Renewable Energy Is Already Paying the Price for Copper Tariffs

March 31, 2025

China, Canada, Mexico, steel, aluminum, cars, and soon, copper. That’s what the market has concluded following a Bloomberg News report last week that copper tariffs would arrive far sooner than the 270 days President Trump gave the Department of Commerce to conduct its investigation into “dumping” of the metal.

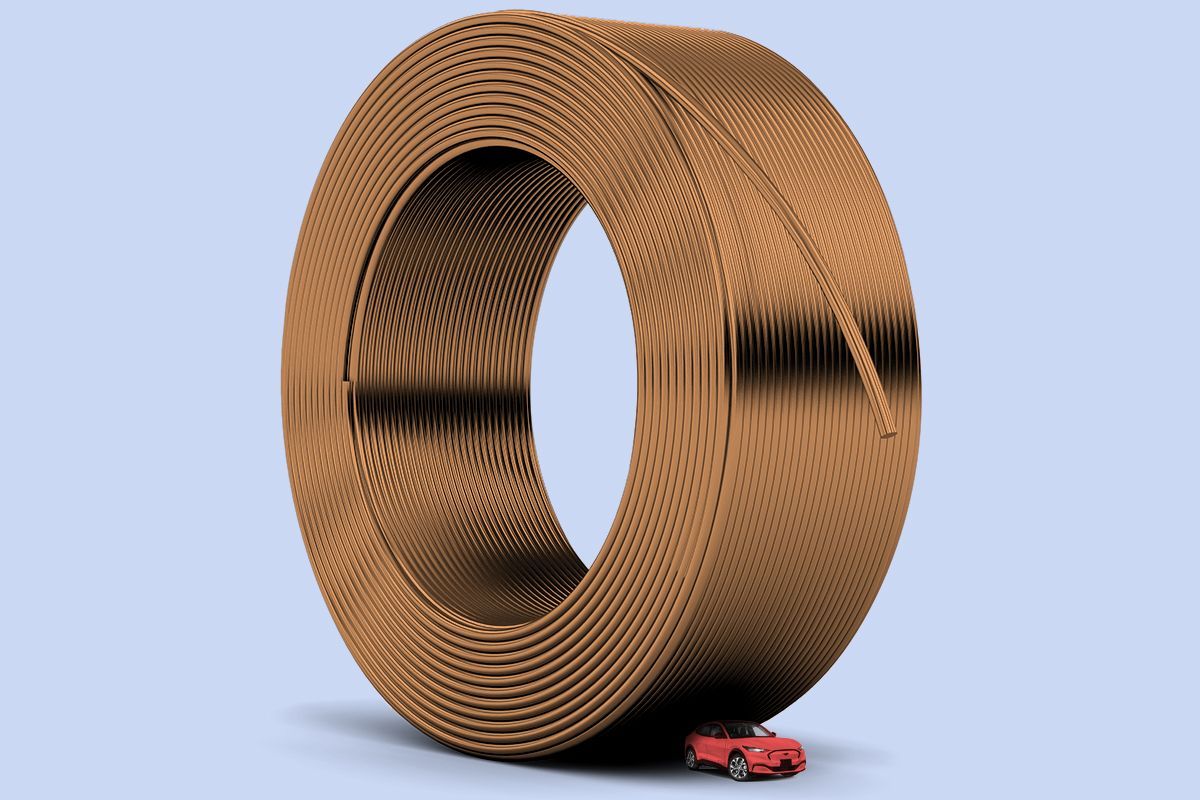

Copper has been dubbed the “metal of electrification,” and demand for it is expected to skyrocket under any reasonable scenario to contain global temperature rise. Even according to a U.S. administration that, at best, neglects climate change considerations, copper is an “essential material for national security, economic strength, and industrial resilience,” as the Trump White House said while announcing its investigation into copper imports.

The effort to boost domestic production of copper did not start with this White House, but it has historically run into the same problems that beset the mining industry: New production can take decades to begin, even after you find the minerals you’re looking for underground. And if demand is not assured — if, for instance, subsidies for electric vehicles filled with copper disappear — then investing in new production could lead to bankruptcy, whereas holding back on new capacity would, at worst, mean forgoing some profits.

Making copper critical

The Trump administration and the broader energy and foreign policy community have been, in general, obsessed with rocks — critical minerals, rare earths, and other minerals that are indeed “critical” to much of the economy but are not listed as such. Copper sits somewhere between these categories — while it does not appear on the United States Geological Survey list of critical minerals, which ranges from aluminum and antimony to zinc and zirconium, it does appear on the Department of Energy’s list of “critical materials.”

These lists guide federal data collection efforts, and that data can then get used to guide policymaking. Being on these lists doesn’t guarantee that a related program will get funding, but it does mean that the data is there to draw from should someone need to make a case for why their program should get funding.

This gap between the lists has been a target for Congress, especially for legislators in the Southwest, where much of America’s copper is mined. The discrepancies in the list is essentially a matter of focus for the Energy and Interior Departments — with Energy naturally focused on what’s especially important for energy infrastructure. Getting consistency between the lists, which are only a few years old, will “increase transparency within our federal agencies, ensuring all of our nation’s critical resources are developed, traded, and produced equally, and strengthen our supply chains,” Mike Lee (R-Ut), a sponsor of the Senate version of the legislation, said in a statement.

Whoever smelt it, sells it

Trump’s executive order asking for the investigation sought to speed up permitting for new mines — and they’ll need all the help they can get. S&P calculates that the average copper mine takes over 30 years to develop. Rio Tinto and BHP’s Resolution Copper project in Superior, Arizona — which the companies hope will produce 20 million tons of copper — has already sucked up some $2 billion of capital while producing zero copper after about 20 years of legal and political opposition. A proposed copper-nickel mine in Minnesota has alreadyabsorbed around $1 billion worth of investment and is still wrangling over the more than 20 permits it needs.

But for the Trump administration’s strategy of tariffs and expedited permitting to actually work for American copper end users, it will have to lead to an expansion of smelting and recycling, in addition to mining.

Reuters reported last year that the Mexican conglomerate Grupo Mexico would re-open an Arizona smelter, but that has yet to happen (it’s currently a Superfund site). A copper mine in Milford, Utah said last week that it was expanding to meet rising copper demand.

The smelting sector is dominated by China. “The United States has ample copper reserves, yet our smelting and refining capacity lags significantly behind global competitors,” the White House said in its copper executive order in February. China’s dominance, “coupled with global overcapacity and a single producer’s control of world supply chains, poses a direct threat to United States national security and economic stability.”

The United States produces around 1.2 million tons of copper annually from its mines and imports around 900,000 tons, according to the United States Geological Survey. Some of that domestically mined copper — around 375,000 tons worth — ends up being exported for smelting, according to the Copper Development Association.

While the United States is near the top of national copper production (well behind the world leader, Chile, but comparable to other large-scale copper producers such as Indonesia and Australia), it has a meager copper refining industry, with only two active smelters producing around 400,000 tons of copper a year — a fraction of China’s refining capacity — leaving American industry reliant on imports.

It gets even more complicated

The energy industry has been dealing with the copper issue for years. More specifically, it’s worrying about how domestic and global production will be able to keep up with what forecasters anticipate could be massive demand.

That goes not just for copper — it also includes the metals that are mined alongside it. First Solar, the U.S.-based solar manufacturing company, has benefited from tariffs on solar panels put in place during the Biden administration. But while First Solar has been a winner in the renewable energy trade conflict, it is still sensitive to the global trade in commodities. That’s in part because it is also a major consumer of tellurium, a mineral that’s a byproduct of copper mining, and which was the subject of expanded export Chinese export controls announced early last month.

“We have, over the past decade employed a strategic sourcing strategy to diversify our tellurium supply chain to mitigate a sole sourcing position in China and are undertaking additional measures to mitigate dependencies on China for certain products containing to tellurium,” Alexander Bradley, First Solar’s chief financial officer, said in the company’s February earnings call. “While we continue to evaluate [whether] there will be any operational impact from China’s decision, this latest development emphasizes the urgent need for the United States to accelerate the strategic development of copper mining and processing of its byproduct materials, including tellurium.”

Electric vehicles are another major user of copper among climate technologies, with EVs having on average around 180 pounds of copper in them, according to the Copper Development Association. Tesla — which will soon be hit by auto tariffs — has been actively trying to reduce its copper consumption. Meanwhile Rivian, one of Tesla’s primary domestic competitors, announced last year that it would cut its production targets dramatically due to what turned out to be a supplier communication snafu for a copper component of its motors.

All this tariff talk has been great for copper producers …

“We’re very bullish on copper prices,” Kathleen Quirk, chief executive officer of Freeport-McMoRan, which runs a number of U.S. copper mines (and a smelter, to boot), said at a financial conference in February. With boosts in demand coming from “power generation, new power generation investments, multibillion-dollar investments in infrastructure and energy infrastructure, it’s going to be very positive for copper.”

Copper prices paid by American manufacturers have been rising for the past five months, according to the monthly PMI survey. Prices in New York reached record highs last week, hitting almost $12,000 per ton as the industry tried to beat the almost-certainly-inevitable tariffs, according to an ING analyst report released last week.

The actual imposition of the tariffs would constitute a “further upside risk to copper prices” — in other words, prices will continue to climb, according to the ING analysts. “The U.S. copper rush could leave the rest of the world tight on copper if demand picks up more quickly than expected,” the ING analysts wrote.

Copper futures have shot up this year by around 25%, leading to profits for those who mine it — especially in the United States.

From the perspective of Freeport-McMoRan, the market gyrations so far have generally been to the upside, with the premium on copper in the U.S. “helping us from that perspective of generating higher revenues for our U.S. price copper,” Quirk said at the conference. But the domestic copper industry as a whole does not see tariffs as the sole way to increase copper production.

“The U.S. will need an all-of-the-above sourcing strategy to secure a stable supply for domestic use. This must include increased mining in the U.S., increased smelting and refining in the U.S., enhanced recycling, keeping more copper scrap within U.S. borders, and continued trade with reliable partners to maintain the flow of critical raw material feedstocks for domestic use,” Copper Development Association chief executive Adam Estelle told me in an emailed statement.

And tariffs can come in faster than new mines and smelters can be built or their capacity expanded. American mining projects have been mired in decades of permitting delays and negotiations with local communities not because there isn’t a market opportunity for new copper, but because it just takes a very long time to open a mine.

Even as she was celebrating Freeport-McMoRan’s robust outlook, CEO Kathleen Quirk noted that “at the same time, it’s become more and more difficult to develop new supplies of copper.”

… but not so great for copper users

That goes especially for industries related to renewable energy, where copper finds itself into grid equipment, solar panels, and wind turbines. Even so, they’ve been wary of talking about an impending tariff directly.

A number of trade groups, including the Zero Emission Transportation Association, the National Electrical Manufacturers Association, and the Solar Energy Industries Association, hailed an executive order aiming to accelerate critical minerals production released March 20. When I asked about copper tariffs, however, a ZETA spokesperson referred me to an earlier statement decrying trade conflict with Canada and Mexico, saying that “imposing tariffs on allies and trading partners like Canada and Mexico — both of which play a significant role in the North American automotive supply chain — will increase costs to consumers and make it more difficult to attract investment into our communities.”

Meanwhile, NEMA’s vice president of public affairs, Spencer Pederson, told me in an emailed statement that “any new trade policies must provide predictability and certainty for future domestic investments and businesses.”

Other manufacturing-centric industries that use copper aren’t thrilled about the prospect of tariffs, either. A spokesperson for the National Association of Manufacturers referred me to its recent survey showing that the top two concerns among its members were “trade uncertainties,” feared by more than three quarters of respondents, and “increased raw material costs,” which worried 60% of respondents. While NAM is broadly supportive of many Trump administration goals, especially around extending the 2017 tax cuts, it has called for a “commonsense manufacturing strategy” which includes “making way for exemptions for critical inputs.” That runs against the Trump administration’s preference for big, obvious tariffs.

Search

RECENT PRESS RELEASES

Related Post