Pure Storage (PSTG): How the Meta Deal Shapes Its Valuation in the AI Storage Race

September 24, 2025

Pure Storage (PSTG) just made waves by locking in a strategic partnership with Meta Platforms, moving its next-generation Flash storage systems into actual volume deployment. This is not simply a headline; it is a clear signal that demand for fast, AI-ready data storage is gaining real traction among tech giants. Investors watching Pure Storage have to be asking how a deal of this scale might shape the company’s growth profile in the months ahead.

This development comes at a time when Pure Storage has already been showing momentum, outpacing many peers over the past year as companies pursue efficient data center upgrades. Despite industry headwinds and rising competition from legacy players, Pure Storage’s stock has gained 77% over the past year, building on several high-profile wins and a string of product expansions. The climb has not been a straight line, but the trend points to strong belief that the company is positioned at the intersection of major tech shifts, especially around AI infrastructure.

After this move with Meta and a year of strong stock gains, does Pure Storage still offer a compelling entry point for investors, or is the market already banking on a best-case scenario?

Advertisement

Most Popular Narrative: 12.5% Overvalued

The most widely followed valuation narrative calls Pure Storage overvalued by a sizable margin, highlighting factors from accelerating revenue forecasts to ambitious profitability assumptions.

“Momentum in subscription-based offerings like Evergreen//One and Cloud Block Store, as demonstrated by strong annual recurring revenue (ARR) growth, a rising share of total revenue, and robust RPO backlog, improves revenue predictability, reduces earnings volatility, and supports higher overall gross margin.”

Want to know what makes this valuation stand out from the crowd? This narrative is betting on an unusual mix of recurring revenue growth and margin expansion, with future earnings targets seldom seen in the storage sector. Curious about which financial leaps underpin that price? Discover which bold numbers are steering this fair value higher than the latest closing price.

Result: Fair Value of $78.5 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, if Pure Storage struggles to grow recurring revenue or faces unexpected competition, the narrative of premium valuation could quickly lose momentum.

Find out about the key risks to this Pure Storage narrative.

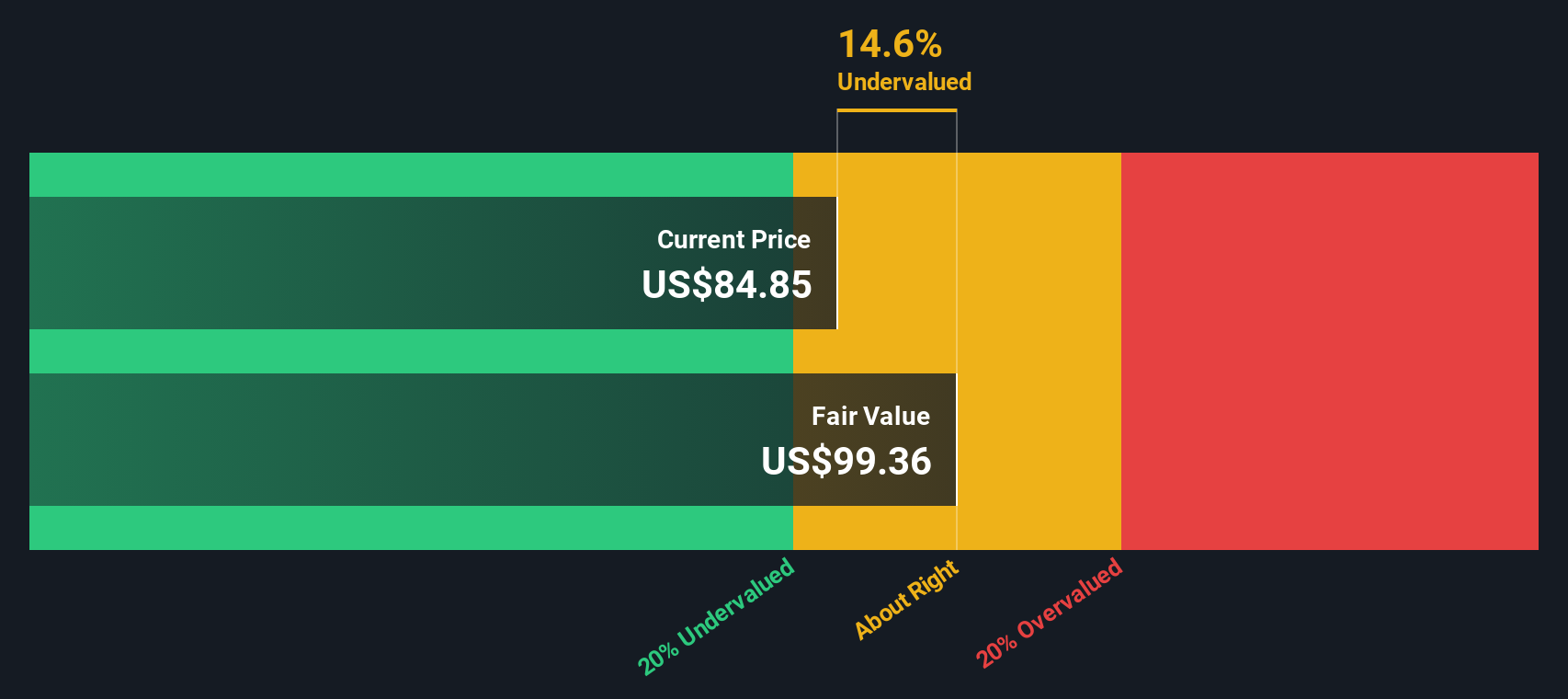

Another View: Discounted Cash Flow Tells a Different Story

Looking through the lens of our DCF model, Pure Storage appears undervalued. This suggests there may be more value beneath the surface than the prevailing narrative implies. Could the market be missing something here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pure Storage for example). We show the entire calculation in full. You can track the result in yourwatchlistorportfolioand be alerted when this changes, or use our stock screener to discoverundervalued stocks based on their cash flows. If yousave a screenerwe even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Pure Storage Narrative

If you want to dig into the numbers or map out your own thesis, you can craft a personalized outlook for Pure Storage in just minutes by using Do it your way.

A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the next big opportunity often starts with a single click. Don’t let your portfolio miss out on sectors generating real buzz and gains right now.

- Boost your potential returns and browse undervalued stocks based on cash flows to tap stocks trading for less than their true worth before the market catches on.

- Unlock fast-moving tech trends by checking out AI penny stocks, where innovation in artificial intelligence is fueling exceptional growth stories.

- Secure steady cash flow for your portfolio when you investigate dividend stocks with yields > 3%, featuring companies providing yields above 3% and strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post