Prediction: This AI Stock Could Quietly Outperform Wall Street Favorites

November 20, 2025

This tech giant may have underperformed the tech sector this year, but investors are missing the bigger picture.

Artificial intelligence (AI) stocks have been in fine form on the stock market in 2025, and this is evident from the healthy gains of 21% clocked by the tech-laden Nasdaq Composite index so far this year.

AI stocks such as Nvidia, Broadcom, AMD, Palantir, and others have delivered outstanding gains to investors in 2025. However, not all companies benefiting from the AI revolution have turned out to be great investments. Meta Platforms (META 0.25%) is one such name.

The “Magnificent Seven” stock is up just 4% this year, and that’s because it has witnessed a sharp pullback of late. The stock fell substantially after releasing its third-quarter results on Oct. 29. A massive noncash tax charge that led the company to miss Wall Street’s earnings estimates, and Meta’s decision to boost capital spending to fund its AI initiatives have been weighing on its shares of late.

However, it won’t be surprising to see this tech giant regain its mojo and deliver stronger gains than some of the more popular AI stocks that have outperformed it this year. Let’s see why that may be the case.

Image source: Getty Images.

Meta Platforms’ AI efforts are paying off

Meta Platforms reported an impressive year-over-year increase of 26% in Q3 revenue to $51.2 billion. The company’s non-GAAP earnings would have landed at $6.73 per share as compared to the year-ago period’s reading of $6.03 per share had it not been for the $15.9 billion non-cash income tax charge related to the implementation of the “big, beautiful bill.”

Meta Platforms

Today’s Change

(-0.25%) $-1.50

Current Price

$588.82

Importantly, Meta management believes that it will “recognize significant cash tax savings for the remainder of the current year and future years under the new law.” What’s worth noting is that Meta’s earnings would have increased by double digits (excluding the impact of the tax charge). That’s impressive considering that its costs and expenses increased by 32% year over year in Q3, exceeding its revenue growth.

AI is a key reason why Meta’s bottom line is increasing at a healthy pace despite the higher spending. The company’s AI-driven content recommendations are leading to higher engagement on its social media properties. Specifically, Meta saw a 5% jump in the time spent on Facebook last quarter, along with a 10% jump in time spent on Threads.

This higher engagement combined with Meta’s AI-powered ad tools is contributing to an increase in ad impressions delivered, as well as an increase in the average price per ad. Meta’s ad impressions across its family of apps increased by 14% year over year in Q3. Additionally, the average price per ad jumped by 10%.

It is easy to see why that’s the case. Meta’s AI advertisement solutions are delivering a 22% increase in return on ad spend as compared to non-AI ad tools. The company points out that “for every dollar U.S. advertisers spend with Meta, they see a $4.52 return when they use our new AI-driven advertising tools.”

Not surprisingly, Meta says that it has already achieved an annual revenue run rate of over $60 billion for its end-to-end AI-equipped advertising tools. That suggests Meta generated $15 billion in revenue last quarter from its AI-powered ad tools. This puts the company on track to corner a sizable chunk of the $107 billion revenue opportunity that the adoption of AI tools within the marketing space is expected to create by 2028.

Given that Meta is on track to end 2025 with $198.5 billion in revenue, the AI-related opportunity within advertising should eventually allow the company to deliver solid incremental growth over the next three years.

But what about the expenses?

Meta is going all out to build more AI-equipped tools. This explains why the company is now on track to reach $71 billion in capital expenses this year as compared to its earlier expectation of $69 billion. That’s a big jump over the $39.2 billion that Meta spent in 2024. What’s more, the company points out that its expenses will grow at a faster rate in 2026.

This is a key reason why Meta stock has struggled of late, as investors are probably questioning the rationale behind the heavy AI-related spend the tech giant is incurring. But the good part is that AI is indeed driving tangible growth for Meta, as we saw in the discussion above. That’s why it makes sense for the company to continue investing more in AI infrastructure and talent.

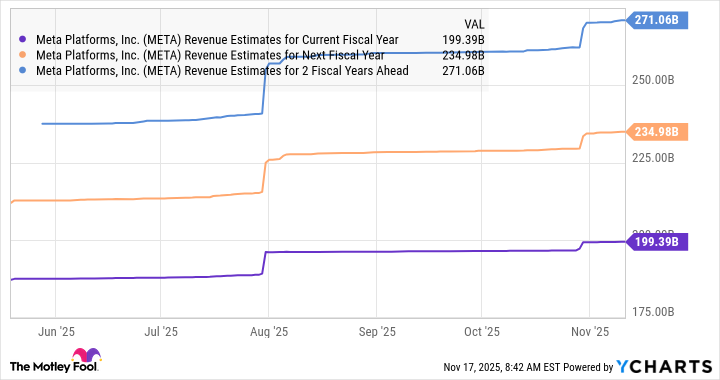

This probably explains why analysts have raised their revenue forecasts for Meta.

META Revenue Estimates for Current Fiscal Year data by YCharts

Even better, investors are now getting a good deal on this stock. It is trading at 8.3 times sales, which is lower than the U.S. technology sector’s average price-to-sales ratio of 9.1. Assuming Meta hits $271 billion in sales at the end of 2027 and trades in line with the tech sector’s average, its market cap could jump to $2.46 trillion.

That suggests a potential jump of nearly 60% from its current market cap. However, the fast-growing adoption of AI tools in the ad space and the head start that Meta has over here suggest that it could end up delivering faster growth, and that could set the stock up for bigger gains. That’s why it would be wise for investors to buy this underperforming tech stock before it steps on the gas.

Search

RECENT PRESS RELEASES

Related Post