Relax, Bitcoin is going to be ok, even if BTC lost 13% in 8 hours: The proof’s in the data

October 11, 2025

Key takeaways:

-

Friday’s Bitcoin price crash shows volatility persists in the spot BTC ETF era, with leverage and liquidity stress amplifying losses.

-

Liquidations hit $5 billion as portfolio margin systems failed, highlighting risks of illiquid collateral assets.

-

Bitcoin derivatives suggest market makers remain cautious amid low liquidity, insolvency rumors, and Monday’s US national holiday, leading to a partial market closure.

Bitcoin (BTC) plunged by $16,700 on Friday, marking a 13.7% correction in less than eight hours. The sharp drop to $105,000 wiped out 13% of total futures open interest in BTC terms. Despite the steep losses and cascading liquidations, these figures are far from unusual in Bitcoin’s history.

Even excluding the “COVID crash” — an impressive 41.1% intraday plunge on March 12, 2020 — which may have been amplified after the leading Bitcoin derivatives exchange at the time, BitMEX, faced liquidation issues and a brief 15-minute outage, there are still 48 other days when Bitcoin endured even deeper corrections.

A more recent example occurred on Nov. 9, 2022, when Bitcoin suffered a 16.1% intraday correction, plunging to $15,590. That episode coincided with the FTX collapse, which escalated after a report revealed that nearly 40% of Alameda Research’s assets were tied to FTX’s native token, FTT. Sam Bankman-Fried’s conglomerate soon halted withdrawals and eventually filed for bankruptcy.

Bitcoin volatility remains high despite ETF-driven market maturity

One could argue that intraday crashes of 10% or more have become less frequent since the spot Bitcoin exchange-traded fund (ETF) launched in the United States in January 2024. Still, considering Bitcoin’s historical four-year cycle, it may be premature to claim volatility has truly eased. Furthermore, the market structure itself has evolved as trading volumes on decentralized exchanges (DEXs) have surged.

The post-ETF events in question include a 15.4% intraday crash on Aug. 5, 2024, a 13.3% correction on March 5, 2024, and a 10.5% drop just two days after the spot ETF debut in January 2024. Regardless of the specific price swings, Friday’s $5 billion in Bitcoin futures liquidations suggests it could take months or even years for the market to fully stabilize.

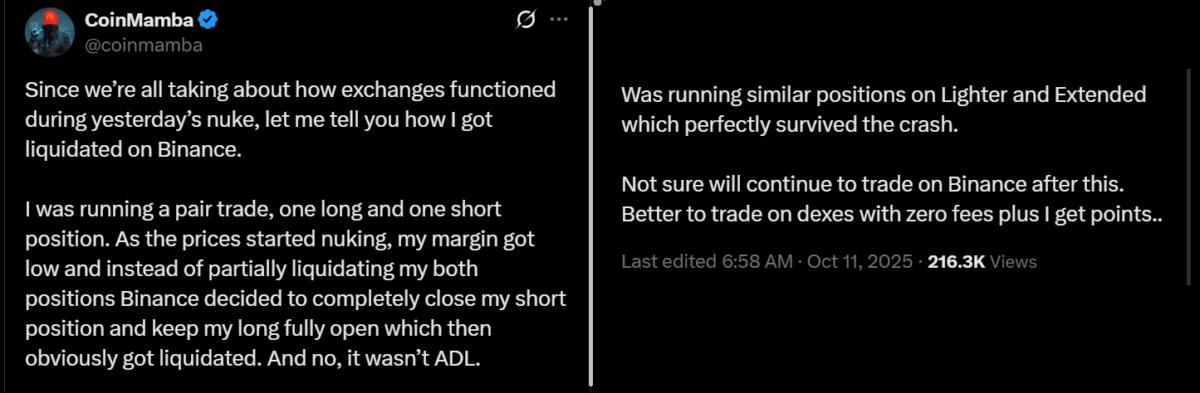

Hyperliquid, a perpetual decentralized exchange, reported that $2.6 billion in bullish positions were forcefully closed. Meanwhile, traders on several platforms, including Binance, reported issues with portfolio margin calculations. At the same time, DEX users complained about auto-deleveraging, which occurs when counterparties fail to meet margin requirements.

In essence, even traders sitting on significant gains saw some positions unilaterally terminated, creating major problems for those using portfolio margin rather than isolated risk management. This situation is not necessarily the fault of exchanges or evidence of malpractice; it is a byproduct of using leverage in relatively illiquid markets. Some altcoins plunged 40% or more, triggering a collapse in traders’ collateral deposits.

Bitcoin/USDT perpetual futures traded about 5% below BTCUSD spot prices during the crash and have yet to recover to pre-event levels. Normally, such discrepancies would present easy opportunities for market makers, but something appears to be preventing a return to normal conditions.

While Friday’s crash clearly marked a disruption, it could also be attributed to thin liquidity over the weekend, especially with US bond markets closed on Monday for a national holiday. Other potential factors include rumors of insolvency, which may have prompted market makers to steer clear of additional risk.

As a result, it may take several days for Bitcoin derivatives markets to fully gauge the extent of the damage and for traders to determine whether the $105,000 level will serve as support or if further correction lies ahead.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Search

RECENT PRESS RELEASES

Related Post