Quantum Solutions Becomes Top Ethereum Holder Outside the US

October 23, 2025

Quantum Solutions now holds almost $15 million worth of ETH in total. The company plans to expand its treasury to 100,000 ETH after a $180 million capital raise, which suggests it has strong long-term conviction in Ethereum’s future. Meanwhile, Citadel founder Ken Griffin disclosed a 4.5% stake in DeFi Development Corp., a Solana-focused DAT with over $400 million in holdings. Both of these moves proves that there is still rising institutional interest in crypto treasuries, even as analysts warn of valuation pressures and consolidation risks across the sector.

Quantum Solutions, a Tokyo Stock Exchange-listed firm backed by ARK Invest and Susquehanna International Group (SIG), became the largest Ethereum-focused digital asset treasury (DAT) outside of the United States after amassing $9 million worth of ETH in just one week. The company’s founder, Francis Zhou, confirmed the milestone on Thursday, and revealed that Quantum Solutions accumulated 2,365 ETH over seven days

The company now holds a total of 3,866 ETH, which is valued at approximately $14.8 million. Zhou said the firm has been buying Ethereum at a pace of around 150 million yen ($983,000) per day, and plans to accelerate its accumulation.

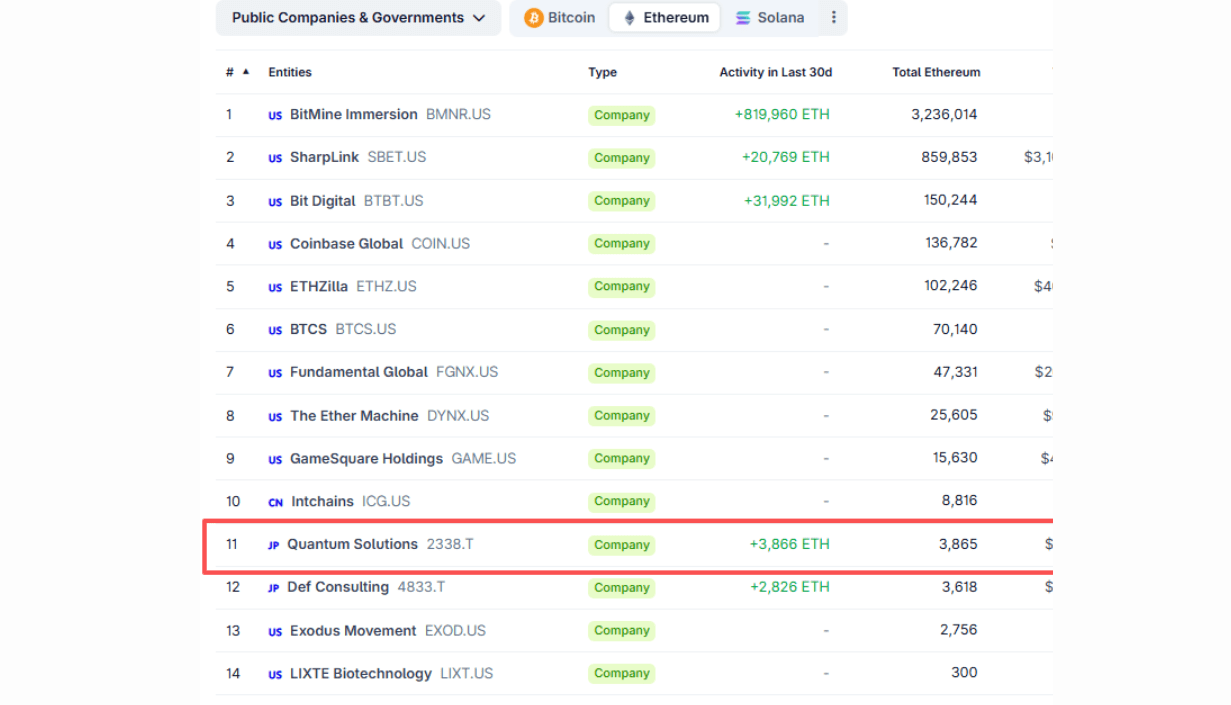

Quantum Solutions’ rapid growth makes it Japan’s leading publicly listed Ethereum DAT and the 11th largest globally, according to data from CoinGecko. While Ethereum makes up the bulk of its holdings, the company also has a smaller Bitcoin treasury of 11.6 BTC, worth roughly $1.3 million.

(Source: Quantum Solutions)

The firm’s ambition extends far beyond its current holdings, with a $180 million capital raise in late September dedicated to building a 100,000 ETH treasury. This certainly suggests that the company has long-term confidence in Ethereum’s value and ecosystem growth.

ARK Invest founder and CEO Cathie Wood praised the development by calling Quantum Solutions “Japan’s first institutional-grade ETH DAT.” ARK Invest has been a big supporter of Ethereum-focused treasury firms, having also invested in Tom Lee’s BitMine, which currently holds the title of the world’s largest Ethereum DAT.

Still, the broader digital asset treasury trend seems to be cooling. Market researchers and analysts noticed a decline in share prices for major DATs, leading to questions about whether the initial hype has begun to fade. Tom Lee himself actually suggested that the DAT bubble might have burst, though he sees the recent market weakness as a buying opportunity.

With this in mind, Quantum Solutions’ aggressive accumulation strategy now stands out as a rare display of conviction in crypto treasuries.

Quantum Solutions is not alone in its confidence in treasury companies. Ken Griffin, the billionaire founder and CEO of Citadel, revealed a 4.5% stake in DeFi Development Corp. (DFDV), a digital asset treasury company that focuses on accumulating Solana.

The disclosure was made through a Schedule 13G filing with the US Securities and Exchange Commission (SEC), and it shows that Griffin owns just over 1.3 million DFDV shares, which is roughly 4.5% of the company’s outstanding common stock. Citadel Advisors LLC and affiliated entities also reported owning an additional 800,000 shares, or about 2.7% of the total.

Citadel Advisors, the investment management arm of Citadel’s $65 billion hedge fund group, is a registered investment adviser with the SEC, and has been expanding its exposure to emerging digital asset opportunities. The move comes during a wave of institutional adoption, which was recently mentioned in a a16z Crypto report. It revealed that firms like BlackRock, Fidelity, JPMorgan Chase, and Citigroup are ramping up their digital asset initiatives.

DeFi Development Corp. quickly became a major player in the digital asset treasury sector, and ranks as the second-largest corporate holder of Solana after Forward Industries. The company recently bought $117 million worth of SOL in just eight days, which helped push its total holdings above 2.19 million SOL — worth nearly $400 million before the latest market pullback. Even after the recent declines, DeFi Development’s holdings are still profitable.

The rise of digital asset treasuries means that there are more and more companies seeking to enhance balance sheets and attract investors by holding high-growth crypto assets. However, analysts warn that the model carries serious risks. David Duong, head of institutional research at Coinbase, said that ongoing regulatory changes, liquidity issues, and market volatility could spark consolidation, favoring larger, more resilient firms.

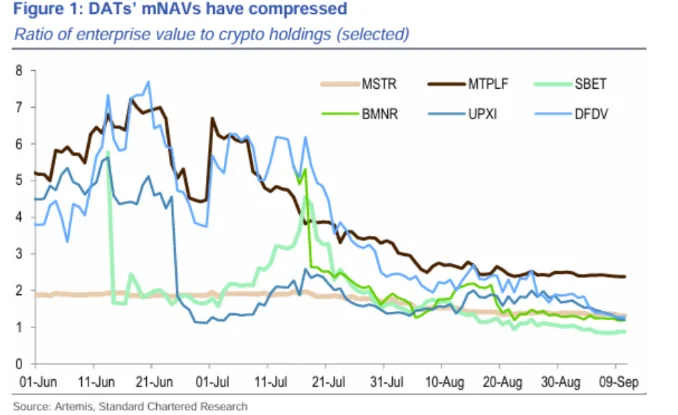

Compressed DAT NAVs (Source: Standard Chartered)

Standard Chartered analysts warned that many DAT companies could face valuation pressure as their market net asset value declines. DeFi Development Corp. was mentioned as one of the firms currently facing compressed valuations.

Search

RECENT PRESS RELEASES

Related Post