Plummeting pot prices have Mass. cannabis businesses on edge

March 25, 2025

Advertisement

Nike John walked to the back of her auto shop-turned-cannabis dispensary in Charlestown on a recent morning and threw open the heavy metal door to the vault.

Inside were rows of shelves stacked with colorfully packaged marijuana products.

“We have chocolate, taffy, gummies,” she said, surveying her inventory. “Over here we have vapes, disposable vapes.”

This store room is the lifeblood of John’s business, The Heritage Club. But lately John isn’t seeing green. All that product is bleeding value as the price of marijuana plummets across the state.

“ It feels like the bottom’s being ripped out from under you,” she said. The turbulence is so bad it has John re-thinking her decision to get into the industry: “Knowing what I know now, I would absolutely never do it again.”

The state’s Cannabis Control Commission just touted record-breaking marijuana sales of $1.64 billion across Massachusetts last year — proof, the commission declared, of a “robust and thriving market.” It was a rare piece of good news for a commission beset by infighting, toxicity and accusations of regulatory lethargy.

Yet even as sales are booming, the price of weed is falling, squeezing individual businesses, including those the commission is charged with helping to support.

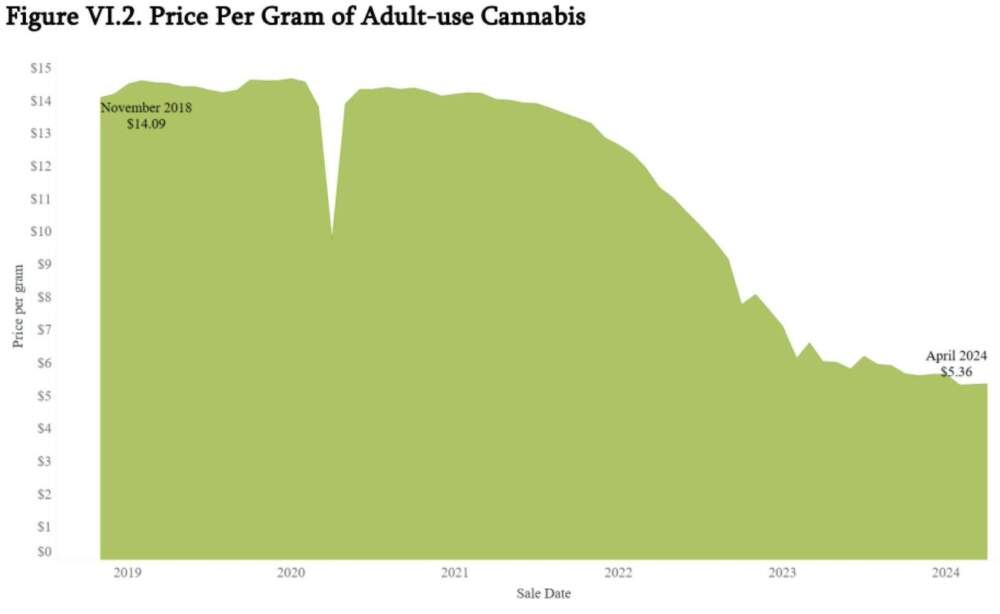

Marijuana at retail shops was going for $14.09 per gram in November 2018, according to commission data. The cost has plunged 62% since then, to $5.36 per gram last year.

The price drop has “really made it hard for businesses to be able to be viable,” said Ryan Dominguez, executive director of an industry trade group, the Massachusetts Cannabis Coalition. “ The sales numbers just don’t tell the full picture of how the industry is doing right now.”

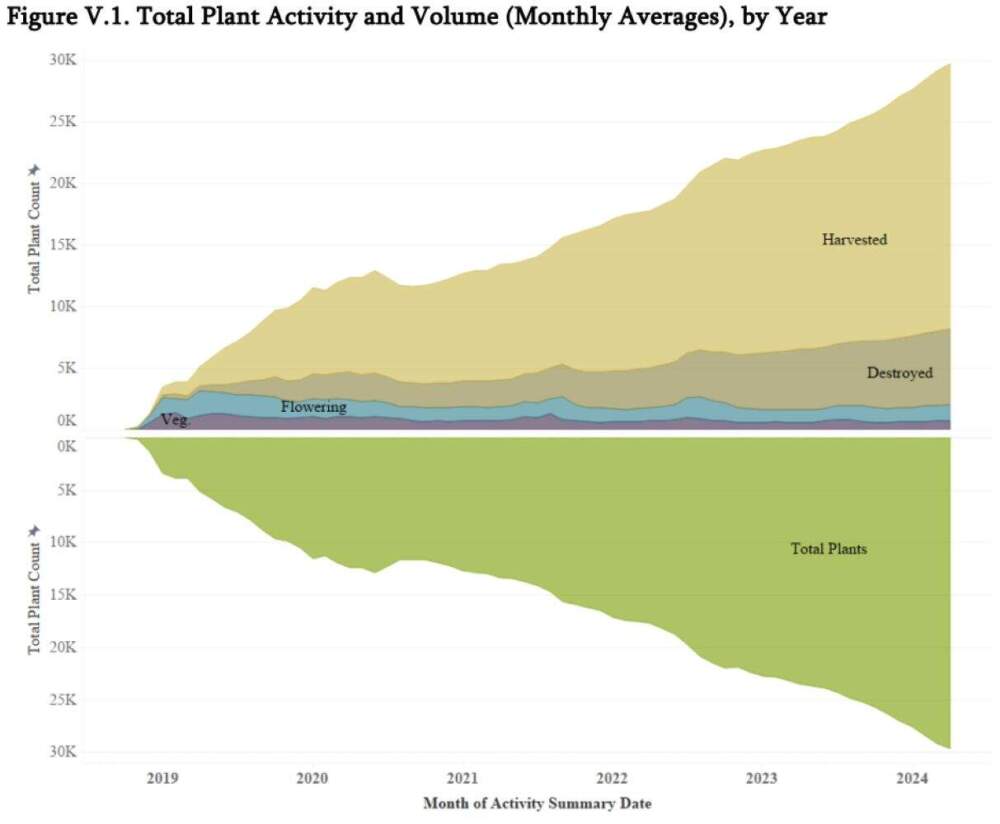

There are a few factors contributing to the decline in marijuana prices. One is that the Cannabis Control Commission has licensed more and more cultivators, who are growing more and more weed. The surge in legal product flowing into the market has led to falling prices.

“It’s a simple supply and demand problem,” Dominguez said.

Another issue is the rise of legalized cannabis in neighboring states. Residents from places like Connecticut or New York, who used to drive to Massachusetts to buy product, aren’t coming as much anymore.

Retail shops also point to the state’s purchase limits. Right now, a customer can only buy up to an ounce of marijuana a day. So while there’s plenty of weed available, customers are limited in how much they can purchase, keeping demand down.

“ If none of those things are changing, and then our operating costs are going up while the prices are going down, it’s just leading us to a very bad situation for the whole industry,” Dominguez said.

Some shops are even closing their doors after just a handful of years in business. Data from the cannabis commission shows 30 active, licensed marijuana businesses ceased operating last year — about twice as many as the prior year. There are 650 licensed businesses currently operating in the state, according to the most recent count.

Until recently, Ed DeSousa grew marijuana at RiverRun Gardens, a small cultivator in Newburyport. DeSousa said he founded the business in 2017 because he was passionate about growing and selling small-scale “craft” cannabis.

But he found it hard to compete with large multi-state operators. DeSousa said retailers wouldn’t always pay for their orders, and there were few legal mechanisms to pursue that debt.

“I saw the writing on the walls,” DeSousa said. He laid off his staff and closed down the business earlier this year.

With “prices going down, stores haggling with us on the price, supply going up, rents going up, it was just, there was no way to do it,” he said.

Advertisement

Dominguez, of the cannabis trade group, said his organization is pushing the state’s cannabis commission and the Legislature for changes, like increasing purchase limits and loosening advertising regulations.

He also thinks Massachusetts could follow in the footsteps of Vermont and temporarily pause new licenses for growers, retailers and other marijuana businesses to try to stabilize the market.

In a statement, Cannabis Control Commission Acting Chair Bruce Stebbins said the agency “acknowledges that some licensees may be facing financial difficulties for many reasons, some outside our control.”

Stebbins pointed to a suite of reforms the commission passed last year meant to help operators, like easing delivery regulations and expanding cultivation capacity for small businesses.

But not everyone thinks it’s wise to interfere with falling prices.

“It’s actually a sign of health when you have reasonably priced weed that people can afford and more and more people buy it,” said Robin Goldstein, director of the Cannabis Economics Group at the University of California, Davis. “The biggest result of having lower prices is that you have the legal market taking a bigger share from the illegal market.”

Marijuana prices are falling across the country, not just in Massachusetts. Goldstein believes this trend is natural for a young market that’s still taking shape.

Stebbins seemed to echo this assessment during testimony before a legislative committee earlier this month. “This price stabilization is normal and reflects a competitive and maturing marketplace,” he said.

Industry analysts expect marijuana will be federally re-scheduled to a less restrictive class, if not fully legalized, in the coming years. That would mean weed grown in Massachusetts could eventually be sold across state lines. If that happens, an abundant marijuana supply could become an asset.

“It’s like this painful phase is galvanizing Massachusetts for the future interstate competition where they’re going to fare better than their neighbors,” Goldstein said.

In the meantime, he said any regulatory efforts to cap supply or prop up prices would be “absolute suicide.”

But Goldstein’s prediction of a “painful phase” is cold comfort for business owners like Nike John who are trying to stay afloat right now.

John entered the industry with a bang — she was among the first applicants to receive a “social equity” license, a license reserved for people from communities disproportionally harmed by the War on Drugs. She was heralded as the first Black woman to own a dispensary in Boston.

But John said she had to lay off seven of the 22 employees at her Charlestown dispensary last year. Now, she said, she’s just breaking even each month.

John looks back at all the hurdles she had to jump over to get to this point: navigating complex regulations to get a license, raising money, negotiating a lease and sourcing product, only to see her expected profits vanish when the price of weed fell.

But John said she’s not giving up.

“I’m a fight till the end kind of person. So I don’t know if I’ll ever call it,” she said. “Someone’s gonna have to call it on me.”

This segment airs on March 25, 2025. Audio will be available after the broadcast.

Search

RECENT PRESS RELEASES

Related Post