Selling Out or Optimism for US Cannabis Cultivators

April 3, 2024

Selling Out or Optimism for US Cannabis Cultivators

There is something unusual in the Air

Published by: StockWatchIndex Editorial Team

Rainer Poertner, Chief Analyst

In California, cannabis was legalized for adult use in 2016 by Proposition 64, which also established a system of taxation and regulation for the legal cannabis industry. However, despite the promise of a thriving and inclusive legal market, many cannabis cultivators, especially in California, are still facing challenges that threaten their survival, prevent them from running a profitable operation and were forced to scale down, or worse, not renew their permits or exit the industry altogether.

Overhyped expectations of growth, revenues, and profits, unusually large investment or debt burdens, inexperience resulting in mismanagement, and extreme market volatility have made it difficult for many public cannabis companies to develop a solid and predictable share price and generate a satisfactory ROI for their investors. Accordingly, many small and even the largest publicly traded cannabis companies have lost an average of 70% in stock value.

It is no secret that especially California cannabis companies have been going through tough times for the last few years. As a result, the last two years saw the legal marijuana market shrink noticeably. According to permit statistics from the California Department of Cannabis Control, the market is down by almost 29%.

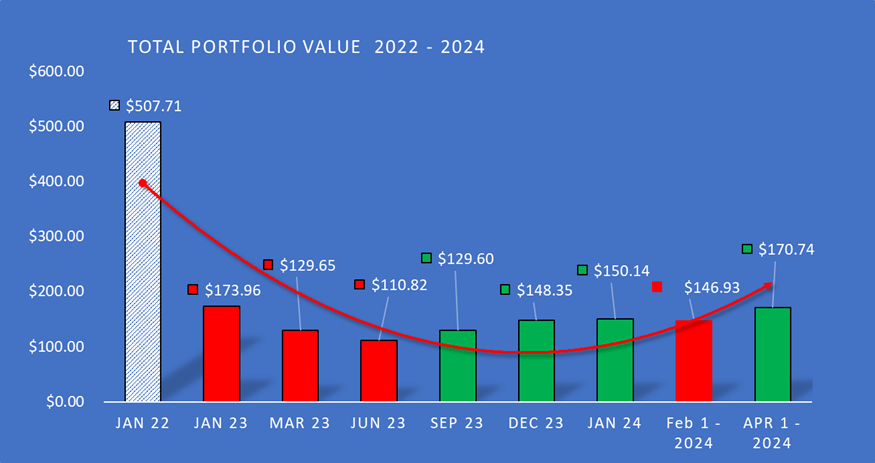

In January 2022, StockWatchIndex (SWI) invested in a portfolio of what we believed to be 14 leading companies in the Cannabis industry and has monitored their share prices, Capitalization, and Return on Investment every month. The share price heatmap below depicts a turbulent market with significant losses and a drastic decrease in share price. The average decrease in share price over the monitoring period, beginning in January 2022, came to an average of 66%.

One of the main challenges for the entire sector is the high level of taxation imposed by the state, especially in California and local governments, on cannabis products. According to the California Department of Tax and Fee Administration, the state levies a 15% excise tax, a cultivation tax of $9.65 per ounce of dry flower or $2.87 per ounce of dry leaves, and a sales and use tax of 7.25% on cannabis products. Additionally, local governments can impose taxes and fees, which vary widely depending on the jurisdiction.

All taxes combined can add up to more than 40% of the retail price of cannabis products, making them less competitive with the still thriving illicit market. In addition, the oversupply of cannabis in the state, partly due to the proliferation of illegal or unlicensed cultivations, which operate outside the legal system and evade taxes and regulations, has made it difficult for legal operations to survive. In July 2022, the DCC reported 11,335 active business licenses. Since 2022, the number of active business licenses in the state has dropped to 9,900, a decline of 28.5%. The number of inactive or expired licenses increased by 48%.

Lately, however, there has been something unusual in the Air.

at Northern California’s Cannabis Companies

OPTIMISM

Now, there seems to be light at the end of the tunnel. After the steep declines from January 2022 through June 2023, stock prices began to stabilize beginning September 2023 and, as of March 2024, are on the rise, gaining at a significant rate of 31% from Match to April 2024.

Ironically, while the still-existing challenges have led many cannabis cultivators to exit the industry or significantly reduce their operations, they have helped to stabilize prices and balance supply and demand on the path to a safe and sustainable market for cannabis products and producers. Farms in Northern California’s Emerald Triangle, which was once home to a thriving cannabis farming economy, have sold out of pot this fall after years of struggling to sell their weed,

The wholesale price of cannabis, which largely determines whether farms can survive or die, appears to have stabilized in California. Specialized cultivation operations are leading this development, and well-managed companies with low overhead are beginning to reap the benefits.

Overall, the future of the US cannabis market appears brighter again, with significant growth and innovation expected over the coming years. However, successfully navigating the complex legal and regulatory landscape, addressing social equity concerns, and adapting to a dynamic market will be crucial for any cannabis business to succeed. The future of the California cannabis market ultimately depends on addressing the existing challenges and capitalizing on the potential for growth through policy changes, market adjustments, and product innovation. American support for cannabis legalization has reached an all-time high.

There are still plenty of challenges. Besides cannabis finally getting legalized federally, navigating the complex and evolving state and local regulatory landscape differing from state to state and even different counties within the same state continues to be challenging and expensive. It still needs to gain access to traditional banking and financial services and allow for the traditional Gap accounting for business expenses.

Nevertheless, the industry is expected to see continued product development innovation, focusing on new delivery methods, formulations, and cannabis-infused products. Technological advancements will likely play a crucial role in areas like cultivation, processing, distribution, data analysis, and marketing.

The developments over the past few months have been encouraging. They will no doubt benefit companies with an experienced management team running their operations focusing on unique quality products that generate good returns for their investors or at least continue to reverse the losses of the last few years. The days of “grow it, and they will come” are over, and every cannabis company will eventually be measured with the typical yardsticks for any publicly traded company. If you follow the mantra of “buy the dip,” this may be the dip you have been waiting for.

Maybe this is the place for you.

Search

RECENT PRESS RELEASES

Related Post