Renewable energy’s scale-up provides a blueprint for carbon removal

May 8, 2025

In March, Climate Impact Partners, a long-standing carbon project developer, signed a 30-year offtake agreement with Microsoft to deliver 1.5 million carbon removal credits from its Panna project, a community-led forest restoration effort in Madhya Pradesh, India. The project’s finance structure looks a lot like a wind farm, said Climate Impact Partners CEO Sheri Hickok, who previously led General Electric’s international windfarm development.

Hickok thinks borrowing lessons from renewable energy’s rapid growth could accelerate the expansion of carbon removal projects. Both incur the majority of their lifetime costs upfront, during project development, and repay that investment over years. Purchase contracts for both typically span decades and often lock in fixed pricing.

These long-term offtakes derisk the upfront investment, establishing the price certainty necessary for investors to finance project development with confidence, and simultaneously secure buyers access to the renewable energy or carbon credits necessary to meet their future climate commitments.

“Corporates know how to do [virtual power purchase agreements] in renewable energy. We do [carbon purchase agreements] in carbon,” said Hickok. The similarity could give companies confidence in signing long-term carbon offtake agreements, because it’s a structure they’ve seen before.

The Panna project will restore nearly 50,000 acres of cropland and community lands in central India. The community will plant nearly 12 million native and fruit trees in the region, drawing 3 million tons of carbon dioxide out of the atmosphere over the project’s lifespan. Microsoft has already claimed half of these carbon credits; Climate Impact Partners will sell the remaining half to other buyers in the future. It’s Microsoft’s largest carbon removal purchase in the Asia Pacific region to date, and its first in India.

Terra Natural Capital, an environmental commodities investment company, is providing the project finance in stages, based on milestones that include planting rates and community engagement.

The project’s robust, two-year pilot, experienced team and demand commitment from Microsoft made it stand out as a strong investment, said Terra Natural Capital Managing Director Eric Vertefeuille. In addition, Kita, a carbon credit insurance company, is insuring the Panna project against under- and non-delivery, giving investors an additional level of confidence.

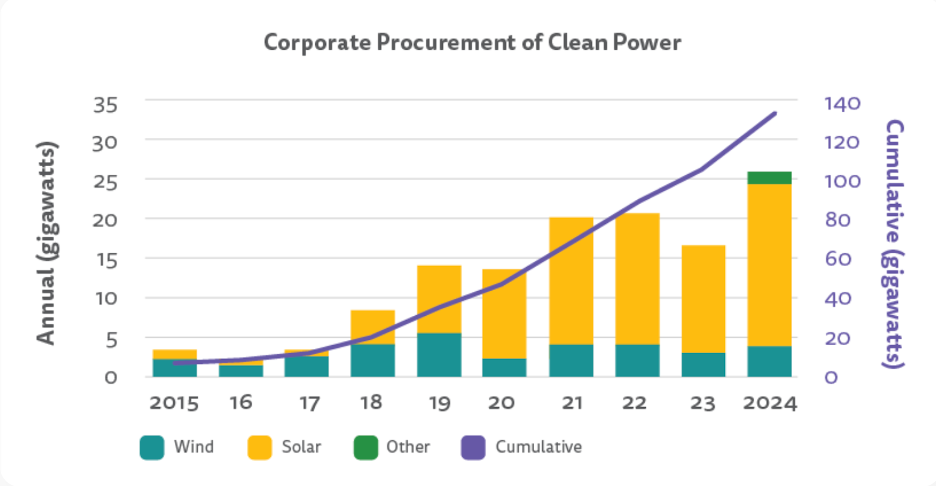

The rapid scale up and declining costs of renewable energy provide a roadmap for other climate technology deployment at scale. Two ingredients have underpinned the renewable energy boom over the last three decades, according to a 2024 report from Terra Natural Capital:

- Government policies, such as subsidies and tax credits, spurred demand and reduced risk.

- Corporate demand signals provided long-term price certainty.

These factors made renewable energy project returns more predictable, opening the door for financial institutions to invest and get projects off the ground. And with the growing field experience, technology costs have steadily declined, making renewable energy a more attractive investment to buyers and creating a positive feedback loop, leading to a steady increase in deployments.

Source: The Business Council for Sustainable Energy, here

Carbon removal can follow a similar path. “Carbon pricing is serving the same role as government policy did for renewable energy,” said Hickok, with long-term offtakes such as Microsoft’s contract with the Panna project providing the price certainty critical for private capital to dive in.

Although renewable energy is seeing record growth year over year, its path wasn’t always smooth. Early on, reliability concerns and demand uncertainty made many investors hesitant to commit large sums. Once the market accelerated, early investors gained competitive advantage.

Carbon removal is now facing many of the same uncertainties. But early movers are poised to reap the same benefits as those who acted early on renewable energy purchasing.

“We are working to demonstrate real returns, infrastructure-type returns, on long-term carbon development,” said Hickok. “We have to get finance flowing into the carbon markets to scale, to build out the capability in the industry.”

To be sure, carbon removal presents unique challenges. For one, nature-based carbon removal operates on nature’s timelines: It can take five to 10 years before a project consistently delivers a stream of carbon removal credits. That’s slightly longer than typical return timelines from a wind or solar farm, making patient capital and long-term offtakes even more critical for the carbon sector.

Although buyers and investors willing to take a long view with carbon offtakes are still in short supply, that long-term commitment also makes carbon projects particularly impactful to local communities, offering “long-term employment and a transformative view for implementation partners in terms of how they view the business models,” said Ben Gatley, Climate Impact Partners’ head of commercial project development. As a result, “they can make quite different decisions around how they run their organization.”

Climate Impact Partners estimates that farmers involved with the Panna project will double their incomes over the investment timeframe from fruit tree yields and carbon payments.

The next step to scale the carbon removal industry is to standardize finance structures, according to Vertefeuille. “All project finance into large infrastructure projects looks and smells the same. It took a long time to get there,” she said. Getting there took practice to establish repeatable playbooks.

“The first movers in renewables had their choice of projects prior to the rise in demand that limited options later on,” said Hickok. “This is the same outlook for carbon.”

Search

RECENT PRESS RELEASES

Related Post