Scared of investing in stocks right now? Read this to put your mind at ease.

May 12, 2025

- Market volatility has made the prospect of investing in stocks daunting in the Trump era.

- Regardless of near-term price swings, being patient over the long term has paid off throughout history.

- This is the fourth installment in BI’s six-part series on making major life decisions during this period of massive change.

Ask any financial advisor if now is a good time to buy stocks, and you’ll likely get the same two words for an answer: It depends.

You’ll then get a couple of questions: What’s your risk tolerance? What’s your timeline?

If you have either a low risk threshold or need the money in a few years’ time, it’s probably not a good time to buy.

But if you possess the magical combination of having time on your side and the ability to shrug off volatility, history shows it’s virtually always a good time to buy.

The equity-investing landscape has been especially difficult during the Trump era. The reaction to the president’s wide-reaching tariff proposals extended a post-inauguration sell-off that pulled the S&P 500 nearly 20% lower in a matter of weeks. But as Trump has backtracked on certain levies, and as the economic picture has remained robust, the index has swiftly recovered more than half of that.

This is the fourth installment of BI’s six-part series on making major life decisions in periods of immense policy-driven change. We’ve already covered best practices for:

What historical data says

If you have a longer-term time horizon, history is on your side, according to Jeff Schulze, the head of economic and market strategy at ClearBridge Investments.

On a recent Franklin Templeton podcast, Schulze pointed out that in the 34 times over the last 75 years when a drawdown of 10% has occurred, the S&P 500 has averaged positive returns over the next 12 months. The forward one-year return is even stronger when a recession hasn’t materialized, averaging 14% over time. And even when a recession has struck, 12-month returns have been positive, although to a lesser degree.

Still, every market cycle is different, and there are reasons to be concerned that a potential bear market this time around could be more severe.

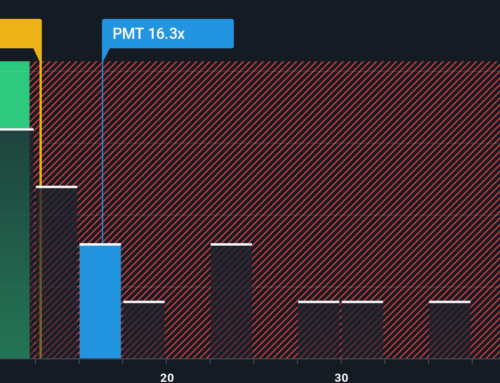

For one, valuations on the S&P 500 have recently been at some of their highest levels in history. The Shiller cyclically adjusted price-to-earnings ratio, which looks at current stock prices compared to a rolling 10-year average of earnings, is still at about 33. That’s higher than at the market’s peak before the 1929 crash.

Stock valuations greatly inform 10-year forward returns. This has led top strategists like David Kostin of Goldman Sachs and Mike Wilson of Morgan Stanley to warn of lackluster returns for the S&P 500 in the decade ahead.

Trump’s 10% baseline tariffs are also seen potentially raising consumer prices while slowing economic growth — a 1970s-style stagflation scenario that investors are increasingly worried about.

On an overall basis, however, stocks seemingly always recover and have delivered strong returns over multi-decade periods. For example, the S&P 500 is up 244% since its late 2007 peak just before the financial crisis.

How to get around trying to time the market

If you’d bought in at the market bottom in 2009, you’d be up nearly 700% in the period since. But there’s no way to time the bottom perfectly.

One way to mitigate this risk is by dollar-cost averaging. That’s a fancy way of saying buying into the market at set intervals — perhaps every Friday, for example, or on the first of every month.

So, if you had $10,000, you could buy in $500 at a time over the course of 20 weeks or months. That way, you buy when the market is up and when it is down. You take the risk of missing a rally over that time, but you also benefit from a more attractive buying point over the long term if the market falls further in the months ahead.

Whichever way you decide to approach entering the market, your returns are likely to be good over the long run, if history is an accurate guide. Warren Buffett once said you should be OK with losing 50% or more of your money — on paper, at least — when you invest in stocks. In other words, you should have the stomach to withstand short-term volatility because you’re in it for the long haul anyway.

If you’re disciplined enough to ignore any pain that comes along and can keep your eye on the prize far off on the horizon, then yes, now is a good time to buy.

If you enjoyed this story, be sure to follow Business Insider on MSN.

Search

RECENT PRESS RELEASES

Related Post