Robinhood’s Blockchain and Prediction Markets Pivot Might Change The Case For Investing In

January 12, 2026

-

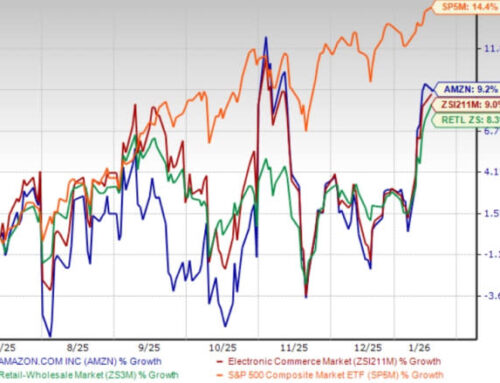

In recent months, Robinhood Markets expanded its crypto arm into tokenized stocks, staking, and a forthcoming Ethereum-based layer-2 network, while its prediction markets business grew into a meaningful revenue contributor by late 2025.

-

This combination of new blockchain infrastructure and fast-growing prediction markets signals a broader shift toward more diversified, transaction-driven income beyond traditional trading.

-

We’ll now examine how Robinhood’s rapid prediction markets growth could reshape its investment narrative and future earnings profile for investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

To own Robinhood today, you need to believe it can turn its large, active user base into durable, diversified revenue beyond traditional trading. The recent surge in prediction market activity supports that story in the near term, but the stock’s rich valuation and signs of softening trading volumes keep the key risk squarely on whether growth can keep pace with expectations in upcoming results.

Among recent developments, the rapid scaling of Robinhood’s prediction markets since their Q1 2025 debut looks most relevant. By Q3 2025, these contracts were already a meaningful revenue contributor, complementing tokenized assets and crypto staking as newer transaction engines that could matter if core equity and options activity remains under pressure.

Yet while the story sounds promising, investors should be aware that any slowdown in new-product growth could leave today’s high expectations exposed and…

Read the full narrative on Robinhood Markets (it’s free!)

Robinhood Markets’ narrative projects $5.3 billion revenue and $1.8 billion earnings by 2028. This assumes 14.0% yearly revenue growth with earnings remaining flat, implying no change from current earnings of $1.8 billion.

Uncover how Robinhood Markets’ forecasts yield a $151.55 fair value, a 29% upside to its current price.

Forty one fair value estimates from the Simply Wall St Community span roughly US$45 to US$158 per share, with opinions spread across the full range. You can weigh those views against the risk that any regulatory delay in tokenization or staking could slow new product momentum and reshape how you think about Robinhood’s longer term earnings power.

Explore 41 other fair value estimates on Robinhood Markets – why the stock might be worth less than half the current price!

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

-

A great starting point for your Robinhood Markets research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

-

Our free Robinhood Markets research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Robinhood Markets’ overall financial health at a glance.

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

-

We’ve found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

-

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

-

Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include HOOD.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post