SharpLink Gaming Bets Big On Ethereum And Shareholders

November 12, 2025

What’s going on here?

SharpLink Gaming just posted a standout Q3 2025 – revenue soared over 1,100% to $10.8 million, thanks to a big bet on ethereum, and unveiled a hefty $1.5 billion stock buyback, even as sales missed Wall Street’s $697 million target.

What does this mean?

SharpLink’s blockbuster revenue jump wasn’t from classic gaming operations, but from cashing in on ethereum’s potential. By doubling down on its ETH per share, ramping up staking activity, and leaning into its crypto treasury to produce yield, the firm’s net income shot up to $104.3 million. This approach let SharpLink convert its digital asset holdings into sizable profits, helping offset softer overall sales. Investors responded positively, especially with the newly announced $1.5 billion stock buyback boosting confidence. With another $200 million in ETH earmarked for Consensys’ Linea platform, SharpLink is one of the few gaming companies taking bold, innovative steps in blockchain.

Why should I care?

For markets: Crypto bets reshape gaming returns.

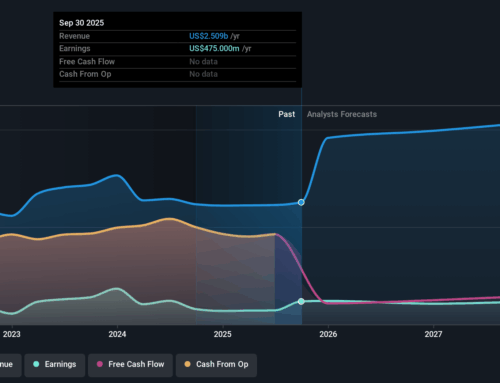

SharpLink’s ethereum-fueled performance shows how digital assets can shake up financial results for sectors beyond crypto. Its shares are getting strong support – four analysts now rate the stock a buy or strong buy, with a median target 71% above the latest close. As traditional revenue numbers take a back seat, investors are closely watching which firms can unlock new value streams with blockchain rather than relying purely on sales.

The bigger picture: Blockchain plays set new industry benchmarks.

SharpLink’s push into ethereum – especially with plans to deploy assets on Consensys’ Linea – signals a shift in how gaming and tech firms think about their balance sheets. This move could nudge more companies to consider holding and using digital assets, as the search for growth and shareholder rewards spreads beyond cash into the crypto economy.

Search

RECENT PRESS RELEASES

Related Post