Should Investors Worry About the “October Effect?” History Offers a Compelling Answer.

October 5, 2025

October is often seen as a bad month for stocks.

The tough times that have happened in October are enough to scare off anyone. From the panic of 1907 to Black Tuesday of 1929 and, more recently, Black Monday of 1987, the month of October has been ripe with financial crises and market crashes over time. And that’s led investors to talk about the “October effect,” the idea that stocks are likely to decline during this month.

This may worry some investors right now, especially as valuations of S&P 500 companies have climbed — along with the index, which recently reached a record high. The benchmark finished September, a month that’s also been associated with stock market declines, on a positive note, gaining 3.5%, and this puts it on track for an annual increase of 14%.

But will the October effect interrupt this positive story? History offers a compelling answer.

Image source: Getty Images.

The reason behind recent gains

First of all, it’s important to consider the reason behind the gains we’ve seen in recent weeks. Stocks have soared, led by technology and growth players, amid generally positive economic and political elements as well as industry-specific news.

The Federal Reserve lowered interest rates last month and signaled two more to come, moves that could cut borrowing costs for companies and support the wallets of consumers. President Donald Trump has negotiated with countries regarding import tariffs. This, along with encouraging comments from companies about their ability to manage tariffs, has eased investors’ minds about tariff headwinds.

Finally, tech companies’ plans to increase spending in the high-growth area of artificial intelligence (AI) have also buoyed market sentiment, driving up their shares along with those of a great variety of companies positioned to benefit from AI. This market is forecast to grow from the billions today to the trillions early next decade. If this happens, many industries — and early investors in AI players — may benefit.

The risk ahead

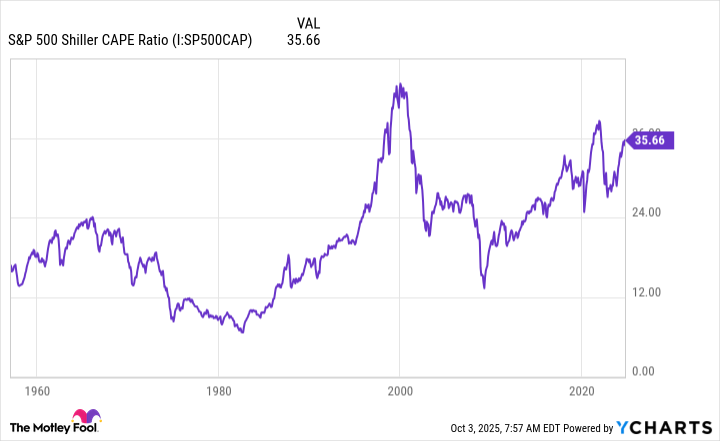

All this has helped the S&P 500 soar in recent times, and that’s great. However, the problem is that valuations have also surged. The S&P 500 Shiller cyclically-adjusted price-to-earnings (CAPE) ratio has reached beyond 35, something it’s done only twice before since the benchmark launched with 500 companies more than 60 years ago. This is an inflation-adjusted picture of stock prices, as it considers companies’ earnings per share over a 10-year period.

S&P 500 Shiller CAPE Ratio data by YCharts. CAPE Ratio = cyclically-adjusted price-to-earnings ratio.

Here’s the risk: When stocks get too expensive, investors may consider them overvalued and hesitate to invest. If that sentiment prevails, the general market might decline. So, this could support a drop in stocks in October.

Now, let’s consider what history says about the October effect. A quick look at the past six years shows that the S&P 500 has actually given us a 50-50 split between winning and losing months.

| Year | S&P 500 Performance |

|---|---|

| October 2019 | up 2% |

| October 2020 | down 2.7 |

| October 2021 | up 6.9% |

| October 2022 | up 8% |

| October 2023 | down 2.2% |

| October 2024 | down 1% |

Data source: Ycharts.

And we might even consider October as more positive than negative since declines in recent years haven’t been extreme, yet the winning months have been particularly strong.

Is the October effect a real concern?

All this suggests that investors shouldn’t worry too much about the October effect, as it’s more of a subject for conversation than something that’s really played out in a big way in recent years. It’s also important to remember that stock market gains and losses don’t just happen randomly but are linked to specific problems, such as the financial crisis of 2008, stemming from the subprime mortgage situation, to cite a somewhat recent crash.

What does this mean for you as an investor? As mentioned, some stocks have become expensive, and this has been the case for a while. Eventually, this could result in declines, but it’s impossible to predict when this will happen. Meanwhile, it’s a great idea to invest as usual: Consider each company individually and buy shares of those that offer solid long-term prospects.

At the same time, any potential decline in stocks shouldn’t be something to fear. Instead, a drop offers you, as a long-term investor, the opportunity to buy quality players at a good price. All this means that, regardless of which direction the S&P 500 takes in October, this month still could play a valuable role in your effort to build wealth over time.

Search

RECENT PRESS RELEASES

Related Post