Rubrik’s Expanded Okta Protection Might Change the Case for Investing in Rubrik (RBRK)

September 27, 2025

-

Rubrik recently announced the launch of Rubrik Okta Recovery, expanding its identity protection solutions to safeguard Okta Identity Provider (IdP) environments with automated, immutable backups and granular recovery capabilities.

-

This enhancement positions Rubrik as the only platform currently offering unified identity protection across Okta, Active Directory, and Entra ID, addressing growing enterprise concerns about always-on access and cyber resilience.

-

We’ll examine how unified protection for enterprise identity systems could influence Rubrik’s investment narrative and future growth outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

For investors to feel confident in Rubrik, the central thesis is that the company can capitalize on rising enterprise demand for unified cyber resilience, especially as identity and data security threats accelerate. The recent launch of Rubrik Okta Recovery extends the company’s competitive moat in identity protection, adding weight to its short-term catalyst of market share gains, though this alone does not neutralize key risks from aggressive competition or the need to prove rapid product adoption.

Among recent announcements, the expanded integration with CrowdStrike Falcon stands out, as it enhances Rubrik’s ability to surgically recover from identity attacks. This development closely relates to the current catalyst around securing more customers seeking comprehensive protection across complex hybrid environments, reinforcing Rubrik’s positioning in the enterprise market.

But investors should also be aware that, in contrast, difficulty achieving rapid product-market fit for these innovations could…

Read the full narrative on Rubrik (it’s free!)

Rubrik’s outlook anticipates $2.0 billion in revenue and $257.3 million in earnings by 2028. Achieving this would require a 26.2% annual revenue growth rate and an earnings increase of $782.1 million from current earnings of -$524.8 million.

Uncover how Rubrik’s forecasts yield a $115.20 fair value, a 40% upside to its current price.

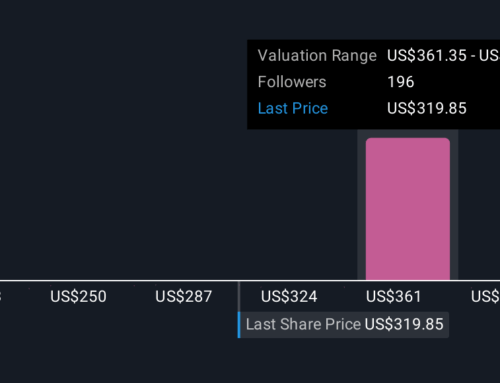

Eleven Simply Wall St Community fair value estimates for Rubrik range from US$20.21 to US$115.60, showing a broad spectrum of views before the latest product news. While you consider these diverse perspectives, keep in mind that execution risk in early-stage identity and cloud transformation strategies could influence future results.

Explore 11 other fair value estimates on Rubrik – why the stock might be worth less than half the current price!

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

-

A great starting point for your Rubrik research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

-

Our free Rubrik research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Rubrik’s overall financial health at a glance.

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

-

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

-

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

-

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include RBRK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post