Recalling Warren Buffett’s Investing Influence on RIAs

May 5, 2025

Recalling Warren Buffett’s Investing Influence on RIAs

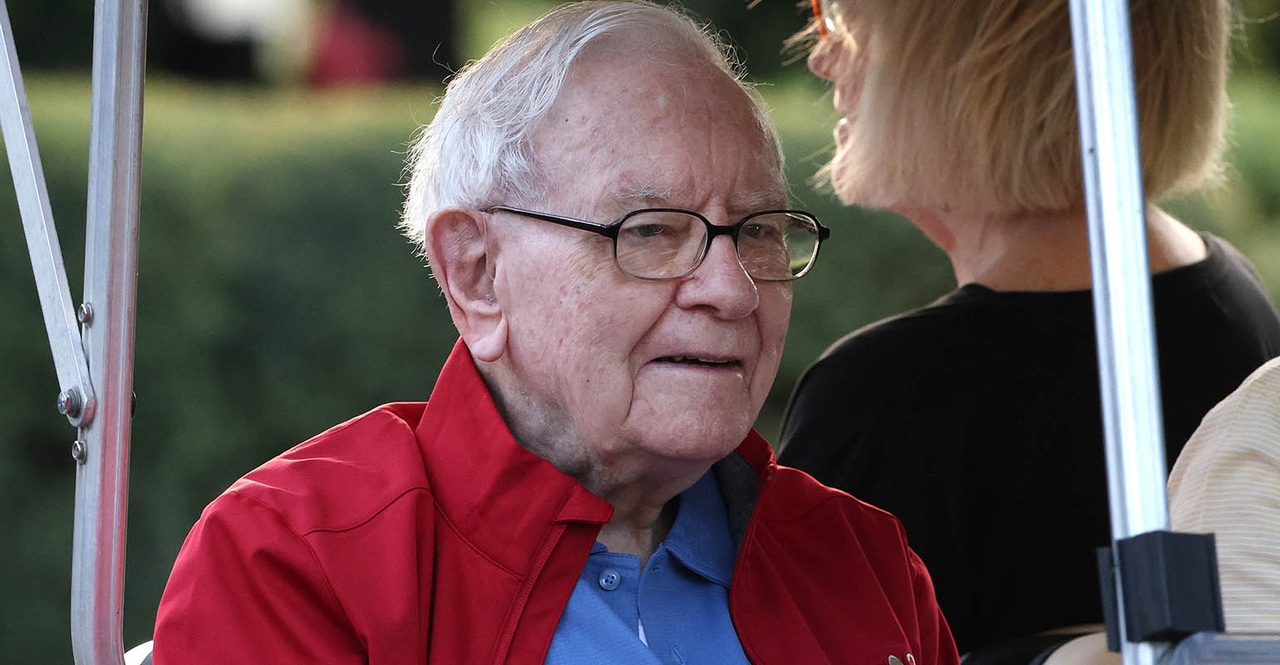

Warren BuffettKevin Dietsch/Getty Images News/Getty Images

The financial world, including advisors, was buzzing this weekend after Warren Buffett unexpectedly announced he would be stepping down as CEO of Berkshire Hathaway at the end of the year.

Over the years, the Oracle of Omaha’s words have been closely followed by everyone from multi-million-dollar asset managers to policymakers to everyday investors. His influence may have been outsized in the registered investment advisor space, with his philosophies on money management and the power of compounding trickling down from the tens of thousands of financial advisors to their millions of clients.

“He’s the greatest investor of all time,” said Josh Brown, CEO of Ritholtz Wealth Management and markets and industry commentator. “There’s no sense in talking about a Mount Rushmore, because there is no one on the same pedestal.”

Alex Caswell, founder and CEO of Wealth Script Advisors in the San Francisco area, said he often used Buffett’s commentary and viewpoints to support his work with clients.

“He was the ultimate pacifier and example for clients in tough times,” Caswell said. “His philosophy and consistency over the decades, while being a contemporary, allowed us to relate an intelligent strategy to clients because of their familiarity with him.”

In typical low-key fashion, Buffett announced the move Saturday at the end of a question-and-answer period at Berkshire’s annual shareholder conference. He said he would recommend to the board that Greg Abel, chairman and CEO of Berkshire Hathaway Energy, should replace him.

Peter Mallouk, president and CEO of Creative Planning, one of the country’s largest RIAs by assets, said via email that Buffett’s influence on him had evolved over the years.

“My main takeaway from following Warren Buffett at a very young age was to do your research, focus on investments you have great conviction around and plan to stick with them for the very long run, making changes only based on very substantive new information,” Mallouk said.

Later, the influence became more about Buffett’s guidance on significant moments.

“As I got older, I saw Warren more as a voice of reason, in particular when everyone else is losing their minds,” he said. “The 2008/2009 crisis was a great example of Warren leaning in while the world was falling apart.”

Several advisors referred to inspiration from Buffett’s quote: “Be fearful when others are greedy and greedy when others are fearful.”

Zack Gutches, founder and lead financial planner of True Riches Financial Planning, based in Denver, said the quote has helped define his practice’s investment principles.

“This quote demonstrates the power and wisdom of being a contrarian investor, which is an investment principle that I believe leads to more successful investing outcomes,” Gutches said via email.

Noah Damsky, founder and principal of Marina Wealth Advisors, a Los Angeles-based firm, said it wasn’t any of Buffett’s quotes or “money-making” ideas that stand out for him, but his “humble approach and disciplined philosophy,” which included being able to change with the times.

“He was adamant about not investing in technology, but after many years, he realized he was wrong, then bought Apple,” Damsky said. “He had high conviction in his beliefs, but was flexible. When he realized he was wrong, he admitted his mistake and changed course. … So many problems can be solved with admitting our mistakes and letting go of our ego.”

Ritholtz CEO Brown said when the announcement came out, he first felt thankful that the 94-year-old was announcing an orderly retirement, in which he emphasized he would not be selling any Berkshire Hathaway stock.

But then, like attendees at the event that Buffett spoke to, a sense of nostalgia followed.

“At first it was this wonderful moment, and then it started to set in and I thought: ‘I can’t believe that era is over,’” Brown said.

Brown noted that Buffett, as the head of an insurance company, could do many things that an average investor could not. But more generally, his idea of holding safe assets to take advantage of compounding—what Buffett often described as a snowball effect—could be used by financial advisors with their clients.

“When they’re setting up asset allocations for clients, and they’re trying to help clients through tough times in the market, that’s something they could point to,” he said. “They could say that the greatest investor in history has been able to do it, and the results speak for themselves.”

Beyond investing, Buffett’s approach to running a massive but “decentralized” publicly traded company influenced Brown’s approach to leadership.

“You empower the best possible people all over the country, and you leave them alone,” he said. “The touchstone for Warren Buffett’s various lieutenants who are running the couple hundred companies that comprise Berkshire is more about their personal bearing than it is about where they went to college.”

Caswell of Wealth Script Advisors did, however, take a moment to appreciate the pure skill of one of history’s greatest investors.

“Warren Buffett has always been calm when others panicked and has used market downturns as opportunities to invest,” he said. “He was the ultimate master of ‘Buy the dip.’”

You May Also Like

Search

RECENT PRESS RELEASES

Related Post