Prediction: These 5 Stocks Will Be Worth More Than $5 Trillion by 2030

November 7, 2025

The $5 trillion club will get crowded in a few years.

The market recently gained its first member of the $5 trillion stock club: Nvidia (NVDA 1.83%). With the massive artificial intelligence (AI) infrastructure buildout still ongoing, Nvidia will likely maintain its position as one of the world’s largest companies throughout 2030. However, I think there are four more that could gain entrance into this exclusive club by 2030.

Image source: Getty Images.

Microsoft and Alphabet are easy bets

The next two companies I think will make it are Microsoft (MSFT 0.36%) and Alphabet (GOOG 2.59%) (GOOGL 2.55%). These two are worth $3.7 trillion and $3.4 trillion, respectively, so they wouldn’t have to put up those impressive returns to join the $5 trillion club by 2030.

Microsoft only needs to rise 35% to gain entrance into the $5 trillion club. Considering that Microsoft’s diluted earnings per share (EPS) rose 13% year over year during the first quarter of fiscal year 2025 (ending Sept. 30) and its revenue rose 18% year over year, it shouldn’t be very hard for Microsoft to gain access to the $5 trillion club within a few years.

Microsoft

Today’s Change

(-0.36%) $-1.77

Current Price

$495.33

Alphabet is in the same boat, as it needs a 45% gain to breach the $5 trillion level. Its revenue rose 16% and diluted EPS increased 35% in Q3, so it’s also on the right trajectory to become a $5 trillion company sooner rather than later.

Amazon and Apple have a harder road ahead

It may seem odd to list Apple (AAPL 0.49%) as a company that could struggle to gain access to the $5 trillion club, especially since it’s the second-largest company right now at about a $4 trillion valuation. However, it’s far more expensive than other stocks, and it doesn’t have the greatest growth to show for it. It grew diluted EPS by 13% on an adjusted basis (Apple had a one-time charge during last year’s quarter that negatively affected its EPS metric), but revenue only rose at an 8% pace.

Today’s Change

(-0.49%) $-1.31

Current Price

$268.46

Furthermore, Apple lagged its peers in the AI race. Apple Intelligence flopped and is being outclassed by its Android peers. This may come back to bite Apple or it may not, but it could affect its market share in the future if its competition starts to launch innovative AI features that are true differentiators. Apple also isn’t cheap, which makes it even more concerning, considering its relatively low growth rates.

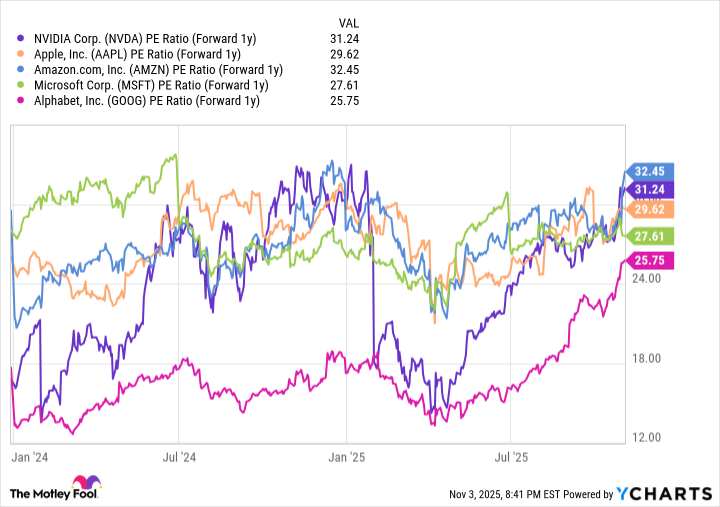

NVDA PE Ratio (Forward 1y) data by YCharts

Apple will have enough growth to get it to a $5 trillion market cap by 2030, but it may reach it a lot slower than people expect due to its overall slower growth rate.

Amazon (AMZN 0.84%) is currently the fifth-largest company in the world, so it has some work to do to get to a $5 trillion market cap. Its current market cap sits at $2.6 trillion, indicating it must rise 93% to reach the $5 trillion club.

However, Amazon isn’t the e-commerce company most people picture it as. It’s heavily building out computing capacity for Amazon Web Services (AWS), its cloud computing wing. AWS is seeing growth from traditional and AI workloads, and it recently announced reaccelerated growth in Q3. Revenue rose 20% year over year, which is a big deal because AWS actually makes up the majority of Amazon’s operating profits.

Amazon is a profit growth story, not a revenue growth one. As higher-margin businesses like AWS and advertising services grow at an outsize pace, so will Amazon’s profits. Currently, Amazon is spending a lot of those profits on building out AI computing capacity, but eventually it will have what it needs and can use those cash flows to return value to shareholders through repurchases, dividends, or investing it back into the business.

This will drive strong growth over the next five years and allow it to reach the $5 trillion threshold before 2030, although it may take the full five years.

Search

RECENT PRESS RELEASES

Related Post