Privacy-Focused Aztec Network’s Ignition Chain Lights Up on Ethereum

November 20, 2025

Privacy-Focused Aztec Network’s Ignition Chain Lights Up on Ethereum

Aztec Network launched its Ignition Chain, becoming the first fully decentralized Layer 2 protocol on Ethereum’s mainnet.

By Omkar Godbole, AI Boost|Edited by Sam Reynolds

Nov 20, 2025, 6:45 a.m.

- Aztec Network launched its Ignition Chain, becoming the first fully decentralized Layer 2 protocol on Ethereum’s mainnet.

- The Ignition Chain uses zero-knowledge proofs to provide private and scalable blockchain transactions, enhancing DeFi applications.

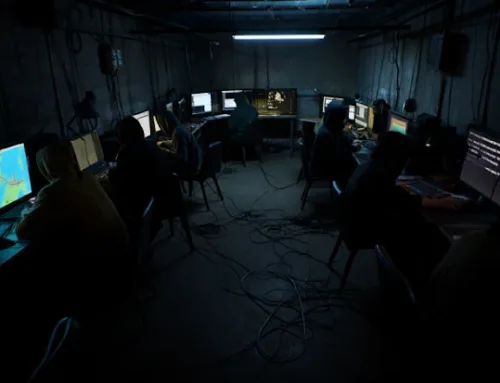

Privacy-focused Ethereum Layer 2 Aztec Network’s Ignition Chain flipped the switch on Wednesday, becoming the first fully decentralized Layer 2 protocol on the mainnet.

“Aztec just shipped the Ignition Chain, the first fully decentralized L2 on Ethereum. This launches the decentralized consensus layer that powers the Aztec Network,” Aztec announced on X.

STORY CONTINUES BELOW

The event happened when the validator queue hit 500, a key checkpoint that signals readiness to secure the network and initiate block production

The Ignition Chain is the engine powering Aztec’s goal of being a fully decentralized “private world computer,” enabling developers to create DeFi applications while maintaining total secrecy.

It combines zero-knowledge proofs with Ethereum’s robust security, enabling truly private, scalable blockchain transactions. So, users get the speed and cost savings of L2, plus privacy that’s been missing in many decentralized finance (DeFi) applications.

Anyone can become a validator or sequencer by staking AZTEC tokens to earn rewards and early birds get a bonus to jumpstart decentralization. The AZTEC token auction is scheduled for Dec. 2, opening the doors for more community involvement.

The debut means privacy-focused, decentralized L2 networks are not just experimental projects, they’re about to become vital infrastructure shaping the future of blockchain.

Ethereum’s consensus depends on distributed trust—meaning lots of independent validators confirm transactions. But if too many validators try to join all at once, network stability risks taking a hit. So new validators queue up, entering in stages.

Reaching 500 validators means Aztec Ignition Chain has hit a critical mass: a strong, resilient base of participants ready to defend the network. More validators mean better decentralization, a lower risk of a bad actor taking control, and a network secure enough to launch fully on Ethereum.

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Omkar Godbole|Edited by Sam Reynolds

26 minutes ago

The ARC will operate within a two-tier framework, complementing the RBI’s Central Bank Digital Currency.

What to know:

- India’s Asset Reserve Certificate (ARC) is a stable digital asset set to launch in the first quarter of 2026, backed 1:1 by the Indian rupee.

- ARC aims to prevent liquidity outflow into dollar-backed stablecoins, supporting India’s domestic economy and public debt demand.

- The ARC will operate within a two-tier framework, complementing the RBI’s Central Bank Digital Currency.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Search

RECENT PRESS RELEASES

Related Post