Resilience key to insurance, financing renewable energy projects

April 16, 2025

Resilience key to insurance, financing renewable energy projects | Insurance Business America

Report identifies top risks threatening energy transition

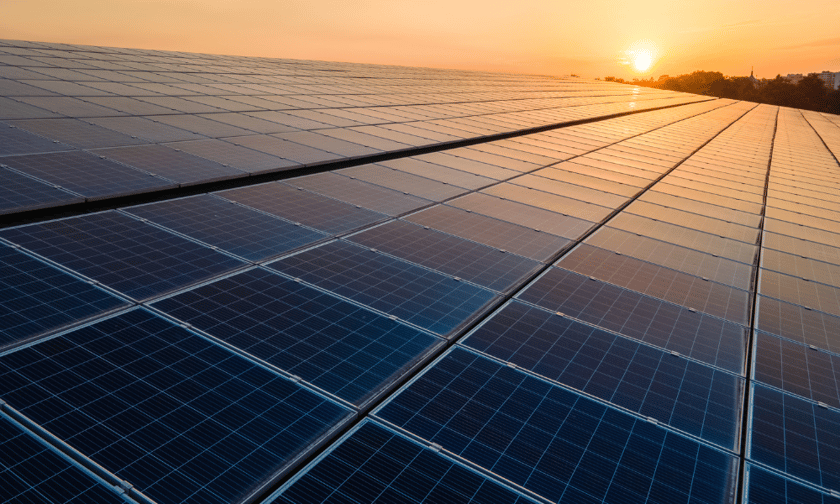

As global efforts to transition toward renewable energy accelerate, risk resilience and insurance dynamics are emerging as central concerns for project stakeholders.

Renewable energy project investment trends

FM Global’s study, which surveyed 650 executives and investors involved in renewable energy, found strong momentum in sector expansion plans.

Nearly all solar developers (97%) and onshore wind operators (95%) anticipate growing their energy output within three years. Among financial stakeholders, 73% reported plans to increase investment in infrastructure.

However, access to capital remains a potential bottleneck. While interest in funding is strong, 64% of lenders and 58% of investors indicated that current demand exceeds supply.

Project resilience – defined by the ability to withstand natural and operational disruptions – is a major variable shaping investment decisions.

A majority of financiers reported that a project’s ability to manage risk influences not only investment willingness (66%) but also valuations (69%) and contractual terms (72%).

Top renewable energy project concerns

Top concerns during the construction phase include increasing equipment costs (44%), regulatory hurdles (41%), and logistical delays (40%).

Once operational, projects face ongoing challenges from extreme weather events (54%), mechanical failures (50%), and supply issues with replacement parts (48%).

Despite these challenges, 59% of energy providers expressed confidence in their projects’ resilience. However, they also acknowledged significant knowledge gaps.

The survey pointed to key areas of uncertainty:

- limited transparency from equipment makers (57%)

- incomplete understanding of local environmental exposures (53%)

- the rapid pace of technological evolution (47%)

These risk gaps translate to financial impacts. Survey respondents cited higher construction expenses (52%), increased insurance premiums (47%), and challenges in obtaining full insurance coverage (44%) as consequences of uncertainty.

Doug Patterson, FM’s senior vice president for Forest Products and FM Renewable Energy, said developers are limited by the information available to them.

“Providers are doing the best they can with the information they have, but they need more insight into the technology they are buying and the environmental factors that threaten it,” he said, emphasising the need to integrate risk expertise early in development.

Energy insurance trends

In parallel, Willis’ Energy Market Review noted continued softening in energy insurance pricing, as underwriters compete in a capacity-rich environment. Record levels of available capital are creating favourable conditions for buyers, although recent losses could affect this trend.

The downstream energy sector saw limited major losses in 2024, encouraging insurers to reduce rates. However, potential losses in the first quarter of 2025 have already reached $1.5 billion, exceeding the prior year’s total, introducing potential volatility.

In the upstream market, a 5% expansion in underwriting capacity is contributing to further rate declines. Underwriters are seeking to grow their share of business, often by taking lead positions on placements. Still, many carriers have already allocated much of their 2025 capacity to construction risk – a historically challenging area for profitability.

Related Stories

Fetching comments…

Search

RECENT PRESS RELEASES

Bitcoin treasury CEO Jack Mallers drops Bitcoin-per-share metric as he takes jab at Michae

SWI Editorial Staff2026-01-22T13:04:18-08:00January 22, 2026|

Study: Cannabis reform lures women, older adults to legal industry

SWI Editorial Staff2026-01-22T13:00:06-08:00January 22, 2026|

Study: Cannabis reform lures women, older adults to legal industry

SWI Editorial Staff2026-01-22T12:59:48-08:00January 22, 2026|

MPH student takes an interdisciplinary approach to climate-related health inequities

SWI Editorial Staff2026-01-22T12:59:15-08:00January 22, 2026|

MPH student takes an interdisciplinary approach to climate-related health inequities

SWI Editorial Staff2026-01-22T12:58:55-08:00January 22, 2026|

Trump’s War on the Environment: Year One

SWI Editorial Staff2026-01-22T12:58:09-08:00January 22, 2026|

Related Post