Record Revenue And Backlog Volatility Might Change The Case For Investing In MasTec (MTZ)

January 11, 2026

- In recent trading, MasTec reported record third-quarter revenue and a larger backlog, yet management cautioned that permitting delays and shifting customer spending can cause significant quarter-to-quarter swings in margins and cash flow.

- This mix of strong activity and operational uncertainty highlights how timing issues in major infrastructure projects can materially influence MasTec’s near-term financial profile.

- Next, we’ll examine how these permitting and spending-related margin swings could affect MasTec’s existing investment narrative built on backlog and growth.

We’ve found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Advertisement

MasTec Investment Narrative Recap

To own MasTec, you need to be comfortable with a story built on large, multi‑year infrastructure programs while accepting choppy quarter‑to‑quarter execution. The latest selloff, despite record third quarter revenue and a larger backlog, mainly reinforces that the biggest near term catalyst and risk both revolve around how smoothly projects move through permitting and how consistently customers release spending, rather than signaling a change in the underlying demand backdrop.

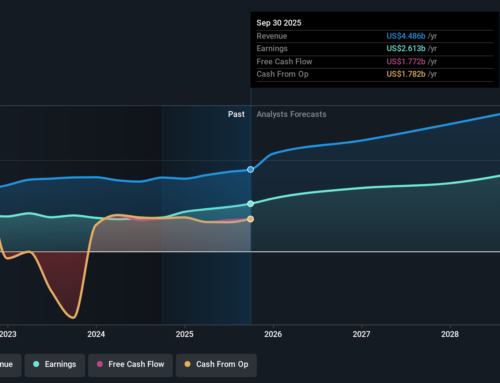

In that context, MasTec’s recent third quarter 2025 results, with US$3,966.95 million in sales and higher net income year on year, are especially relevant. They highlight that even when reported figures look strong, management still points to permitting delays and shifting customer priorities as key reasons margins and cash flow can swing meaningfully from one quarter to the next, which is central to how investors think about the backlog turning into earnings.

But behind the headline backlog strength, investors should be aware of how permitting delays and customer spending shifts can…

Read the full narrative on MasTec (it’s free!)

MasTec’s narrative projects $17.2 billion revenue and $730.8 million earnings by 2028.

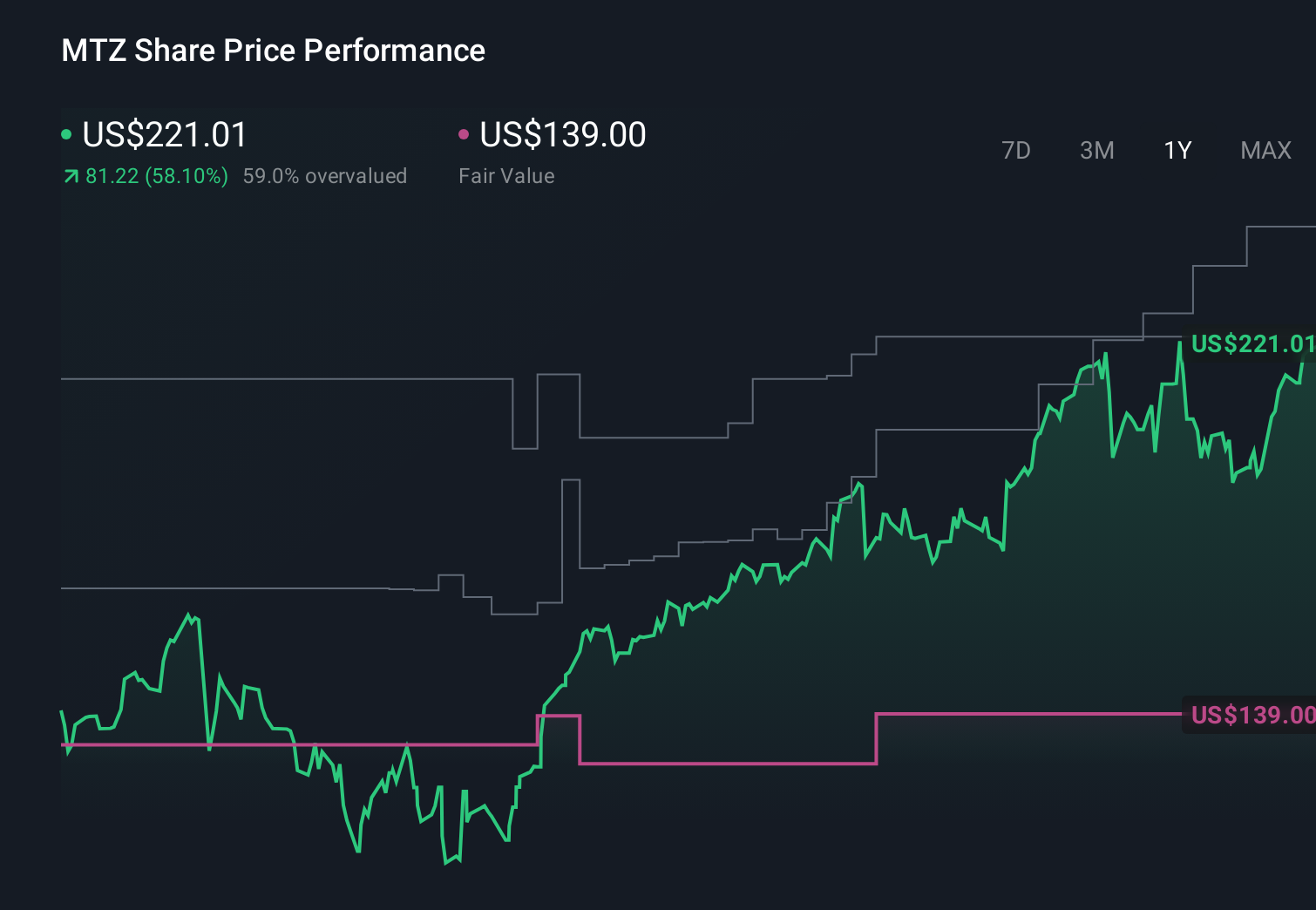

Uncover how MasTec’s forecasts yield a $246.67 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see MasTec’s fair value between about US$145 and US$247 per share, underlining how far opinions can stretch. Against that spread, the recent reminder that permitting delays and shifting customer spending can swing margins and cash flow shows why you may want to compare several viewpoints before deciding what the backlog is really worth.

Explore 4 other fair value estimates on MasTec – why the stock might be worth as much as 13% more than the current price!

Build Your Own MasTec Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your MasTec research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MasTec research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate MasTec’s overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post