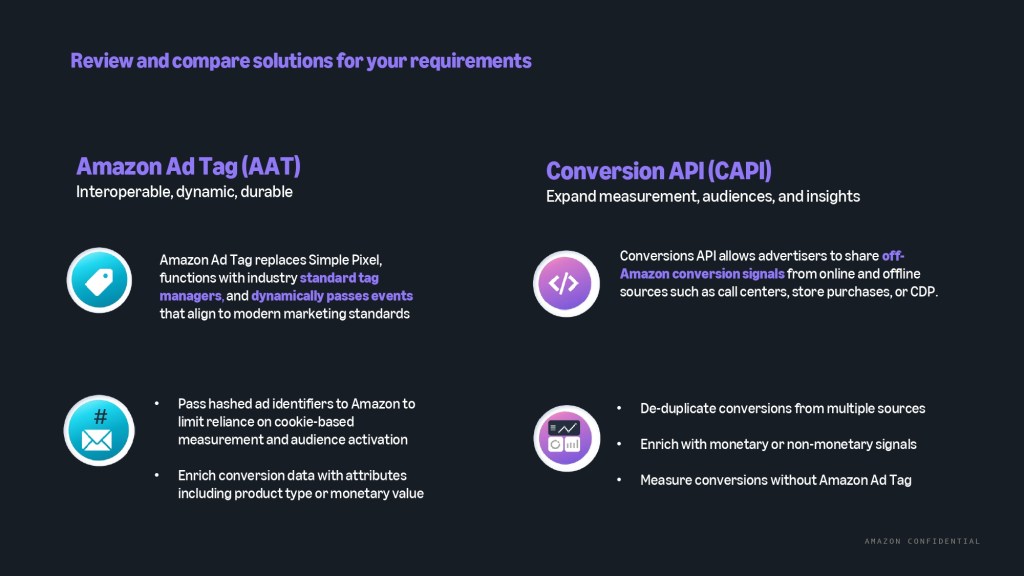

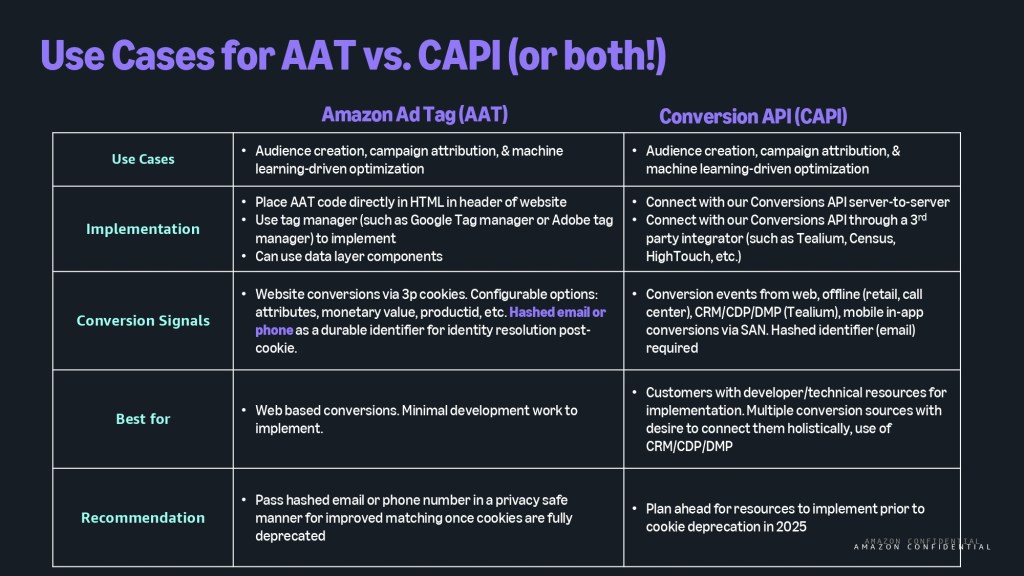

Speaking of performance, Amazon is also singling out the Amazon Ad Tag and Conversion API — two complementary tools of its measurement and attribution stack. They’re used to help advertisers track performance, optimize campaigns and connect conversions across the web and apps to Amazon ads.

Here’s how they differ and work together.

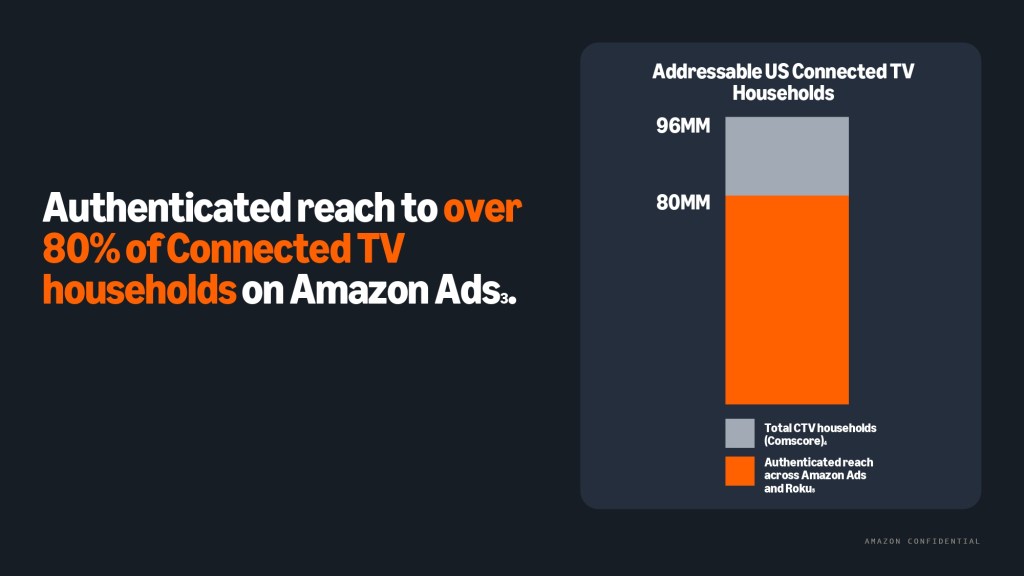

Naturally, there’s a whole section of the pitch that’s carved out for its CTV play. It’s crucial to Amazon pulling in larger ad dollars and has been a focal point of its ads business since it launched ads in Prime last January.

It’s no secret that Amazon’s DSP has become a cornerstone of its bid to take a larger slice of the ad market, and in doing so boost the profitability of its wider business. In the third quarter, it raked in $17.7 billion in ad revenue, up 24% on the same period a year ago.

Click below to view the full pitch deck:

While Amazon declined to comment, The Trade Desk did not respond to Digiday’s request for comment.

Search

RECENT PRESS RELEASES

Related Post