Risk-Off Tape Hits Ethereum Harder Than Bitcoin As Crypto Market Momentum Slows

January 19, 2026

Ethereum-led crypto liquidations overtook Bitcoin as macro headwinds capped upside and traders stayed cautious amid muted market momentum.

- Ethereum overtook Bitcoin in liquidations on Tuesday morning, as the crypto market saw relatively muted liquidations totaling $113.25 million over the last 24 hours.

- Bitcoin traded around $92,358, with $14.59 million in liquidations, mostly on the long side.

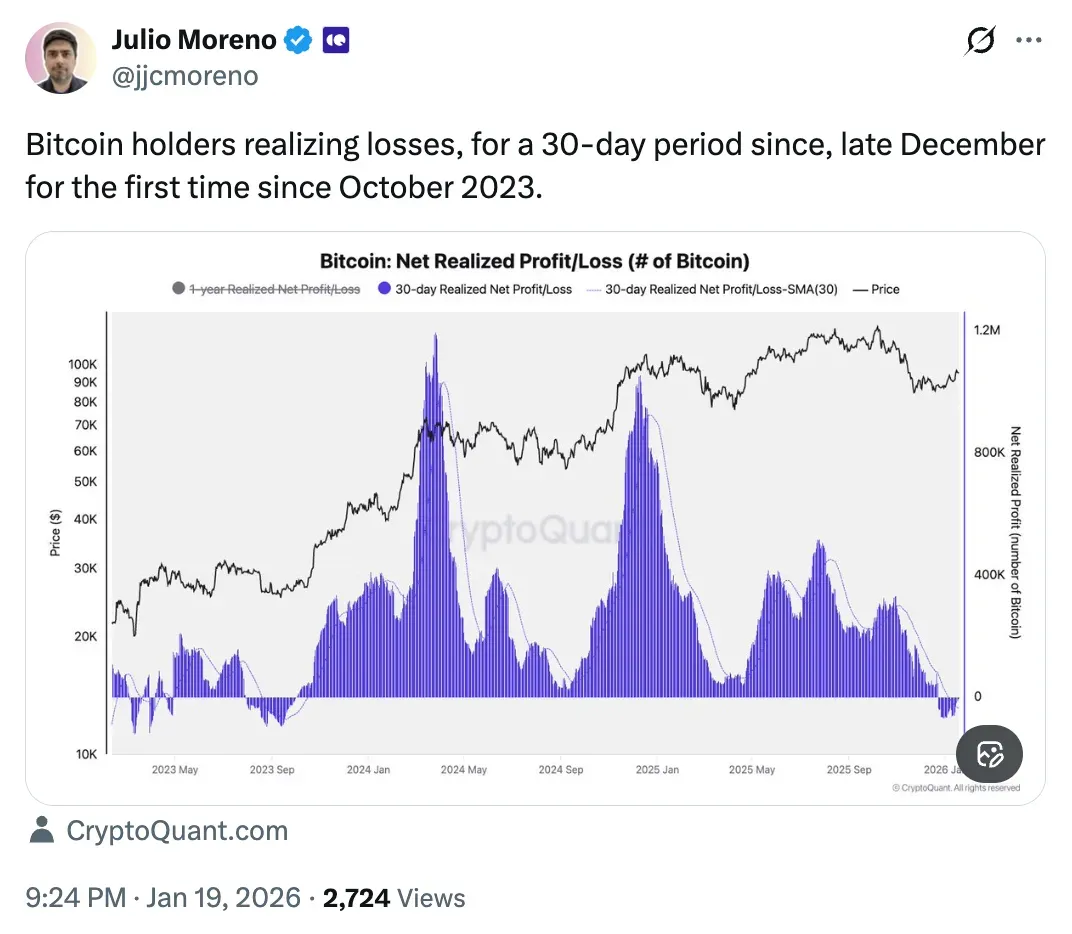

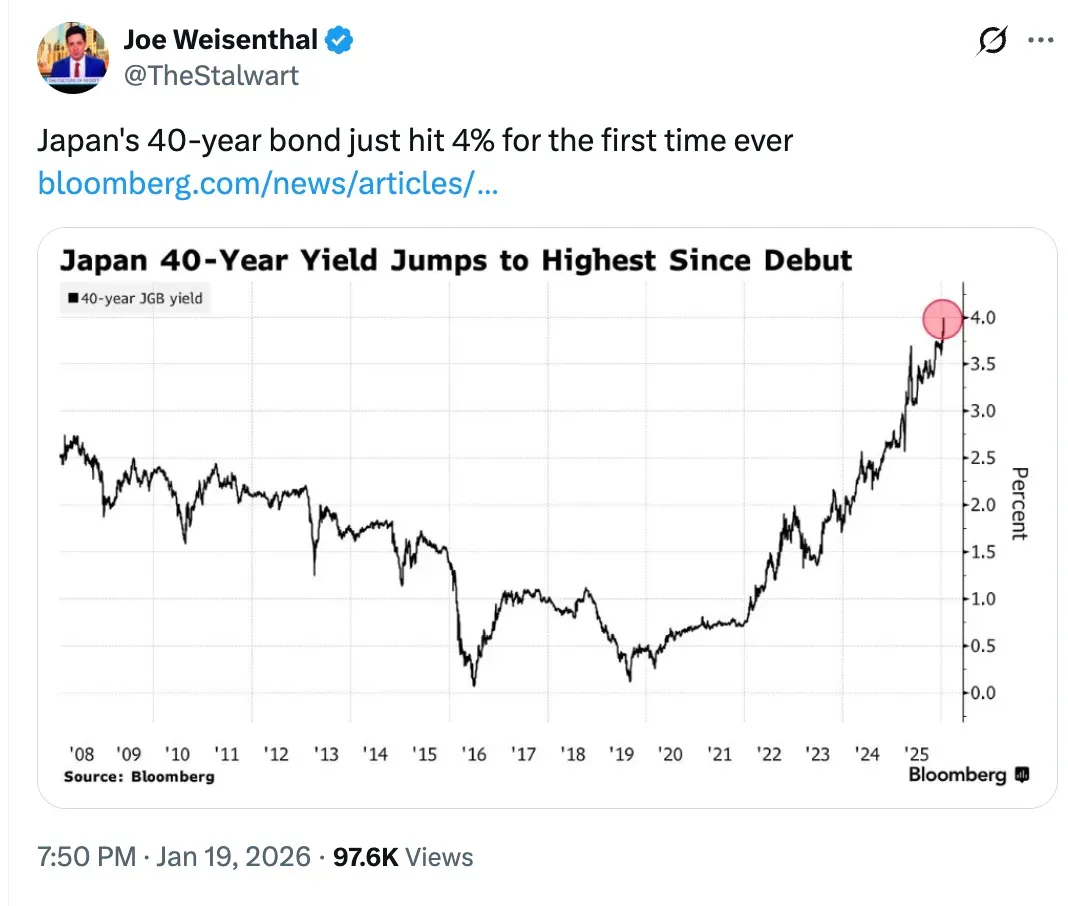

- Bitcoin holders suffered 30-day losses for the first time since 2023, and Japan’s 40-year bond yield hit 4%, tightening global conditions.

Cryptocurrency markets struggled to rise in the early hours of Tuesday amid heightened macro overhang, as Ethereum saw about $27.09 million in liquidations, mostly longs, making it the most liquidated asset, surpassing Bitcoin (BTC).

The second-largest crypto, Ethereum (ETH), traded around $3186, down 0.65% over the past day, with total liquidation of roughly $27.09 million, dominated by long positions at $22.53 million and short positions at $4.56 million in the last 24 hours, as per Coinglass data. This was the largest liquidation seen in the crypto market in the last 24 hours, surpassing Bitcoin. On Stocktwits, retail sentiment around Ethereum dropped from ‘bullish’ to ‘bearish’ territory, along with chatter levels dropping from ‘high’ to ‘normal’ over the past day.

The entire crypto market saw about $113.25 million in the last 24 hours, with analysts and market watchers believing that crypto may be moving into a longer five-year cycle than the traditional four-year cycle.

Bitcoin (BTC) was trading close to $92,358, down 0.33% over the past 24 hours. Liquidation data shows that nearly $14.59 million was liquidated from Bitcoin alone, with $9.55 million in long positions and $5.04 million in short positions. This suggests moderate pressure on the long side. On Stocktwits, retail sentiment around Bitcoin dropped from ‘bullish’ to ‘bearish’ territory, as chatter remained at ‘normal’ levels over the past day.

The current market movement comes as silver hit a record high of $94 per ounce, driven by geopolitical tensions such as the US-EU trade dispute over Greenland. Interestingly, on-chain data shared by Julio Moreno of CryptoQuant showed that Bitcoin holders are now realizing losses over the past 30 days for the first time since 2023. This signals short-term market stress.

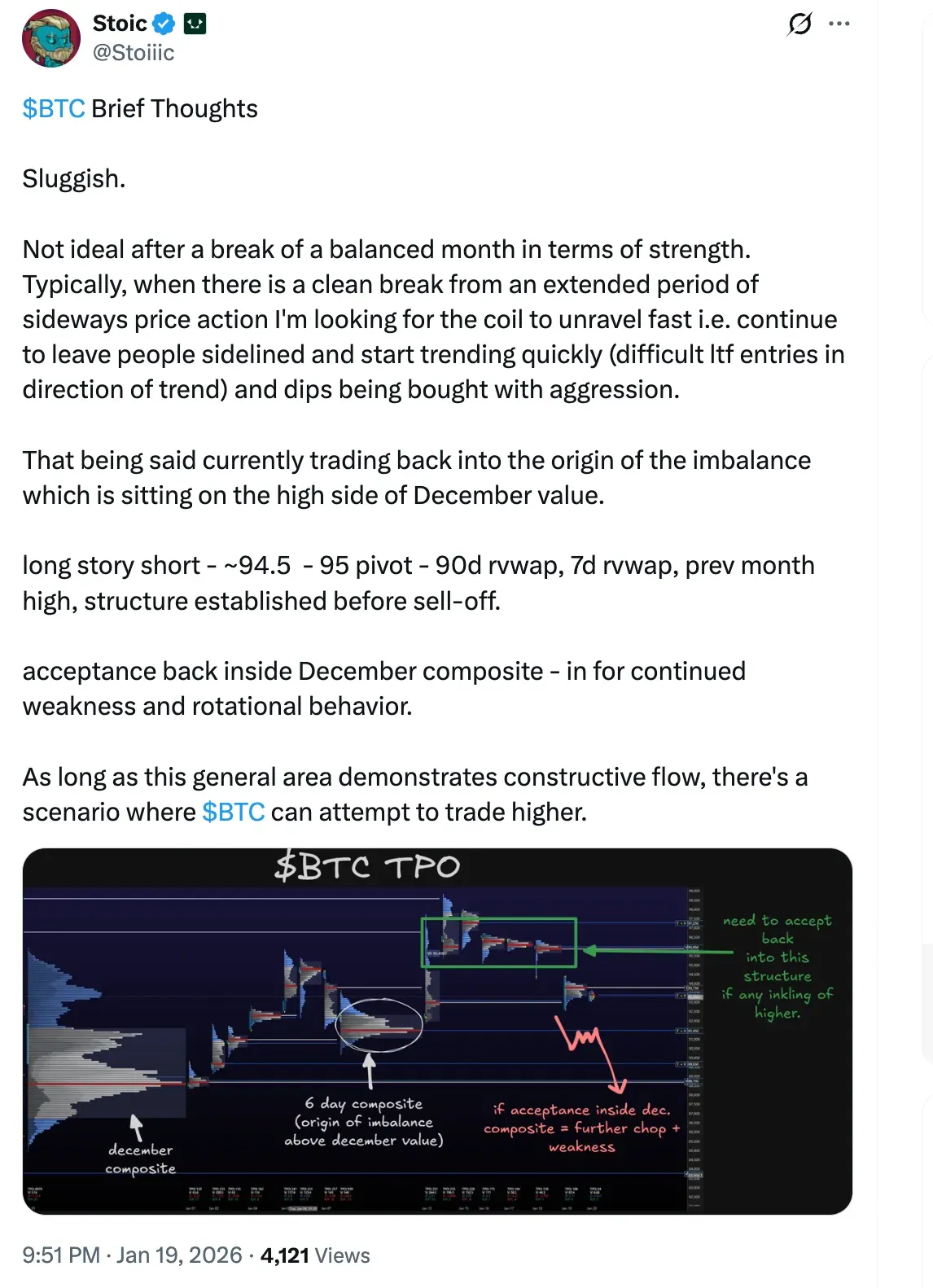

Crypto analyst Stoic also pointed out on X that the current Bitcoin price is back into the December value area, which he frames as a new support zone that the asset must hold to avoid further dips.

Coupled with these on-chain metrics is the macro signal of Japan’s 40-year bond yield hitting 4% for the first time, which is tightening global financial conditions. Analysts noted that risk assets are now under macro pressure.

Solana (SOL) was trading at around $133.48, down 0.2% in the last 24 hours, and saw about $3.27 million in total liquidations. The liquidations consisted of $2.29 million in long positions and $980,810 in short positions over the past 24 hours. On Stocktwits, the retail sentiment around Solana changed from ‘bearish’ to ‘extremely bearish’ territory with chatter at ‘normal’ levels over the past day.

Ripple’s XRP (XRP) traded around $1.97, up by 0.3% over the past 24 hours, with a total of $5.11 million in liquidations. The liquidations consisted of $2.76 million in long positions and $2.35 million in short positions over the past 24 hours. On Stocktwits, retail sentiment around XRP shifted from ‘neutral’ to ‘bearish’ territory, with chatter at ‘low’ levels over the past day.

Dogecoin (DOGE), trading at around $0.1280, up 0.7% in the last 24 hours, saw about $2.24 million in total liquidations. The liquidations totaled $1.26 million in longs and $982,800 in shorts over the past 24 hours. On Stocktwits, the retail sentiment around Dogecoin changed from ‘neutral’ to ‘bearish’ territory, with chatter at ‘low’ levels over the past day.

Binance Coin (BNB), trading at around $928.60, up 0.6% in the last 24 hours, saw about $120,780 in total liquidations. The liquidations totaled $52,720 in longs and $68,060 in shorts over the past 24 hours. On Stocktwits, the retail sentiment around BNB remained in the ‘bearish’ territory, with chatter at ‘high’ levels over the past day.

Cardano (ADA), trading around $0.366, up 0.3% in the last 24 hours, saw about $577,130 in total liquidations. The liquidations totaled $542,550 in longs and $34,580 in shorts over the past 24 hours. On Stocktwits, the retail sentiment around Cardano remained in the ‘neutral’ territory, with chatter at ‘low’ levels over the past day.

Read also: Galaxy Digital’s Alex Thorn Sees Market Structure Bill As ‘Bullish Catalyst’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Search

RECENT PRESS RELEASES

Related Post