SharpLink Gaming (SBET): Assessing Valuation Following Ethereum Gains and Treasury Strateg

November 25, 2025

SharpLink Gaming reported a major jump in revenue and net income for the recent quarter, as its Ethereum-focused treasury strategy delivered outsized gains. Investor attention is now turning to how effectively the team manages these crypto assets going forward.

See our latest analysis for SharpLink Gaming.

SharpLink Gaming’s recent Ethereum-fueled profit surge comes after a rollercoaster year for shareholders. Despite some sharp ups and downs, the company’s 1-year total shareholder return stands at 24%. However, its share price has slid 28% over the past month and lost half its value in the last quarter. While excitement is building around crypto-driven gains, the inconsistent share price momentum suggests investors are still weighing the long-term story against near-term volatility.

If you’re interested in uncovering more high-potential names beyond today’s headlines, now is the perfect time to broaden your scope and discover fast growing stocks with high insider ownership

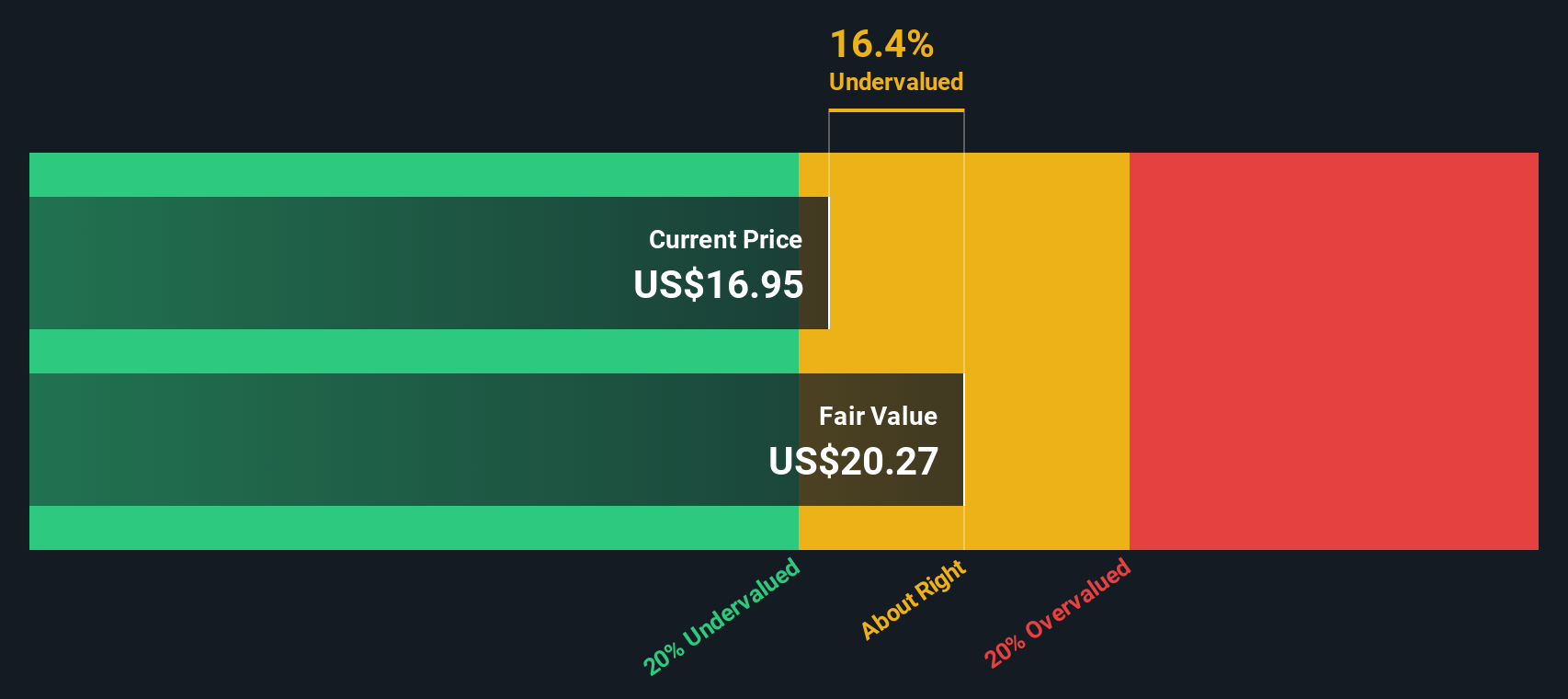

With SharpLink’s rapid financial turnaround but volatile share price, the spotlight now shines on valuation. Investors are left to wonder if the recent pullback unlocks a true bargain or if the market is already pricing in future growth.

Advertisement

Price-to-Book of 0.6x: Is it justified?

SharpLink Gaming’s shares are trading at a price-to-book ratio of 0.6x, a level that signals the market is heavily discounting its asset value compared to peers. With the last close at $10.08, the market is valuing the company’s net assets at a significant discount despite the recent momentum in revenue growth.

The price-to-book ratio compares a company’s market value to its book value, offering a snapshot of how much investors are willing to pay for each dollar of net assets. For digital and hospitality businesses like SharpLink Gaming, this figure can reflect sentiment about future profitability versus current asset backing.

At just 0.6x, SharpLink Gaming’s multiple is well below both the US Hospitality sector’s average of 2.5x and the peer group’s average of 5x. This suggests a big disconnect between the company’s fundamentals and how it is currently priced, with the market possibly overlooking its rapid top-line expansion or remaining wary due to its unprofitable status and dilution history.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 0.6x (UNDERVALUED)

However, ongoing net losses and recent share dilution could weigh on investor confidence and disrupt SharpLink’s path to a sustained valuation rebound.

Find out about the key risks to this SharpLink Gaming narrative.

Another View: Discounted Cash Flow Insight

Looking at SharpLink Gaming through our DCF model provides a different valuation perspective. The shares are trading around 28% below our fair value estimate of $14.01. While this suggests undervaluation by cash flow analysis, it raises a question: does this model capture the real potential and risk for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SharpLink Gaming for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own SharpLink Gaming Narrative

Keep in mind, if you have a different perspective or want to dig into the details yourself, you can build your own analysis in just a few minutes. Do it your way

A great starting point for your SharpLink Gaming research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize your advantage with Simply Wall St’s stock screener. Gain the inside edge on tomorrow’s market leaders, and don’t let these unique opportunities pass you by.

- Tap into the energy of artificial intelligence by reviewing these 26 AI penny stocks, which are redefining how businesses operate and grow across multiple industries.

- Secure reliable income streams for your portfolio by selecting from these 14 dividend stocks with yields > 3% currently offering robust yields above 3%.

- Position yourself at the forefront of financial innovation by tracking these 81 cryptocurrency and blockchain stocks that are set to benefit from blockchain technology and changing trends in digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post